| Re: Living In The UK: Property,Mortgage And Related by bigtt76(f): 12:44am On Jan 10 |

Thank you so much for this, I appreciate your contribution. But is Freehold new builds easy to access? ukay2:

No gree for any LEASEHOLD ooo....Go for FREEHOLD a beg |

| Re: Living In The UK: Property,Mortgage And Related by bigtt76(f): 12:45am On Jan 10 |

Thank you so much for this, I appreciate your contribution. Lexusgs430:

I hope you know buying a leasehold property, is just an upgraded version of paying rent ...........

Await the legislation on leasehold + conditions attached, if you want to go down the leasehold route......

Have you read the conditions attached to the service charges + upward reviews of the service charges........ |

| Re: Living In The UK: Property,Mortgage And Related by bigtt76(f): 12:46am On Jan 10 |

Thank you so much for this, I appreciate your contribution. deept:

1. Any property is worth going for if it meets your goals and the conditions are right.

2. Only you can answer this question. I will ask myself some questions: What is my outgoing if I am going to pay a mortgage? will I be able to take care of my other needs and save after paying a mortgage? If God forbid household income reduces, do I have some sort of buffer to continue to pay the mortgage until income increases... amongst other questions

3. It is not uncommon, however, question to ask myself is can i afford the extra ~£80 per month cost? what control do I have over 'service charge', this can go up at the discretion of the management company and you have to pay.

4. third party is there to make money

Research fleacehold

|

| Re: Living In The UK: Property,Mortgage And Related by bigtt76(f): 12:47am On Jan 10 |

Thank you so much for this, I appreciate your contribution. How can I access Freehold new builds ...any idea? Any idea what the highlighted mean? Solumtoya:

People have done justice to your questions so I will just throw in my opinion. These are personal opinions so seek professional advice or look at your situation closely before making any move.

1. That's totally subjective. An apartment in Leeds can be good or bad for you so one can't tell. I generally avoid buying Apartments for residential purposes for several reasons but they are great for renting.

2. Hmmm... The numbers. A 379k house on a 22 year 90% Mortgage at 5.53% is £2,200 monthly. Almost half of your income seems quite high and will be a struggle for most people. I used 22 year mortgage because I was guessing your age. If the buyer is 30, for instance, and does a 40-year mortgage, repayments could be as low as £1,700 monthly.

The second point is "Leasehold", as you can tell, most of us are not fans of leaseholds. I would avoid them if I can.

3. Service Charge of almost £1k per annum is already high. Anticipate it going higher in future. My service charge is less than £10 monthly. My friend's service charge was raised from about 3k to about 5k per annum. You have no control over that. But if you see a good deal, you have to stomach the service charge las las.

4. Better service, but typically higher costs

|

| Re: Living In The UK: Property,Mortgage And Related by missjekyll: 3:29am On Jan 10 |

bigtt76:

Thank you so much for this, I appreciate your contribution. How can I access Freehold new builds ...any idea? Any idea what the highlighted mean?

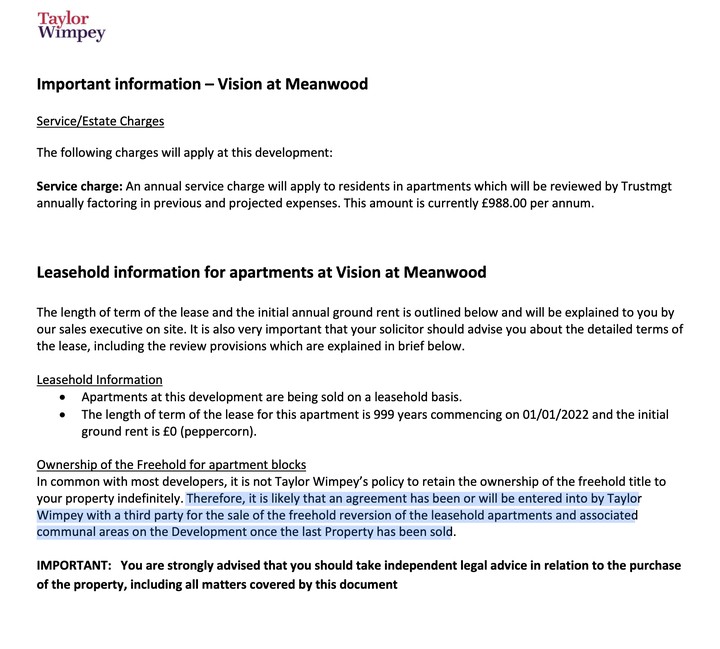

Taylor Wimpey have got your freehold now. Once they sell the last house in the estate, they ll sell your freehold to a third party that won't be you. I would steer clear of these leaseholds , to be honest 2 Likes |

| Re: Living In The UK: Property,Mortgage And Related by Lexusgs430: 4:50am On Jan 10 |

missjekyll:

Taylor Wimpey have got your freehold now. Once they sell the last house in the estate, they ll sell your freehold to a third party that won't be you.

I would steer clear of these leaseholds , to be honest You're not known to mince your words .......😄🤣 1 Like |

| Re: Living In The UK: Property,Mortgage And Related by Estroller: 5:25am On Jan 10 |

bigtt76:

Thank you so much for this, I appreciate your contribution. How can I access Freehold new builds ...any idea? Any idea what the highlighted mean?

Taylor Wimpey currently owns the freehold but has agreed or will agree to transfer the freehold to another entity when the last unit in the development is sold, the new entity will now be the one to collect your ground rent. So In both cases you will remain a leaseholder. Best to avoid leaseholds if you can, generally difficult to do with flats and apartments but much easier with houses new build or not. 2 Likes |

| Re: Living In The UK: Property,Mortgage And Related by profemebee(m): 4:58pm On Jan 10 |

hi bro, been busy reading thru each page.. The Building/Content Insurance cost in yours... is it one-off? or you still pay monthly? Congrats on the new house (to everyone) Solumtoya:

Not hidden but little costs here and there that could add up. The only major one really is the Solicitor's fee which is like £1.5k to £3k. With a New build, you have to furnish, etc depending on what the Builders are willing to do or not do. With an Old build, you might have to fix a few things.

If you're like me, I would say "no think am, just put head". If I realised I would be spending so much, I would have waited for another 1 year to save up but it was better I didn't know cos I have spent so much but just one day at a time.

I have put down below some of the extra costs for me and I didn't include things like Sofa, Transport for the various times I had to go to the site; and numerous purchases to furnish the new house. Most of these may not apply if it's a house that's already furnished. The Upgrades are things like fridge, spotlights, extra taps and lights, turf in the garden, etc. |

| Re: Living In The UK: Property,Mortgage And Related by profemebee(m): 5:05pm On Jan 10 |

found the answer to my question, thanks Solumtoya:

Yearly |

| Re: Living In The UK: Property,Mortgage And Related by zeke100(m): 8:19pm On Jan 10 |

Nemie:

Congratulations to you on your new home. Please I'd like to know if the brokers consider the number of years left on the visa. I have been advised to wait until my visa is renewed before obtaining an AIP by some friends, as I would have 1 year left upon attaining the 2 year mark in the UK, so thought to find out if this is really a thing. Thank you for the wishes and apologies for responding late as I am just seeing this. Pearlyface did justice to the question 1 Like |

| Re: Living In The UK: Property,Mortgage And Related by profemebee(m): 8:46pm On Jan 10 |

hi hi, what a great set of intelligent and resourceful minds.. I already feel like I own a home lol For each of us that help out with answers and support, may thy wishes and prayers be answered too... I will have questions from time to time.. 1.This building and life insurance that is tied to mortgage... is it the same as the normal life insurance we all know? 2. What if one already has life insurance before doing mortgage? will one need to do another for the mortgage? 3. Do I need to go thru a real estate agent to kick-start or i can just start looking for a good home i'm interested in  ? 4. What if i use a real estate agent but i like a house that isn't on sale by that real estate agent? Can i still use their mortgage advisor? 1 Like |

| Re: Living In The UK: Property,Mortgage And Related by Lexusgs430: 9:15pm On Jan 10 |

profemebee:

hi hi,

what a great set of intelligent and resourceful minds..

I already feel like I own a home lol

For each of us that help out with answers and support, may thy wishes and prayers be answered too...

I will have questions from time to time..

1.This building and life insurance that is tied to mortgage... is it the same as the normal life insurance we all know?

- No. You need to have building insurance when you have a mortgage to protect your lenders investment and afterwards, to protect your asset.....

2. What if one already has life insurance before doing mortgage? will one need to do another for the mortgage?

- If you have LI during the term of your mortgage, when one kicks the bucket, hopefully the eventual payout, would clear the mortgage + small change.......

3. Do I need to go thru a real estate agent to kick-start or i can just start looking for a good home i'm interested in ? ?

- Best to go through an agent, the buying process in the UK is fully structured and processed.....

4. What if i use a real estate agent but i like a house that isn't on sale by that real estate agent? Can i still use their mortgage advisor?

- You can use any estate agent or broker, the choice is yours......

|

| Re: Living In The UK: Property,Mortgage And Related by Estroller: 9:44pm On Jan 10 |

profemebee:

hi hi,

what a great set of intelligent and resourceful minds..

I already feel like I own a home lol

For each of us that help out with answers and support, may thy wishes and prayers be answered too...

I will have questions from time to time..

1.This building and life insurance that is tied to mortgage... is it the same as the normal life insurance we all know?

Yes with life insurance, only difference is it now reflects your new reality as a home owner with the added "burden" of the mortgage debt that will without the policy, pass to your family in the unfortunate event of your death.

2. What if one already has life insurance before doing mortgage? will one need to do another for the mortgage?

You can either take out a new policy or update your existing policy to reflect your homeownership status. Some keep both but this might result in you being overinsured, essentially paying too much for what you can get for less.

3. Do I need to go thru a real estate agent to kick-start or i can just start looking for a good home i'm interested in ? ?

Not necessarily, once you have a budget, location and type of house in mind, jump on Rightmove and the likes and start checking out properties. You can use your budget, the location and type of house to filter.

4. What if i use a real estate agent but i like a house that isn't on sale by that real estate agent? Can i still use their mortgage advisor?

You are not obliged to use any of the services of the professionals be it mortgage advisor, conveyancer, etc suggested to you by the estate agent. They represent the interest of the seller and not yours the buyer so you are merely a means to a pay check to them as they will be compensated by those professionals if they successfully referred you.

|

| Re: Living In The UK: Property,Mortgage And Related by profemebee(m): 10:38am On Jan 11 |

thanks for the responses...

That location thing ehnnn.. this research of a thing is deep because one has to consider proximity to London cos of work, Kids' school, community. etc.

Also, the rates i'm seeing.. hopefully being married to a Brit brings the rates down a bit for me.. we earn way over £100k but the problem is that LISA rates cap at 450k for any house you intend to use the LISA funds for..

How many houses with minimum 3bedrooms can be gotten around that? We can't go too far from London because of work ..

[quote author=Estroller post=127880817][/quote] |

| Re: Living In The UK: Property,Mortgage And Related by Solumtoya: 3:11pm On Jan 11 |

profemebee:

hi hi,

what a great set of intelligent and resourceful minds..

I already feel like I own a home lol

For each of us that help out with answers and support, may thy wishes and prayers be answered too...

I will have questions from time to time..

1.This building and life insurance that is tied to mortgage... is it the same as the normal life insurance we all know?

2. What if one already has life insurance before doing mortgage? will one need to do another for the mortgage?

3. Do I need to go thru a real estate agent to kick-start or i can just start looking for a good home i'm interested in ? ?

4. What if i use a real estate agent but i like a house that isn't on sale by that real estate agent? Can i still use their mortgage advisor?

Life Insurance is a personal decision and wasn't compulsory. If you have one, fine, it's really for you and not the Mortgage. Real Estate Agents, and even Mortgage Brokers/Advisor, are not compulsory. I never really used a Real Estate Agent and I could really done without a Mortgage Advisor too. The only compulsory party is really the Solicitor. For your comfort, I'd advise to use any good Mortgage Advisor though to cross the ts and dot the "i"s. 1 Like |

| Re: Living In The UK: Property,Mortgage And Related by Solumtoya: 12:05am On Jan 12 |

Barclays have crashed their rate massively. Now the cheapest 2 year deal in the market. If you have uncompleted offer, time to reapply and lock in this. 3 Likes |

| Re: Living In The UK: Property,Mortgage And Related by profemebee(m): 9:58am On Jan 12 |

thanks boss More questions: 1. Please how do you people that have completed mortgage transactions manage the timeline between when the tenancy of your rented place is done and when the mortgage deal is successfully exchanged so that you avoid paying rent and mortgage in both places? 2. If one exchanges contract and completes mortgage in Jan 2024, when does one start paying the 1st monthly mortgage payment? Solumtoya:

Life Insurance is a personal decision and wasn't compulsory. If you have one, fine, it's really for you and not the Mortgage.

Real Estate Agents, and even Mortgage Brokers/Advisor, are not compulsory. I never really used a Real Estate Agent and I could really done without a Mortgage Advisor too. The only compulsory party is really the Solicitor. For your comfort, I'd advise to use any good Mortgage Advisor though to cross the ts and dot the "i"s. |

| Re: Living In The UK: Property,Mortgage And Related by deept(m): 10:00am On Jan 12 |

profemebee:

thanks boss

More questions:

1. Please how do you people that have completed mortgage transactions manage the timeline between when the tenancy of your rented place is done and when the mortgage deal is successfully exchanged so that you avoid paying rent and mortgage in both places?

2. If one exchanges contract and completes mortgage in Jan 2024, when does one start paying the 1st monthly mortgage payment?

you forgot council tax for both properties |

| Re: Living In The UK: Property,Mortgage And Related by profemebee(m): 10:07am On Jan 12 |

thanks for making it worse  lol How do people manage the timeline considering they're not in control of when the mortgage is fully completed deept:

you forgot council tax for both properties |

| Re: Living In The UK: Property,Mortgage And Related by Peerielass: 10:37am On Jan 12 |

profemebee:

thanks for making it worse  lol lol

How do people manage the timeline considering they're not in control of when the mortgage is fully completed

Unfortunately you may need to pay both for a month (or two) to give you time to actually move into the new property, get furniture and carpets, arrange mail redirection etc. In my experience if you complete in Jan 2024. It’s likely your first mortgage repayment might be on 1st March. The mortgage provider will issue a letter after completion stating the monthly repayment amount and the date for the first collection. Council tax starts counting the moment you take ownership. Remember to take opening and closing meter readings for electricity/ gas in both the new property and the rented property. 1 Like |

| Re: Living In The UK: Property,Mortgage And Related by deept(m): 10:56am On Jan 12 |

profemebee:

thanks for making it worse  lol lol

How do people manage the timeline considering they're not in control of when the mortgage is fully completed

Usually your solicitor should have a target completion date if the sale is straightforward. You can work around that date with a one week, two week overlap to move etc. If you have a contract with your landlord, you will have to pay rent on what's left on the contract, however, if you have an AST or rolling contract just give the landlord the required notice. You hardly move house without having some sort of liability for both properties at the same time. On a lighter note, spend this money  |

| Re: Living In The UK: Property,Mortgage And Related by profemebee(m): 11:06am On Jan 12 |

thanks for this.. This is something we need to tell FTB ooooo... so they're prepared From your example, for the initial 1st month (Feb 2024) there will be no mortgage payment except for Council tax.. so you just pay the normal rent and bills for where you live.. Then use the Feb 2024 to sort mail redirection, billers, etc For the opening and closing meter readings for electricity/ gas in both the new property and the rented property, i guess this is how it works: Rented property: Take closing meter readings on the last day of "living" in the rented place... meaning you leave before the next day Mortgage property: Take opening readings on the day you go to the house even if you've not moved in? Peerielass:

Unfortunately you may need to pay both for a month (or two) to give you time to actually move into the new property, get furniture and carpets, arrange mail redirection etc.

In my experience if you complete in Jan 2024. It’s likely your first mortgage repayment might be on 1st March. The mortgage provider will issue a letter after completion stating the monthly repayment amount and the date for the first collection.

Council tax starts counting the moment you take ownership. Remember to take opening and closing meter readings for electricity/ gas in both the new property and the rented property. |

| Re: Living In The UK: Property,Mortgage And Related by profemebee(m): 11:13am On Jan 12 |

lol spend which money??  my Tenancy says: "Any time after the expiry of the fifth month of the Term the Tenant may invoke this break clause by providing not less than one month's written notice to the Landlord." This means after the 5th month in a 12-month rent period, i can give one month notice i want to leave right? deept:

Usually your solicitor should have a target completion date if the sale is straightforward. You can work around that date with a one week, two week overlap to move etc.

If you have a contract with your landlord, you will have to pay rent on what's left on the contract, however, if you have an AST or rolling contract just give the landlord the required notice. You hardly move house without having some sort of liability for both properties at the same time.

On a lighter note, spend this money  |

| Re: Living In The UK: Property,Mortgage And Related by Peerielass: 11:23am On Jan 12 |

profemebee:

thanks for this.. This is something we need to tell FTB ooooo... so they're prepared

From your example, for the initial 1st month (Feb 2024) there will be no mortgage payment except for Council tax.. so you just pay the normal rent and bills for where you live..

Then use the Feb 2024 to sort mail redirection, billers, etc

For the opening and closing meter readings for electricity/ gas in both the new property and the rented property, i guess this is how it works:

Rented property: Take closing meter readings on the last day of "living" in the rented place... meaning you leave before the next day

Mortgage property: Take opening readings on the day you go to the house even if you've not moved in?

Correct.✅ I’ll take the meter reading for the rented property as I’m stepping out of the house with my last kaya and about to hand over the keys to the agent/landlord. Take a date stamped photo for reference. 1 Like |

| Re: Living In The UK: Property,Mortgage And Related by jedisco(m): 11:30am On Jan 12 |

Solumtoya:

A friend of mine just left the UK for Canada. He bought his house here some 3 years back. He rented it out and last I heard, he was trying to sell it. So, for anyone who is holding out because he intends to relocate, remember a house is an asset which you can sell. Just ensure you buy at a good price so you can easily sell without loss if need be. True... Government policies have seen to it that house prices have risen significantly in the last 2-3 decades. The 2 years following covid saw insanely unexpected growth though. Canada is another ball game. Very restrictive building regs + high immigration pushing house prices thru the roof. For a country with the land mass they have, they should keep restricting supply and acting surprised with prices 2 Likes |

| Re: Living In The UK: Property,Mortgage And Related by Solumtoya: 12:18pm On Jan 12 |

profemebee:

thanks for this.. This is something we need to tell FTB ooooo... so they're prepared

From your example, for the initial 1st month (Feb 2024) there will be no mortgage payment except for Council tax.. so you just pay the normal rent and bills for where you live..

Then use the Feb 2024 to sort mail redirection, billers, etc

For the opening and closing meter readings for electricity/ gas in both the new property and the rented property, i guess this is how it works:

Rented property: Take closing meter readings on the last day of "living" in the rented place... meaning you leave before the next day

Mortgage property: Take opening readings on the day you go to the house even if you've not moved in?

Nah, they backdate the amount to the date you completed o. So it might not be the normal monthly payment. Might be higher or less. Rent and Mortgage payment will typically overlap unless you plan it very tightly. Council Tax and most utility bills won't overlap |

| Re: Living In The UK: Property,Mortgage And Related by Estroller: 2:57pm On Jan 12 |

profemebee:

thanks boss

More questions:

1. Please how do you people that have completed mortgage transactions manage the timeline between when the tenancy of your rented place is done and when the mortgage deal is successfully exchanged so that you avoid paying rent and mortgage in both places?

That overlap is rarely unavoidable. Be prepared to pay both your rent and your mortgage as well as other bills for both properties for a couple of weeks or months depending on whether the house you are moving into requires some work before you move in.

2. If one exchanges contract and completes mortgage in Jan 2024, when does one start paying the 1st monthly mortgage payment?

First payment will be collected in March, but it will be prorated, starting from the day you collect the keys and added to the first full month (February) so the first payment is usually higher than subsequent ones, you'll see this in your offer letter

|

| Re: Living In The UK: Property,Mortgage And Related by Estroller: 3:02pm On Jan 12 |

Solumtoya:

Nah, they backdate the amount to the date you completed o. So it might not be the normal monthly payment. Might be higher or less. Rent and Mortgage payment will typically overlap unless you plan it very tightly. Council Tax and most utility bills won't overlap He's responsible for both from the day he takes the keys and he'll still be living in his rented house until he moves so he's responsible for those at the rented address as well. The only exception will probably be broadband. |

| Re: Living In The UK: Property,Mortgage And Related by jedisco(m): 6:13pm On Jan 12 |

profemebee:

thanks for making it worse  lol lol

How do people manage the timeline considering they're not in control of when the mortgage is fully completed

I recently completed and you can minimise the overlap with good planning especially if a new build. The developers gave 2 weeks notice to completion but we already had a strict period in mind. I spoke with my landlord earlier on and informed me of my intention to move soon but would tell him the exact day once I know when I'mto complete. I finally gave him 3 weeks notice (ideally should have been four but we get on well) which gave me a week overlap. The final mortgage statement supplied by my solicitor stated the day it comes into effect. I made the first payment 2 weeks after completion and the second in another 2 weeks time. Subsequently would be monthly. With old build especially if in chain, it may be a bit more tricky but can be done except if you are not keen on moving asap. 2 Likes |

| Re: Living In The UK: Property,Mortgage And Related by Solumtoya: 6:17pm On Jan 12 |

Estroller:

He's responsible for both from the day he takes the keys and he'll still be living in his rented house until he moves so he's responsible for those at the rented address as well. The only exception will probably be broadband. Not in my experience. I only start paying for Council Tax from the day I move in. I can't pay for Council tax for an empty house and also my residential home at same time. I collect keys and keep paying Council Tax for my current home, then start paying for the new home the date I move in. I may be wrong o, folks can correct me. As for the Utility Bills, kinda same. Electric and Gas, Water won't really accumulate till you move in so yeah, they overlap but it doesn't really matter. Broadband, TV License, etc definitely don't overlap. 1 Like |

| Re: Living In The UK: Property,Mortgage And Related by deept(m): 6:56pm On Jan 12 |

Solumtoya:

Not in my experience. I only start paying for Council Tax from the day I move in. I can't pay for Council tax for an empty house and also my residential home at same time. I collect keys and keep paying Council Tax for my current home, then start paying for the new home the date I move in. I may be wrong o, folks can correct me.

As for the Utility Bills, kinda same. Electric and Gas, Water won't really accumulate till you move in so yeah, they overlap but it doesn't really matter.

Broadband, TV License, etc definitely don't overlap. New build ba?!!! i doubt you'll get away with it for an old property. The seller would have informed the council that they are no longer responsible for the tax and would give them your details. Councils can give concessions and collect no tax on empty house for a period, not indefinitely, but i think the owner would have to apply for it. In some councils the council tax for empty houses are even more than those that are occupied to discourage empty homes. |

| Re: Living In The UK: Property,Mortgage And Related by Estroller: 8:48pm On Jan 12 |

Solumtoya:

Not in my experience. I only start paying for Council Tax from the day I move in. I can't pay for Council tax for an empty house and also my residential home at same time. I collect keys and keep paying Council Tax for my current home, then start paying for the new home the date I move in. I may be wrong o, folks can correct me.

As for the Utility Bills, kinda same. Electric and Gas, Water won't really accumulate till you move in so yeah, they overlap but it doesn't really matter.

Broadband, TV License, etc definitely don't overlap. Maybe it differs from council to council then, I was responsible for both in my case. New home from the date of completion and rented till the day we moved out. |

?

?  lol

lol