| Re: Forex Trade Alerts / Discussions: Season 24 by Donsheddy: 3:23pm On Feb 29, 2024 |

Santom:

There's something you need to know about trade management...

It's not all about Entries,

Exit and management is as important as the former.

Most folks can't be profitable because they don't know how to manage their trades!

I know what I want to see in the market at different sessions and it guides me to how to manage my trades!

Who says time and price doesn’t exist?

Well,

I sent everything on how I managed this trade on my WhatsApp status… check my bio to connect with me!

I also sent this entries to my Inner circle.

• Join my Telegram channel for market outlook and reviews https:///Lordmills_Fx

• Follow me

https://twitter.com/Lor_dmills

for more insights. Na them.... Newbies bewareeeeeee 4 Likes 2 Shares |

| Re: Forex Trade Alerts / Discussions: Season 24 by Aremolekunowo(m): 3:26pm On Feb 29, 2024 |

GabsonFX2:

Infinity Forex Trader Rules to comply with for payout guarantee....

I traded cautiously to abide by all these rules of consistency, be it lot size or the 33% rule - I met them all, I did my maths........

Now, I'm waiting 14 days for my payday ($8K profit on the line), and I'm curious. What I read about them on trustpilot reviews is troubling

Fingers crossed! Chief pls what about 33% rules ? |

| Re: Forex Trade Alerts / Discussions: Season 24 by OfficialP: 3:53pm On Feb 29, 2024 |

Santom:

There's something you need to know about trade management...

It's not all about Entries,

Exit and management is as important as the former.

Most folks can't be profitable because they don't know how to manage their trades!

I know what I want to see in the market at different sessions and it guides me to how to manage my trades!

Who says time and price doesn’t exist?

Well,

I sent everything on how I managed this trade on my WhatsApp status… check my bio to connect with me!

I also sent this entries to my Inner circle.

• Join my Telegram channel for market outlook and reviews https:///Lordmills_Fx

• Follow me

https://twitter.com/Lor_dmills

for more insights. Am one of your active followers for twitter, didn't even know you are here |

| Re: Forex Trade Alerts / Discussions: Season 24 by dmahn(m): 4:14pm On Feb 29, 2024 |

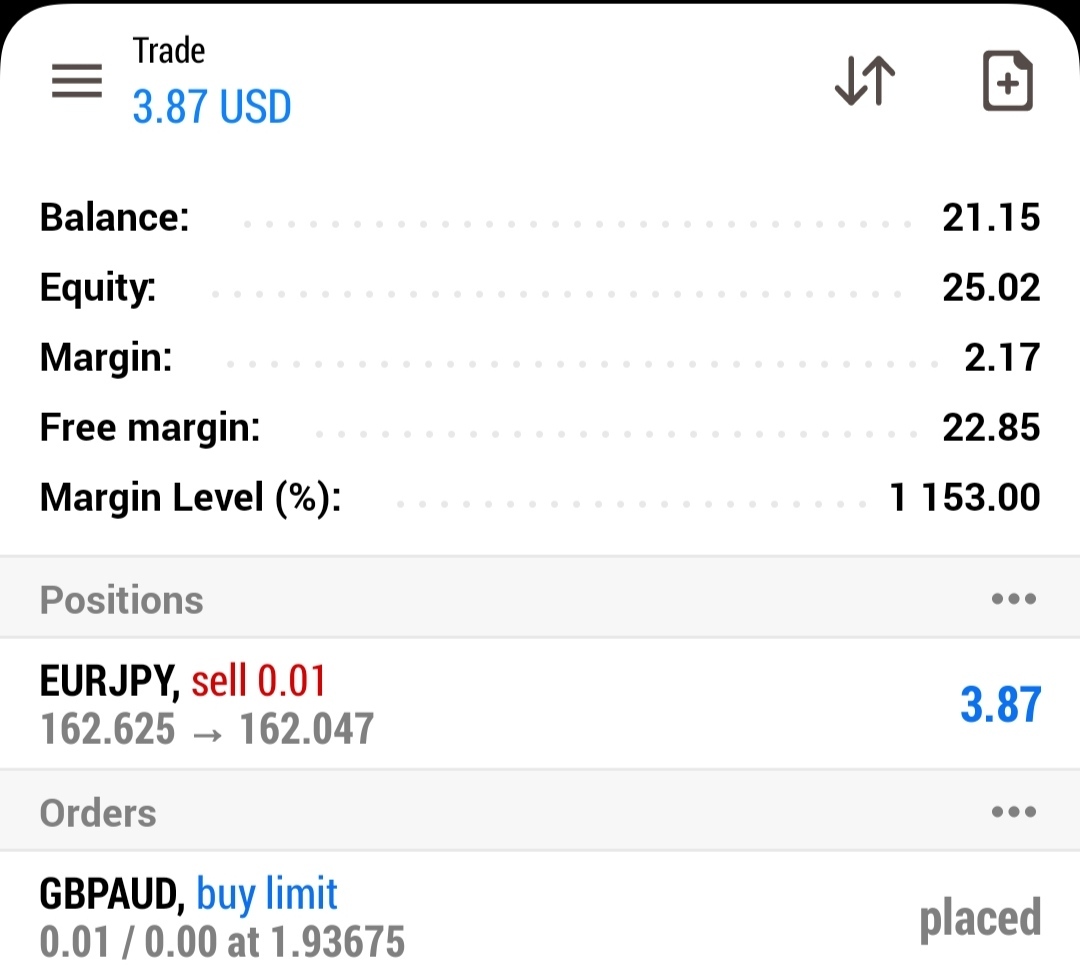

dmahn:

Octa fx and ultra fast withdrawal na 5&6  My $20 account has vomited $5 3ce.. Another request this morning and it drops with a minute.. Balance back to $20...We go Again.. Withdrawal dey sweet oo My $20 account has vomited $5 3ce.. Another request this morning and it drops with a minute.. Balance back to $20...We go Again.. Withdrawal dey sweet oo  ... ...

No be only challenge I go dey face everyday 😅

Its time for another withdrawal  ... 4th $5 withdrawal from a $20 account... Its like the prop guys are my enemy 😅... This used to be me b4 joining the prop space.. Na this confidence make me go enter prop space say I'm ready for the challenge only for me to be swimming in DD for the past 8 months  ... I took a break from prop trading now and pips wey no dey show on prop dey show on personal account.... What could be wrong 2 Likes

|

| Re: Forex Trade Alerts / Discussions: Season 24 by boom99(m): 4:25pm On Feb 29, 2024 |

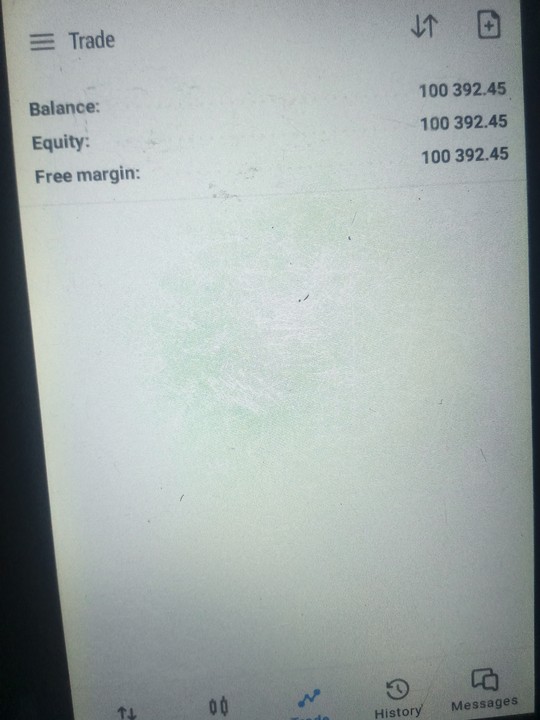

February fundednext account... Small but something..... 1 Like 1 Share

|

| Re: Forex Trade Alerts / Discussions: Season 24 by Davigled: 4:26pm On Feb 29, 2024 |

dmahn:

Its time for another withdrawal  ... 4th $5 withdrawal from a $20 account... Its like the prop guys are my enemy 😅... This used to be me b4 joining the prop space.. Na this confidence make me go enter prop space say I'm ready for the challenge only for me to be swimming in DD for the past 8 months ... 4th $5 withdrawal from a $20 account... Its like the prop guys are my enemy 😅... This used to be me b4 joining the prop space.. Na this confidence make me go enter prop space say I'm ready for the challenge only for me to be swimming in DD for the past 8 months  ... I took a break from prop trading now and pips wey no dey show on prop dey show on personal account.... What could be wrong ... I took a break from prop trading now and pips wey no dey show on prop dey show on personal account.... What could be wrong Ajeh, thou art motivating me oooo, oya send ya tithe to me so that I can appreciate the market gods on your behalf for bestowing you with this orgasmic profits... 1 Like |

| Re: Forex Trade Alerts / Discussions: Season 24 by Lanshile(m): 5:46pm On Feb 29, 2024 |

January was really tough but I think this February is something else

If u enjoy a good run of result this February please post ur history make I see how u take pick am maybe with little explanations if u no wan cap too much please 1 Like |

| Re: Forex Trade Alerts / Discussions: Season 24 by Davigled: 5:50pm On Feb 29, 2024 |

Lanshile:

January was really tough but I think this February is something else

If u enjoy a good run of result this February please post ur history make I see how u take pick am maybe with little explanations if u no wan cap too much please

Bossmi, both Jan and Feb was good to me but na indiscipline and overtrading dey kill me laslas, I'll be posting updates on my progress for the month of feb later after market close, but you can check my trade explorer to see my performance for Feb, visit the link in my signature 1 Like |

| Re: Forex Trade Alerts / Discussions: Season 24 by nzechu(m): 5:57pm On Feb 29, 2024 |

Davigled:

Next week might be too late ooo, remember PCE is a few hours away, no fear, take the trade. 😜😜😜 yea true, but I am playing from a weekly perspective, I will need to wait for this week's candle to close, so I can know where the price is at, and where it's supposedly going |

| Re: Forex Trade Alerts / Discussions: Season 24 by Lanshile(m): 6:02pm On Feb 29, 2024 |

Davigled:

Bossmi, both Jan and Feb was good to me but na indiscipline and overtrading dey kill me laslas, I'll be posting updates on my progress for the month of feb later after market close, but you can check my trade explorer to see my performance for Feb, visit the link in my signature Okay bro will check the trade explorer |

| Re: Forex Trade Alerts / Discussions: Season 24 by GabsonFX2: 7:17pm On Feb 29, 2024 |

33% rule means in simple terms:

When you click on or request payout of an amount say X, 33% of that payout must be more than the highest profit made on a trade.

In other words, the highest profit made in all your trades must be less than 33% of your requested payout in a month.

E.g; for me, my highest profit made on a single trade was $2,340 ish, therefore, I must make a total profit of (at least) $7,090 to be able to request $7,090.

If any of the two above is not met, they will deduct that highest profit made, $2,340 from the total requested, $7,090; and pay you the remainder, $4,750.

Aremolekunowo:

Chief pls what about 33% rules ? |

| Re: Forex Trade Alerts / Discussions: Season 24 by Donsheddy: 7:44pm On Feb 29, 2024 |

Another month with any profit...

Na so this fx hard?? 1 Like |

| Re: Forex Trade Alerts / Discussions: Season 24 by Tinyemeka(m): 7:54pm On Feb 29, 2024 |

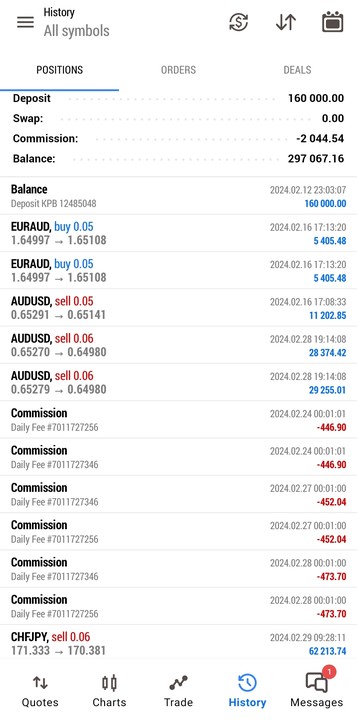

JPY did well to strongly fight back after several months of devaluation against its major pairs, which were all in overbought conditions.

EurJpy on the W1 chart is showing signs of a continued down trend so I guess I'll leave my open trade to run to around 160.15. Started with N160,000 deposit. Heading to N400,000. Paining me that I closed the CHFJPY too early.

I think XAUUSD faces strong resistance around 2070 - 2090 zone. Still monitoring and hoping entry point gets clearer by tomorrow. 1 Like 1 Share

|

| Re: Forex Trade Alerts / Discussions: Season 24 by Petah(m): 8:11pm On Feb 29, 2024 |

WELDONE CHIEF, WHICH BROKER IS THIS? Tinyemeka:

JPY did well to strongly fight back after several months of devaluation against its major pairs, which were all in overbought conditions.

EurJpy on the W1 chart is showing signs of a continued down trend so I guess I'll leave my open trade to run to around 160.15. Started with N160,000 deposit. Heading to N400,000. Paining me that I closed the CHFJPY too early.

I think XAUUSD faces strong resistance around 2070 - 2090 zone. Still monitoring and hoping entry point gets clearer by tomorrow. |

| Re: Forex Trade Alerts / Discussions: Season 24 by Tinyemeka(m): 9:00pm On Feb 29, 2024 |

Petah:

WELDONE CHIEF, WHICH BROKER IS THIS? Fxtm |

| Re: Forex Trade Alerts / Discussions: Season 24 by peteregwu(m): 9:19pm On Feb 29, 2024 |

ebenezary:

Gold is now trading close to 2050, what a market

please what to of support and resistance do you use or any indicator at all

See my chart, the only indicator you will see there is 20ema and 200ema. What do you mean by support and resistance? |

| Re: Forex Trade Alerts / Discussions: Season 24 by GabsonFX2: 10:25pm On Feb 29, 2024 |

samfelly:

Dem go pay you, chief. But if dem decide not to pay, all of us here go go bombard their twitter page with the hashtag #PayGabson 😁😃. By the time 100 pipo from here drop such and they still refused, we go go paint Trustpilot with the same hashtag and label them fraud  |

| Re: Forex Trade Alerts / Discussions: Season 24 by GabsonFX2: 10:28pm On Feb 29, 2024 |

Exactly my thought on the Chat-gpt thing. No excuse for them, as I already blocked all loopholes. Let them bring it on, we will see. In fact, there are many other rules, but I won them all too. I'm just curious to see that day and what they want to come up with that I have not managed on my end.

PriceActionZ:

Bro exactly my taughts. May be fundedtrader,ftmo, 5er and fundednext are good, ay other one, i am not comfortable with them. I magine look at the rules that Gabsonfx2 posted there, you will see that these are the type of rules that are very unclear and full of loopholes for them not to pay you. They are not straight forward. Like something Chat-gpt drafted for them. If they refuse to pay him, they will regret coming accross a good nigerian trader.

1 Like 1 Share |

| Re: Forex Trade Alerts / Discussions: Season 24 by peteregwu(m): 10:51pm On Feb 29, 2024 |

On GBPCHF, a break out from the resistance trendline could send it higher to 1.12900 1 Like

|

| Re: Forex Trade Alerts / Discussions: Season 24 by peteregwu(m): 1:09am On Mar 01, 2024 |

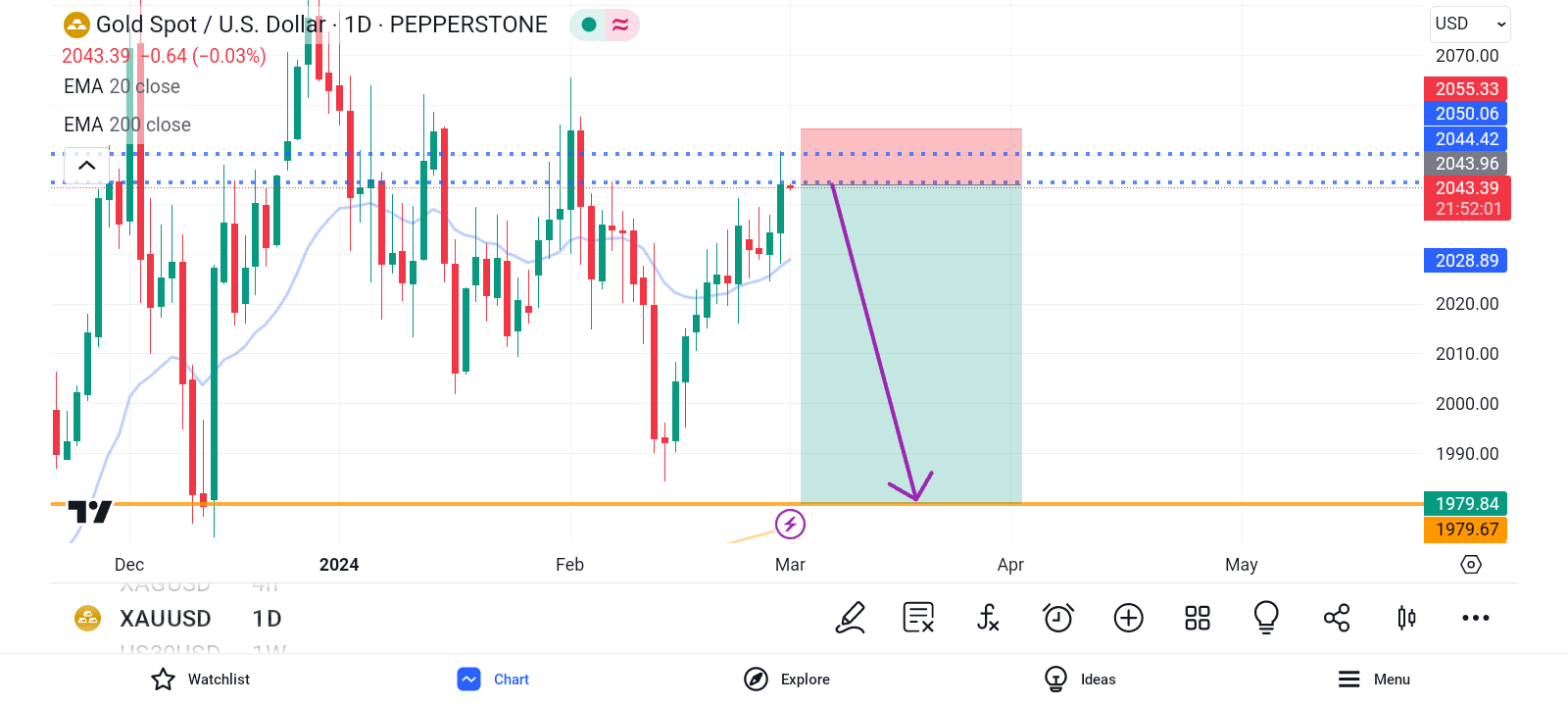

On GOLD/USD, I am looking for a deep fall towards 1979 but this is very risky. 1 Like

|

| Re: Forex Trade Alerts / Discussions: Season 24 by FXcandles(m): 1:46am On Mar 01, 2024 |

ICTcadet:

Do you really trade? Yes of course. 1 Like |

| Re: Forex Trade Alerts / Discussions: Season 24 by FXcandles(m): 1:55am On Mar 01, 2024 |

Oil prices are still in the daily range of 77-79, the war in the Middle East does not seem to be a trigger for oil prices to soar. In contrast to the crypto asset surge in recent weeks, Bitcoin jumped more than 18% in 7 days, Solana gained 21%, and Ethereum also jumped 11.83% 2 Likes

|

| Re: Forex Trade Alerts / Discussions: Season 24 by Jesusmyking(m): 3:27am On Mar 01, 2024 |

any free account claims going on anywhere please update us abeg. Happy new month to us all. |

| Re: Forex Trade Alerts / Discussions: Season 24 by haryodehjia(m): 5:23am On Mar 01, 2024 |

Happy new month |

| Re: Forex Trade Alerts / Discussions: Season 24 by Davigled: 8:57am On Mar 01, 2024 |

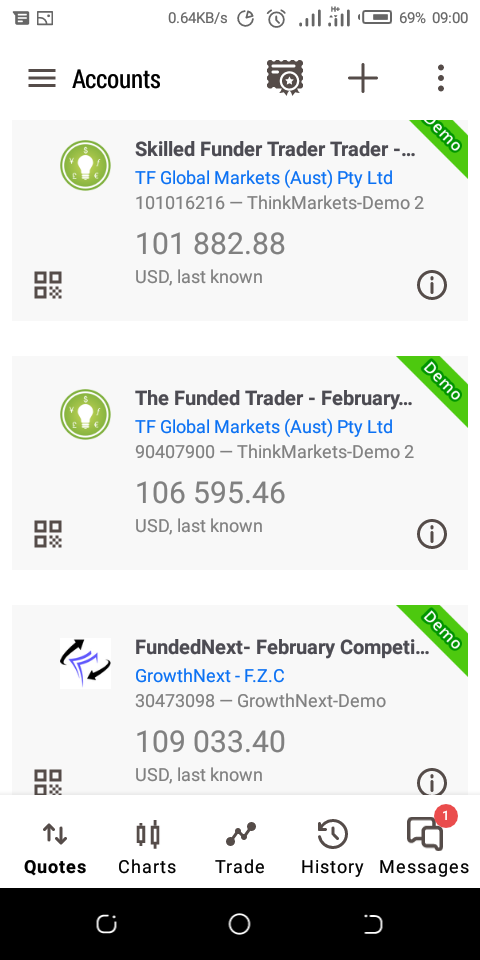

Good morning fams, and a happy merry new month to you all. today is Friday, and I won't be trading today, I just want to talk about my performance for the month of February, I'd say my performance in the month of February was better than January and this time around, fortunately for me, I did not end up blowing all my profits, but I must confess that I am a bit disappointed with myself. my goal for the propfirms monthly competition is to see whether I can consistently hit 10% every month, well I did it in January but I ended up blowing all my profits due to overtrading. I ended January at break even. at least I wasn't disqualified and that meant something to me. I also hit 10% on all 3 of my competition accounts, but I still couldn't hold on to my profits because of my nemesis aka overtrading. in the first week of February, I actually hit 10% within 2 days of trading, and I did not gambled if you're wondering, I actually do pyramid into a trade that I am very confident about and it played out accordingly. I was euphoric and I began to gun for 20%, unfortunately I over traded in the second week of February and I lost about 60-70% of my profits made in the first week, that really humbled me psychologically and also emotionally. so I consciously made up my mind to cut down on the trades I took, the third and fourth week of February were pretty good, because I slowly recovered all the losses I incurred in the second week and ended up back at 11%, but unfortunately this week was kind of a stalemate or a pretty bad week as I ended up losing 2% of my profits and ended the month at 9%. I must confess that I am sad that I couldn't hold on to my 10% for the second time again. there are also certain issues that I have note in my trading and I humbly seek the house guidance on it;

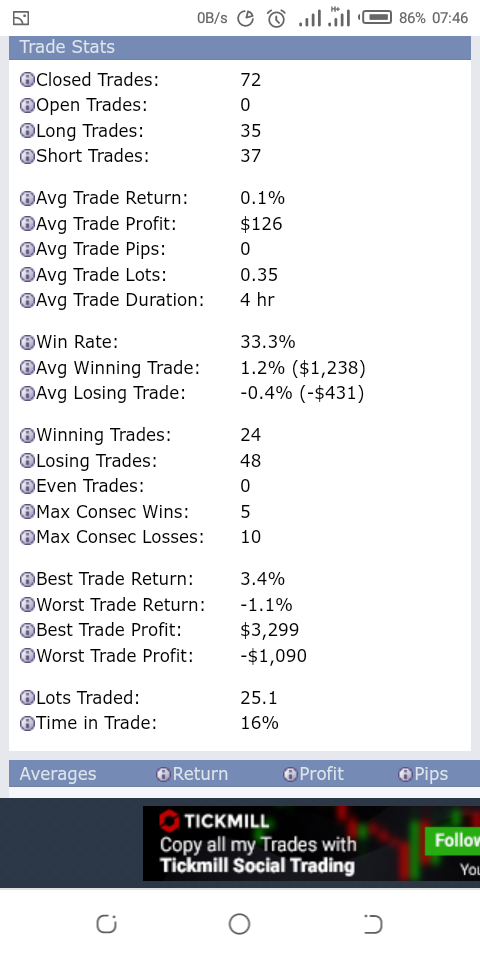

1. Overtrading seems to be my biggest nemesis, I went through my trade explorer and viewed my trade statistics for Feb on my Fundednext competition account, I had a total trade of 72 of which 48 where lossing trades and 24 were winning trades, my win rate is 33%, total profits were 29000, total losses were 20000, hence net profit 9000. looking at this stats, I realized that if and only if I could have cut down on the number of trades that I take and really focused on quality set up, then my performance could have been better. although I have started a regimen on tackling this problem at hand and that is to strictly trade Tuesday, Wednesday and Thursday only, every week that's strictly trading 3 days in a week. secondly keeping my daily drawdown at 2% daily, since I risk only 0.5% per trade, that means maximum of 4 trades per day ( two two for the two pairs I trade).

2. Greed: I think this issue is a bit tricky as I'm not sure if it's my greed that hampers my performance at times or maybe it's poor trade management. one of the biggest challenges for me this month was seeing having profitable trades that ended up in losses. that really really got to me. there were countless times I had winning trades that were up 100 pips plus but I refused to close the trades because I was waiting for it to hit tp which always end up hitting my stoploss. my trading risk rewards which I mostly aim towards to is 1:4 or 1:3, but recently I have been thinking of sticking to 1:2 RR. unfortunately my greed won't let me stick to it, I just feel like 1:2 is isn't satisfactory to me, I am confused and conflicted about it.

3. Lastly, I still struggle with indiscipline, as there are times that I succumb to temptations of breaking my rules. like last week, I wasn't supposed to trade on Friday, I broke the rule and end up losing 1%, on Thursday mid morning at around 2am, I was awake and I checked the charts during asian session which I don't trade, saw a very tempting set-up which I took with the hope of making a bad ass killing from RR perspective, long story short, it flopped and I lost another 1%. Lord knows that I beat myself up for breaking my rules at times but I still end up doing it, although I don't break my rules frequently as I used to do before, but I feel like should have gotten to a stage or level where I ought not to break my rules.

So overall, Feb for me wasn't too bad at all, I'm $35 away from BE on my 5%ers, Fundednext Feb comp 9%, TFT Feb comp 6.5%, and unfortunately SFT 1.8%. Now at the start of the month my performance on Fundednext, TFT and SFT, were the same, but along the lines it began to diverge due to some lapses. I noted that it's not easy trading multiple accounts without a trade copier, there times I get sloppy entries on my other accounts because when, I enter a trades on one account, by the time I logged in to the other accounts, price had already moved. I also notice discrepancies in the pricing feed between brokers, there are times that I set limit others, which may get triggered on one account and may not be triggered on the other accounts. All this affected my performance across all accounts and as for the SFT, I actually gambled on it this week, due to the fact that it's the end of the month and it seems to be the least performing account, so I decided to take some big shots on it if it would be in my favor, sadly it didn't.

I'll stop here because I seem to have written quite a long post, but I want to thank everyone here on the community for the value that they keep adding here, I wasn't as good as I am now early last year, but I am much more better than before, I know I am not a good trader but I am seeing progress in my trading journey. I am happy and grateful for having a community that I can commit to and also be accountable to. pls elders in the house do not hesitate to advise, admonish or scold me, as always, I am willing to learn. cheers 8 Likes 1 Share

|

| Re: Forex Trade Alerts / Discussions: Season 24 by Petah(m): 8:58am On Mar 01, 2024 |

happy new month,

the 3rd month of the year,

keeping sharping your skill one trade at a time.

may this year be the year we are not only profitable but become what we have always dreamt. amen. 2 Likes 1 Share |

| Re: Forex Trade Alerts / Discussions: Season 24 by Englishisamust: 9:20am On Mar 01, 2024 |

GabsonFX2:

Matlab not mathlab.

I was reading through and saw your comment, first thing I was about to write was you should study python or directly data analysis, then while in Naija, find online jobs located abroad, US, Canada, UK, etc. There are lot of companies that source out these jobs to internationals living outside. By doing these, they avoid the high salary Canadians or Americans would have received. Now that I further read you have a japa plan. Then below:

I see matlab to be a usable tool if your postgraduate program will be engineering related, and that it would not by itself land you a job except it's a usable ad-on to your degree. Note that there are less jobs and more applicants in this path, meaning that after graudation from your post-g program, the struggle for job and job hunting gets intense and especially if you have zero or less experience in the field (I've been there). But, if you learn python and sql, you could directly channel your post-g study to data analysis, data science, machine learning/data engineering, AI learning, AWS or cloud architecture. The available jobs after graduation are multiples of that of engineering stated above. Although, there are now many people going into this field cos it's hot cake for jobs, however, I can confirm this is more applicable to data analysis. Hence, focus more into getting into data science or machine learning, AWS, AI or machine learning/data engineering.

In practical, I will find time to send you some real time job postings, with their requirements; I'm sure these will open your eyes to what exactly is required for getting jobs, then you focus on them and not just about japa-ing to study or learning anything that crosses your mind.

Selah!

Boss can I message you!!! |

| Re: Forex Trade Alerts / Discussions: Season 24 by GarkiAccessory(m): 9:32am On Mar 01, 2024 |

Davigled:

Good morning fams, and a happy merry new month to you all. today is Friday, and I won't be trading today, I just want to talk about my performance for the month of February, I'd say my performance in the month of February was better than January and this time around, fortunately for me, I did not end up blowing all my profits, but I must confess that I am a bit disappointed with myself. my goal for the propfirms monthly competition is to see whether I can consistently hit 10% every month, well I did it in January but I ended up blowing all my profits due to overtrading. I ended January at break even. at least I wasn't disqualified and that meant something to me. I also hit 10% on all 3 of my competition accounts, but I still couldn't hold on to my profits because of my nemesis aka overtrading. in the first week of February, I actually hit 10% within 2 days of trading, and I did not gambled if you're wondering, I actually do pyramid into a trade that I am very confident about and it played out accordingly. I was euphoric and I began to gun for 20%, unfortunately I over traded in the second week of February and I lost about 60-70% of my profits made in the first week, that really humbled me psychologically and also emotionally. so I consciously made up my mind to cut down on the trades I took, the third and fourth week of February were pretty good, because I slowly recovered all the losses I incurred in the second week and ended up back at 11%, but unfortunately this week was kind of a stalemate or a pretty bad week as I ended up losing 2% of my profits and ended the month at 9%. I must confess that I am sad that I couldn't hold on to my 10% for the second time again. there are also certain issues that I have note in my trading and I humbly seek the house guidance on it;

1. Overtrading seems to be my biggest nemesis, I went through my trade explorer and viewed my trade statistics for Feb on my Fundednext competition account, I had a total trade of 72 of which 48 where lossing trades and 24 were winning trades, my win rate is 33%, total profits were 29000, total losses were 20000, hence net profit 9000. looking at this stats, I realized that if and only if I could have cut down on the number of trades that I take and really focused on quality set up, then my performance could have been better. although I have started a regimen on tackling this problem at hand and that is to strictly trade Tuesday, Wednesday and Thursday only, every week that's strictly trading 3 days in a week. secondly keeping my daily drawdown at 2% daily, since I risk only 0.5% per trade, that means maximum of 4 trades per day ( two two for the two pairs I trade).

2. Greed: I think this issue is a bit tricky as I'm not sure if it's my greed that hampers my performance at times or maybe it's poor trade management. one of the biggest challenges for me this month was seeing having profitable trades that ended up in losses. that really really got to me. there were countless times I had winning trades that were up 100 pips plus but I refused to close the trades because I was waiting for it to hit tp which always end up hitting my stoploss. my trading risk rewards which I mostly aim towards to is 1:4 or 1:3, but recently I have been thinking of sticking to 1:2 RR. unfortunately my greed won't let me stick to it, I just feel like 1:2 is isn't satisfactory to me, I am confused and conflicted about it.

3. Lastly, I still struggle with indiscipline, as there are times that I succumb to temptations of breaking my rules. like last week, I wasn't supposed to trade on Friday, I broke the rule and end up losing 1%, on Thursday mid morning at around 2am, I was awake and I checked the charts during asian session which I don't trade, saw a very tempting set-up which I took with the hope of making a bad ass killing from RR perspective, long story short, it flopped and I lost another 1%. Lord knows that I beat myself up for breaking my rules at times but I still end up doing it, although I don't break my rules frequently as I used to do before, but I feel like should have gotten to a stage or level where I ought not to break my rules.

So overall, Feb for me wasn't too bad at all, I'm $35 away from BE on my 5%ers, Fundednext Feb comp 9%, TFT Feb comp 6.5%, and unfortunately SFT 1.8%. Now at the start of the month my performance on Fundednext, TFT and SFT, were the same, but along the lines it began to diverge due to some lapses. I noted that it's not easy trading multiple accounts without a trade copier, there times I get sloppy entries on my other accounts because when, I enter a trades on one account, by the time I logged in to the other accounts, price had already moved. I also notice discrepancies in the pricing feed between brokers, there are times that I set limit others, which may get triggered on one account and may not be triggered on the other accounts. All this affected my performance across all accounts and as for the SFT, I actually gambled on it this week, due to the fact that it's the end of the month and it seems to be the least performing account, so I decided to take some big shots on it if it would be in my favor, sadly it didn't.

I'll stop here because I seem to have written quite a long post, but I want to thank everyone here on the community for the value that they keep adding here, I wasn't as good as I am now early last year, but I am much more better than before, I know I am not a good trader but I am seeing progress in my trading journey. I am happy and grateful for having a community that I can commit to and also be accountable to. pls elders in the house do not hesitate to advise, admonish or scold me, as always, I am willing to learn. cheers 👍👍👍 Boss your us100 is sweet to trade hope you got something out of it yesterday? |

| Re: Forex Trade Alerts / Discussions: Season 24 by dmahn(m): 9:56am On Mar 01, 2024 |

Davigled:

Good morning fams, and a happy merry new month to you all. today is Friday, and I won't be trading today, I just want to talk about my performance for the month of February, I'd say my performance in the month of February was better than January and this time around, fortunately for me, I did not end up blowing all my profits, but I must confess that I am a bit disappointed with myself. my goal for the propfirms monthly competition is to see whether I can consistently hit 10% every month, well I did it in January but I ended up blowing all my profits due to overtrading. I ended January at break even. at least I wasn't disqualified and that meant something to me. I also hit 10% on all 3 of my competition accounts, but I still couldn't hold on to my profits because of my nemesis aka overtrading. in the first week of February, I actually hit 10% within 2 days of trading, and I did not gambled if you're wondering, I actually do pyramid into a trade that I am very confident about and it played out accordingly. I was euphoric and I began to gun for 20%, unfortunately I over traded in the second week of February and I lost about 60-70% of my profits made in the first week, that really humbled me psychologically and also emotionally. so I consciously made up my mind to cut down on the trades I took, the third and fourth week of February were pretty good, because I slowly recovered all the losses I incurred in the second week and ended up back at 11%, but unfortunately this week was kind of a stalemate or a pretty bad week as I ended up losing 2% of my profits and ended the month at 9%. I must confess that I am sad that I couldn't hold on to my 10% for the second time again. there are also certain issues that I have note in my trading and I humbly seek the house guidance on it;

1. Overtrading seems to be my biggest nemesis, I went through my trade explorer and viewed my trade statistics for Feb on my Fundednext competition account, I had a total trade of 72 of which 48 where lossing trades and 24 were winning trades, my win rate is 33%, total profits were 29000, total losses were 20000, hence net profit 9000. looking at this stats, I realized that if and only if I could have cut down on the number of trades that I take and really focused on quality set up, then my performance could have been better. although I have started a regimen on tackling this problem at hand and that is to strictly trade Tuesday, Wednesday and Thursday only, every week that's strictly trading 3 days in a week. secondly keeping my daily drawdown at 2% daily, since I risk only 0.5% per trade, that means maximum of 4 trades per day ( two two for the two pairs I trade).

2. Greed: I think this issue is a bit tricky as I'm not sure if it's my greed that hampers my performance at times or maybe it's poor trade management. one of the biggest challenges for me this month was seeing having profitable trades that ended up in losses. that really really got to me. there were countless times I had winning trades that were up 100 pips plus but I refused to close the trades because I was waiting for it to hit tp which always end up hitting my stoploss. my trading risk rewards which I mostly aim towards to is 1:4 or 1:3, but recently I have been thinking of sticking to 1:2 RR. unfortunately my greed won't let me stick to it, I just feel like 1:2 is isn't satisfactory to me, I am confused and conflicted about it.

3. Lastly, I still struggle with indiscipline, as there are times that I succumb to temptations of breaking my rules. like last week, I wasn't supposed to trade on Friday, I broke the rule and end up losing 1%, on Thursday mid morning at around 2am, I was awake and I checked the charts during asian session which I don't trade, saw a very tempting set-up which I took with the hope of making a bad ass killing from RR perspective, long story short, it flopped and I lost another 1%. Lord knows that I beat myself up for breaking my rules at times but I still end up doing it, although I don't break my rules frequently as I used to do before, but I feel like should have gotten to a stage or level where I ought not to break my rules.

So overall, Feb for me wasn't too bad at all, I'm $35 away from BE on my 5%ers, Fundednext Feb comp 9%, TFT Feb comp 6.5%, and unfortunately SFT 1.8%. Now at the start of the month my performance on Fundednext, TFT and SFT, were the same, but along the lines it began to diverge due to some lapses. I noted that it's not easy trading multiple accounts without a trade copier, there times I get sloppy entries on my other accounts because when, I enter a trades on one account, by the time I logged in to the other accounts, price had already moved. I also notice discrepancies in the pricing feed between brokers, there are times that I set limit others, which may get triggered on one account and may not be triggered on the other accounts. All this affected my performance across all accounts and as for the SFT, I actually gambled on it this week, due to the fact that it's the end of the month and it seems to be the least performing account, so I decided to take some big shots on it if it would be in my favor, sadly it didn't.

I'll stop here because I seem to have written quite a long post, but I want to thank everyone here on the community for the value that they keep adding here, I wasn't as good as I am now early last year, but I am much more better than before, I know I am not a good trader but I am seeing progress in my trading journey. I am happy and grateful for having a community that I can commit to and also be accountable to. pls elders in the house do not hesitate to advise, admonish or scold me, as always, I am willing to learn. cheers That's why we've been advised here to stay away from all these competitions. Competition will only build the gambler in you and not the ideal trader. You cannot do without overtrading, gambling, fomo and all... Well!! if that's the only means of getting an account, you can keep trying but note that those guys on top of the list are gamblers. You can wait for NFP and cpi set both buy and sell order with max lot on all the giant pairs.. Just one cpi move might get you 25% 3 Likes |

| Re: Forex Trade Alerts / Discussions: Season 24 by friendbee: 10:34am On Mar 01, 2024 |

HAPPY NEW MONTH dmahn:

That's why we've been advised here to stay away from all these competitions. Competition will only build the gambler in you and not the ideal trader. You cannot do without overtrading, gambling, fomo and all... Well!! if that's the only means of getting an account, you can keep trying but note that those guys on top of the list are gamblers. You can wait for NFP and cpi set both buy and sell order with max lot on all the giant pairs.. Just one cpi move might get you 25% |

| Re: Forex Trade Alerts / Discussions: Season 24 by boom99(m): 10:58am On Mar 01, 2024 |

Samfelly where are you. I need you help |

| Re: Forex Trade Alerts / Discussions: Season 24 by 2pep(m): 11:18am On Mar 01, 2024 |

Happy New Month to you famz If I was told that I would be part of the February competition winners after going down -96% drawdown, I wouldn't have believed that but one thing I know is, this is a divine intervention not my doing.   |

... 4th $5 withdrawal from a $20 account... Its like the prop guys are my enemy 😅... This used to be me b4 joining the prop space.. Na this confidence make me go enter prop space say I'm ready for the challenge only for me to be swimming in DD for the past 8 months

... 4th $5 withdrawal from a $20 account... Its like the prop guys are my enemy 😅... This used to be me b4 joining the prop space.. Na this confidence make me go enter prop space say I'm ready for the challenge only for me to be swimming in DD for the past 8 months  ... I took a break from prop trading now and pips wey no dey show on prop dey show on personal account.... What could be wrong

... I took a break from prop trading now and pips wey no dey show on prop dey show on personal account.... What could be wrong

HAPPY NEW MONTH

HAPPY NEW MONTH