| Manufacturers May Sack Workers As Naira Loses 39% Value by TajuDEENaMao: 3:44am On Jan 08 |

The naira has depreciated by 38.9 percent against the United States dollar at the official I&E window of the Central Bank of Nigeria in the past three months, according to findings by The PUNCH.

Data obtained from the FMDQ Securities Exchange revealed that the local currency fell from N745.19/$ on October 3, 2023, to N1035.12/$ as of January 3, 2024.

While the naira depreciated from 471/dollar to about 700/dollar at the official market shortly after the announcement of the exchange rate unification policy of the CBN in June 2023, PUNCH findings showed the local currency had fallen further in the past few months to over N1000/dollar.

At the parallel market, the local currency has been trading around 1,220/dollar in recent weeks.

On Sunday, manufacturers and other members of the organised private sector said the falling naira value at the official and parallel markets was having a severe negative impact on their bottom lines.

Specifically, the Manufacturers Association of Nigeria, Lagos Chamber of Commerce and Industry, as well as the Nigerian Association of Small-Scale Industrialists, said their members were already scaling down operations over the development, a situation that might lead to the sacking of more workers.

The naira volatility on the I&E window has continued despite recent efforts by the Federal Government to improve the liquidity of the FX market.

The naira began 2024 at N988.46/$, an 8.97 percent decline from the N907.11/$ it closed trading on the last day of 2023 on the official window. It further tumbled to N1035.12/$ on Wednesday, January 3. This decline in the value of the naira marked the third time that the naira has closed above N1000/$ on the I&E window.

On December 8, the naira fell to an all-time low of N1,099.05/$, and on December 28, 2023, it closed trading at N1043.09/$. On Friday, the naira closed trading at N869.39/$, recovering to close the week better than it started.

According to data from the FMDQ Securities Exchange, the naira has now lost about 38.91 percent of its value since October 3 when it closed trading at N745.19/$ on the I&E window.

On the day before the rate cap was removed by the CBN in June 2023, the naira closed trading at N471/$.

The continued decline of the naira is happening despite efforts, including clearing FX backlogs, by the government to boost liquidity in the foreign exchange market. Towards the end of 2023, the Minister of Finance and Coordinating Minister of Economy, Wale Edun, revealed that the Federal Government had received a $2.25bn foreign exchange support facility from the African Import-Export Bank.

According to the minister, the first tranche of its $3.3bn facility from the bank is aimed at resolving FX shortages in the economy.

In August, the Nigerian National Petroleum Company Limited announced it had secured a $3bn emergency crude oil repayment loan from the African Export-Import Bank to support the Federal Government’s effort to stabilise the foreign exchange rate.

The naira has yet to respond positively to this latest injection of liquidity to the dismay of many. In its December Nigeria Development Update, the World highlighted that of volume of FX trades in the official window remained consistently low.

Data from the FMDQ Securities Exchange has shown that FX volumes on the I&E window have consistently hovered around $100m to $150m.

The Washington-based bank noted that without stabilisation in the official FX market at market-reflective rates, the risks to expected net FDI and net FPI would remain high for the country.

Commenting on the issue of volatility, the CBN Governor, Olayemi Cardoso, recently stated that the bank was concerned about this and doing all within its power to address it.

He said, “We are taking a comprehensive look at all the different policies that have come out from the central bank over a period of time and come out with an elegant document that states what is required from start to scratch and is clear on how to play that market.”

OPS expresses worry

However, members of the OPS including MAN, and LCCI have expressed worry that more companies may wind down operations in Nigeria if the trend of foreign exchange scarcity continues in the country.

In June 2023, the Central Bank of Nigeria directed Deposit Money Banks to remove the rate cap on the naira at the official Investors and Exporters’ Window of the foreign exchange market, to allow for a free float of the national currency against the dollar and other global currencies.

This came barely two weeks after President Bola Tinubu promised to unify the nation’s multiple exchange rates, and less than a week before the suspension and detention of CBN Governor Godwin Emefiele, whose unorthodox monetary policies had become a stumbling block to investors and the economy.

The CBN’s decision to float the currency was hailed by the organised private sector and economists who said the move would unify the country’s multiple exchange rate and sanitise the forex market

However, in the immediate aftermath of the implementation of this policy, the naira fell from N471 on the official market to N664. This implied a 40.97 percent decline in the value of the naira when the naira was floated. Since then, the currency has dropped by 36 percent to N908 as of January 7, 2024.

In November, reports emerged that the CBN had begun to clear the $7bn backlog which had accumulated as a result of forex scarcity in the preceding months. Despite the development, the naira continued to depreciate, closing at the official market at N831 by the end of November.

During a presentation in Abuja last month, World Bank lead economist for Nigeria Alex Sienaert said Nigeria still needed to control inflation and stabilise its foreign exchange market to boost economic growth following currency reforms and the removal of a petrol subsidy.

According to him, the government still needs to remove remaining import restrictions, despite lifting a forex ban on 43 items, improve infrastructure and pursue clear, consistent trade policies.

The bank also urged the CBN to tighten monetary policy, build market confidence around free foreign exchange pricing, phase out “ways and means” advances to the government and discontinue its development finance initiatives, part of a series of unorthodox policies used by Emefiele.

‘forex scarcity calamitous’

While speaking in an exclusive interview with The PUNCH, the President of the Manufacturers Association of Nigeria, Francis Meshioye, said manufacturers were wary that if the current trend continued, the consequence would be calamitous for the real sector of the economy.

He further expressed dismay that the current business climate was causing companies to shut down manufacturing operations in Nigeria.

He said, “If the trend continues, there will be more calamity. The serious fear we have is that if this continues, then the sector will suffer. We are not happy that manufacturers are shutting down. We hope that it is not a continuous trend.

“We are not happy that another manufacturer just closed shop. We hope that is not a continuous trend. It is not good news for us at the beginning of the year.”

Over the past few months, manufacturers have intensified their call for the government to craft a lasting solution to the perennial crisis of forex illiquidity.

In its recent 2024 sector outlook, MAN urged the CBN to prioritise forex and credit allocation to the manufacturers.

The General Manager of Royal Foam Products Limited, Ezekiel Akhiromen, said the recent fall in the naira rate was negatively affecting operators.

He said, “Of course. It is affecting us, about 80 percent of what we buy requires forex – the chemicals and other materials come in from outside the country.”

Companies face shutdown

On his part, the President of the Lagos Chamber of Commerce and Industry, Gabriel Idahosa, said more companies would exit Nigeria if forex scarcity continued to constitute a headache for businesses.

Idahosa, who was speaking on the announcement by a manufacturing firm — Jubilee Syringe Manufacturing, that it was winding down production activities, said over-reliance on CBN allocation for forex was hurting the Nigerian economy.

Idahosa said, “The only thing that came to mind as to why the company ceased operation is foreign exchange, because if they are importing some of the items they use, then they will have a hard time, but the market for syringes is unlimited.”

If things continue the way they are, then businesses will be forced to relocate, even Nigerian businesses are relocating, how much more foreign businesses? There are Nigerian businesses in Ghana now.”

Speaking further, Idahosa advised firms to hedge against currency volatility via exports and backward integration policies.

He added, “I have been advising a lot of my clients and pointing them to what a lot of their competitors are doing. Most manufacturing entities are now seeing the importance of having a division that is exporting. So when everybody is crying that

“CBN is not allocating enough forex, they are getting their forex from exports, but a lot of Nigerian companies don’t have because the crowd mentality is that CBN will allocate foreign currency to them. But CBN does not have a factory where it produces foreign currency.

“So, once NNPC does not bring oil money and our diaspora remittances are exhausted, where else do you get forex, because we are not attracting much foreign investments.”

Companies downsizing — NASSI

Also speaking, the National Vice Chairman of the Nigerian Association of Small Scale Industrialists, Segun Kuti-George, said companies were currently in a ‘state of limbo,’ and were being forced to downsize to stay in business.

He lamented that businesses were going through a difficult time as a result of the forex scarcity as many of them were forced to go to the parallel market to procure foreign exchange at extortionate rates.

Kuti-George said, “We are just existing. There is no alternative to foreign exchange. Businesses are in limbo. Those that have not folded up are somewhat in limbo, except for those producing basic household goods.

“Businesses have been downsizing quietly. They don’t have to announce that they are laying off staff. It is not something that makes it to the tabloids. No one will tell you that they are downsizing. They will simply lay people off.” https://punchng.com/manufacturers-may-sack-workers-as-naira-loses-39/?amp 2 Likes 4 Shares

|

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by shox: 4:03am On Jan 08 |

Down, down the naira goes.

Government will soon lose control of the devaluation and succumb to defeat in defending the naira. Na dollar we go spend las las for this country .

Even nairamarley no dey trend again.

Any artist wey wan blow should just take the stage name dollarmarley and you’re good to go 😀 19 Likes 3 Shares |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by CodeTemplar: 4:24am On Jan 08 |

Gradually, the consequences of not building local manufacture grounds up is revealed. Over the years, the preferred way to be an industrialist is to import highly processed raw materials then do little packaging.

Only import substitution can save the Naira value now. 31 Likes 6 Shares |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by incandescentena: 4:32am On Jan 08 |

Poor drivers of the economy 32 Likes 4 Shares |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by JAMANZE: 4:37am On Jan 08 |

Wetin concern me. Na their Nigeria 7 Likes 1 Share |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by kernniejay(m): 4:38am On Jan 08 |

Tinubu that is acclaimed to be very intelligent has proven to be no better than Buhari who has no idea about economic policy. The painful thing is that, it is the people that will suffer the ineptitude of these policy makers by way of job loss, poverty, inflation, insecurity, poor standard of living and shortened life span. 54 Likes 5 Shares |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by AqualinaXYZ: 4:42am On Jan 08 |

They should sack everyone

Make hunger choke

Make i see how who no see food eat go dey shout on your mandate 36 Likes 3 Shares |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by opamoses1: 4:45am On Jan 08 |

Local manufacturing is the way to go to rid the country on the dependence on dollars.

The floating of the naira to get it's real value is showing that the naira is a terrible currency that has been padded by the government for too long... Get rid of importers of things that can be easily manufactured in the country. 4 Likes |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by kettykin: 4:48am On Jan 08 |

I forecasted this last year and I was called all sorts of names by Tinubu's supporters and lagosians. Only very few people who could think out of the box believed me 39 Likes 3 Shares |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by TajuDEENaMao: 4:56am On Jan 08 |

opamoses1:

Local manufacturing is the way to go to rid the country on the dependence on dollars.

The floating of the naira to get it's real value is showing that the naira is a terrible currency that has been padded by the government for too long... Get rid of importers of things that can be easily manufactured in the country. Get rid of importers of things that can be easily manufactured in the country? You're very funny.....you want to stop import when your local manufacturers are sacking workers and closing plants due to Naira instability and unfavorable business climate. This would amount to economic shutdown Economics 101 18 Likes 2 Shares |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by justtoodark: 5:04am On Jan 08 |

you dont want to give up parallel market....

soo it will climb more and more....

you still only care about parallel market rate than cbn rate....

sane civilians in a country would only care about central bank rate of the country....

una endless greed will destroy the naira completly....

i laugh over una thinkin you will start usin dollars in nigeria....una will end up like ghana cancelin zeros....

what will be left is a nigeria only for the rich.... 5 Likes |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by justtoodark: 5:11am On Jan 08 |

kettykin:

I forecasted this last year and I was called all sorts of names by Tinubu's supporters and lagosians. Only very few people who could think out of the box believed me and you and your people i only say continue like this.... rich people can afford security....you....?? you think rich people will allow you to spit in their garri without declarin you and your people to terrorits and send army after una....?? i laugh over people like you.... 1 Like 1 Share |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by TreasureJunky: 5:16am On Jan 08 |

Tinubu should be held responsible for this,, and no thanks to his supporters..

It's only tribalism that will make someone still be supporting tinubu at this point 21 Likes 2 Shares |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by justtoodark: 5:18am On Jan 08 |

TreasureJunky:

Tinubu should be held responsible for this,, and no thanks to his supporters..

It's only tribalism that will make someone still be supporting tinubu at this point look who dey talk....playin better than you.... you will still use parallel market after your blame blabla anyways.... 1 Like 1 Share |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by Odogwuzack: 5:19am On Jan 08 |

kernniejay:

Tinubu that is acclaimed to be very intelligent has proven to be no better than Buhari who has no idea about economic policy. The painful thing is that, it is the people that will suffer the ineptitude of these policy makers by way of job loss, poverty, inflation, insecurity, poor standard of living and shortened life span. Peter Obi would have been worse obviously. 2 Shares

|

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by Odogwuzack: 5:21am On Jan 08 |

kettykin:

I forecasted this last year and I was called all sorts of names by Tinubu's supporters and lagosians. Only very few people who could think out of the box believed me Tinubu was still the best candidate in the last presidential election based on antecedents. 3 Likes 4 Shares |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by Odogwuzack: 5:23am On Jan 08 |

TreasureJunky:

Tinubu should be held responsible for this,, and no thanks to his supporters..

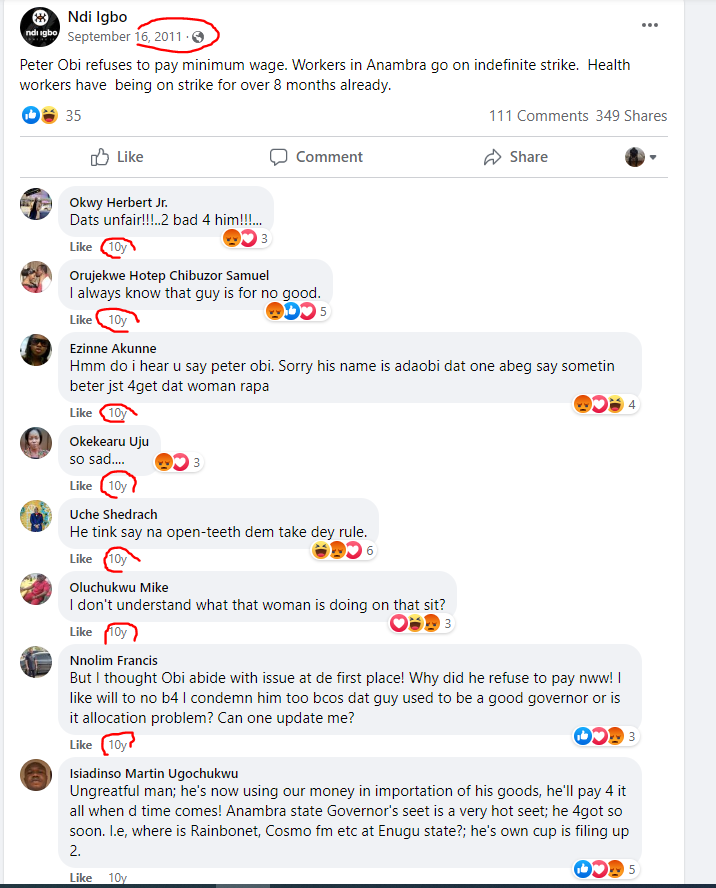

It's only tribalism that will make someone still be supporting tinubu at this point The same tribalism that is making you to support Obi after all the curses you rained on him during his administration in Anambra on NL and other social media platforms. 1 Like 1 Share |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by justtoodark: 5:24am On Jan 08 |

Odogwuzack:

Tinubu was still the best candidate in the last presidential election based on antecedents. none of them has a solution to what we caused ourselves.... better vote somebody that understand this messy game.... tinubu was the best choice and already had a resume as former lagos governor that everybody want to move to today.... 1 Like 1 Share |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by IVORY2009(m): 5:35am On Jan 08 |

Tinubu, wearhouse economist  11 Likes 3 Shares |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by PaChukwudi44(m): 5:44am On Jan 08 |

Odogwuzack:

Tinubu was still the best candidate in the last presidential election based on antecedents. What antecedents exactly? 13 Likes 3 Shares |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by Iamanoited: 7:00am On Jan 08 |

NAIRA IS NIGERIA SOVEREIGNTY AND MUST BE VALUED AND PROTECTED.

GOVERNMENT MUST LISTEN TO MAN'S COMPLAINTS ON LOCAL INDUSTRIES, PRODUCTS PRICING AND GENERAL INFLATION.. |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by Blaze14k: 7:31am On Jan 08 |

I don't know what tinubu is actually doing buh what baffles me is that some people are busy chasing obi saying he will never be president. You are struggling yet u still have the strength to attack someone else, honestly nigerians are crazy people 8 Likes 1 Share |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by faceland: 7:32am On Jan 08 |

Some workers are quitting on their own when 50% of income is used as transportation to work.

1k naira is not money anymore, yet very hard to get. 8 Likes 1 Share |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by ariesbull: 7:33am On Jan 08 |

They will never sack YORUBA RONU people and the RONU people aren't suffering the economic hardship they are fine cos they voted on their brother and he is giving them gold tea that is cold 6 Likes

|

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by cassette(m): 7:33am On Jan 08 |

Odogwuzack:

Tinubu was still the best candidate in the last presidential election based on antecedents. Console yourself all you want, but your family is relishing in anguish and deep poverty, nothing would change the fact that bad decisions have consequences!! 13 Likes |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by Houseofglam7(f): 7:36am On Jan 08 |

🥺 |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by eleko1: 7:36am On Jan 08 |

|

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by SmartyPants(m): 7:36am On Jan 08 |

TajuDEENaMao:

Get rid of importers of things that can be easily manufactured in the country?

You're very funny.....you want to stop import when your local manufacturers are sacking workers and closing plants due to Naira instability and unfavorable business climate.

This would amount to economic shutdown

Economics 101 Lol. Which Economics 101. A country that hypothetically does not import anything will never need fx. A country that doesn't need fx will have a stable currency and low inflation. A country with a stable currency and low inflation will not see mass layoffs. I don't know where you learned your own Economics 101. A developing country must go through an industrialization phase or it will never develop. There are ways to manage the transition through fiscal and monetary policies 1 Like |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by faceland: 7:37am On Jan 08 |

Very soon they would be selling soft drink and energy drinks in small sachets (it would be diluted and 500 naira). |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by MrPOTUS: 7:39am On Jan 08 |

opamoses1:

Local manufacturing is the way to go to rid the country on the dependence on dollars.

The floating of the naira to get it's real value is showing that the naira is a terrible currency that has been padded by the government for too long... Get rid of importers of things that can be easily manufactured in the country.  No country or manufacturing firm is independent. Local manufacturing firms need chemicals for production, should dey use their urine? Those chemicals are imported. Abi na d skyrocketing price of diesel we wan talk about? I don't blame you people, suffering and smiling have become a way of life. 7 Likes |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by Teymanhenry(f): 7:41am On Jan 08 |

opamoses1:

Local manufacturing is the way to go to rid the country on the dependence on dollars.

The floating of the naira to get it's real value is showing that the naira is a terrible currency that has been padded by the government for too long... Get rid of importers of things that can be easily manufactured in the country. The FG is the main importer of goods. Imagine, after building the dangote refinery. Next we hear was Dangote refinery is importing crude oil. Same crude oil we have in Nigeria 3 Likes |

| Re: Manufacturers May Sack Workers As Naira Loses 39% Value by TajuDEENaMao: 7:42am On Jan 08 |

SmartyPants:

Lol. Which Economics 101. A country that hypothetically does not import anything will never need fx. A country that doesn't need fx will have a stable currency and low inflation. A country with a stable currency and low inflation will not see mass layoffs.

I don't know where you learned your own Economics 101.

A developing country must go through an industrialization phase or it will never develop. There are ways to manage the transition through fiscal and monetary policies It's obvious you can't read and assimilate |