| Re: Nigerian Stock Exchange Market Pick Alerts by onegentleguy: 12:35pm On Nov 29, 2019 |

2 Likes |

| Re: Nigerian Stock Exchange Market Pick Alerts by onegentleguy: 12:35pm On Nov 29, 2019 |

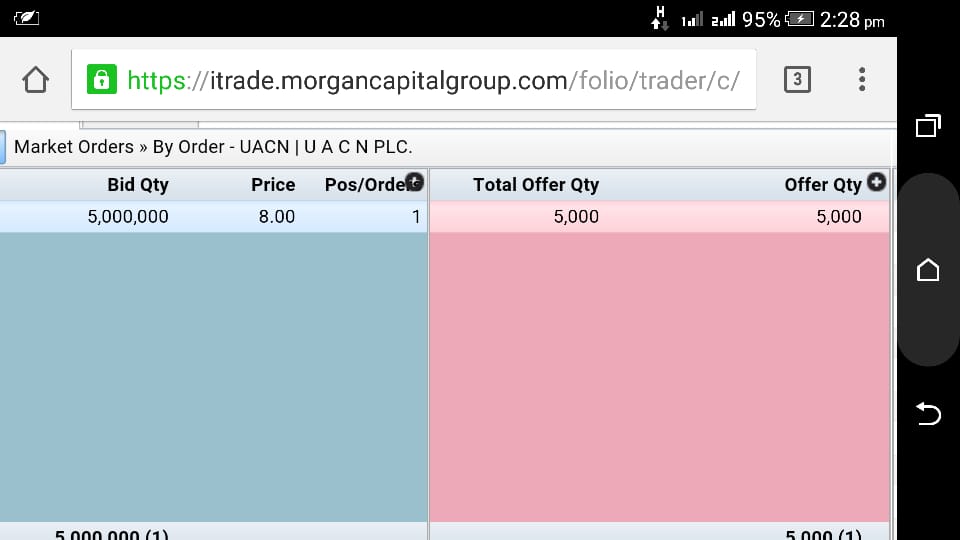

It happened with NEIMITH, it has just stated out in UACN... and will soon happen in ETI.

Before some folks will see what we have seen, the price of that coy would've nearly doubled !!

We are here. 2 Likes |

| Re: Nigerian Stock Exchange Market Pick Alerts by onegentleguy: 12:36pm On Nov 29, 2019 |

|

| Re: Nigerian Stock Exchange Market Pick Alerts by onegentleguy: 12:37pm On Nov 29, 2019 |

|

| Re: Nigerian Stock Exchange Market Pick Alerts by Mcy56(f): 12:38pm On Nov 29, 2019 |

|

| Re: Nigerian Stock Exchange Market Pick Alerts by PETERiCHY(m): 12:44pm On Nov 29, 2019 |

Mcy56:

UACN on fireeeee............. 8naira now  8naira is still a 50% discount from the #16 per share right issue they did enlisted last year. Couple with the 60% and 30% ratio a UACN holders will get from UNBUNDLING of UPDC & REIT respectively. When you add all of that you will see the JOURNEY is yet to COMMENCE.  BARGAIN HUNTERS TAKE NOTE! *ThE OcToPuS* 2 Likes |

| Re: Nigerian Stock Exchange Market Pick Alerts by bigjay01(m): 12:50pm On Nov 29, 2019 |

OakPearl:

Solid!

At some point I got tired of shouting "buy UACN". been buying all the way from 9s last year down to lower 5s a few months ago. This last purchase though at 7.5 has dragged my average up to 7. i am done buying unless I see it in the 6s. no wahalla! |

| Re: Nigerian Stock Exchange Market Pick Alerts by bigjay01(m): 12:54pm On Nov 29, 2019 |

onegentleguy:

Sharp man !!    Seplat's been ranging, bought at £2.2 on listing, costs me £5 monthly to maintain my account. I didn't want to commit new funds into the market. Hence the sell. I could have arbitraged by buying locally and saving N50 per share, but UACN presented more upsides. |

| Re: Nigerian Stock Exchange Market Pick Alerts by chillykelly86(m): 12:55pm On Nov 29, 2019 |

fxuser:

FUGAZ (example)

A 200-ema Check (40week –ema)

200 -ema is a long term moving average and a strong indicator of trend . Above is bullish , below is bearish , very slow as its represents the average of the last 200 days closing prices (for nse the 50 is a solid indicator , due to low volume nature etc). Price have been below for months.

Banks Above 200-ema proper

- UBA (golden cross)

- Access (golden cross tey tey)

- FBN (golden cross loading)

Just Under testing the 200-ema (but above the 50-ema)

- Zenith (needs to close abv 19, but abv 50-ema)

- GTB (needs to close above N30)

Trend Analysis

- All bullish with further upside to come , sit tight font get shaken out by daily NOISE

- When price is above long term MA’s , poor entries are forgiven , just stay put esp long term holders

- Pull backs above long term EMA are entry opportunities

(like dis week, if ur selling now , u will likely buy higher , snr ogas will explain better in normal language lol)

RISK MGT / STOP

- A close below the 50-ema is a big warning (take all profits, no story) , a break below 200-ema is get out for long term holders

A blessed month ahead Thanks Boss. Please which site do you use for technical analysis of the NSE? |

| Re: Nigerian Stock Exchange Market Pick Alerts by Homextras: 1:02pm On Nov 29, 2019 |

|

| Re: Nigerian Stock Exchange Market Pick Alerts by OLAJADON: 1:37pm On Nov 29, 2019 |

Infinitisi:

To succeed in the stock market you need knowledge, far more knowledge than people realise. Without adequate knowledge/financial literacy you are only going to crash. From your questions it is obvious you have little or no knowledge about the stock market. So what I advice are these:

1. You need to first understand what shares/stocks are and how the stock marker works. This is very important. Go online and look for books that explain how the stock market works in simple terms. You can try the one in this link https://zerodha.com/varsity/module/introduction-to-stock-markets/ pls note I haven't read the book and the author is Indian so he will be talking about the Indian stock exchange. But the principle is the same across the world.

2. Decide if you want to be a fundamentalist or a technical trader. A fundamental investor analysis the companies financial results and looks for good, financially healthy stocks to buy at prices lower than what they are worth. He buys to hold for a long time and enjoy long term capital appreciation and/or dividends. He may also sell if prices rises to a level he fills the stock is over prices. The technical trader on the other hand uses technical analysis (just like forex trading) to analyse stock charts and take advantage of short term trading opportunities, buying low and selling high. So decide which side you want to belong and study along that line. You can also combine both strategies. Some do it here.

For a basic intro to fundamental analysis download and read this https://zerodha.com/varsity/module/fundamental-analysis/

For a basic intro to technical analysis download and read this https://zerodha.com/varsity/module/technical-analysis/

3. Do yourself a favour and read the first 50 pages of this thread. Then you can read the last 50 pages of this thread too and from now on keep following the thread. A lot of useful information can be found here and some of your questions will have already been answered here.

4. LAST AND MOST IMPORTANT DO NOT PUT A KOBO IN THE STOCK MARKET TILL YOU HAVE STUDIED AND HAVE AT LEAST A FOUNDATIONAL KNOWLEDGE OF WHAT THE STOCK MARKET IS AND KNOWLEDGE OF FUNDAMENTAL AND/OR TECHNICAL ANALYSIS

Give yourself time. The stock market is here and is nor running away.

Good luck. thank you so much |

| Re: Nigerian Stock Exchange Market Pick Alerts by OLAJADON: 1:40pm On Nov 29, 2019 |

Mcy56:

Hhmmm. Let me try........Pls know that I'm still learning also.

My ogas will be able to fine-tune it better and add quality to my answers if they're chanced

1. Knowing best stock to buy depends majorly on how healthy the coy is thru their quarterly financial reports. There are analysts who specializes in interpreting these results and can advice if its good, better, improving or simply not doing well. They also give recommendations on whether to buy/hold/sell any of these stocks. Also, some special news may trigger purchase of some stocks, maybe take over or acquisition news, etc.

2. Yes, there are strategies, like buying low and sell high, bear/bull period watch, watch your emotions, be greedy when others are fearful, always monitor performance of your stock, etc. Though I dont know about forex and therefore cant be able to relate it here.

3. Yes. You can start with as low as 5,000 depending on the stock broker you chose to open trading account with. Some dont collect such low amount for a start. Reason Morgan Capital or Mytradebook is recommended here. You can however maximize your profits if you continue to increase your fund by funding your trading account.

4. The likes of Afrinvest, Morgan, Meristem, Greenwich, etc are all registered stock brokers which you can open account with in other to trade. They give regular reports and stock recommendations BUT dont follow it verbatim without carrying out your due diligence. You can ask about it here to get experts' opinions. You dont stop reading comments and financial books. Follow some ogas here. Check this moniker, infinitisi, he has loads of e-books to read too.

Most importantly, continue to follow this thread. We have seasoned experts and gurus here who are always helping and ready to help. They analyse these stocks and give buy/sell recommendations as well. That's it from me for now. Good luck.  sure thanks 1 Like |

| Re: Nigerian Stock Exchange Market Pick Alerts by Nobody: 1:42pm On Nov 29, 2019 |

PETERiCHY:

When LOCO sighted UACN @8:00k    Honeywell ministry is not disappointing. You can remain there while I remain here for my usual 15%. |

| Re: Nigerian Stock Exchange Market Pick Alerts by DeRuggedProf: 1:50pm On Nov 29, 2019 |

locodemy:

Honeywell ministry is not disappointing.

You can remain there while I remain here for my usual 15%. TERM OF THE MONTHZENITHOPHOBIA: The fear of price advancement.....  Hope there is no security lending program exclusively for ZENITH.....  1 Like |

| Re: Nigerian Stock Exchange Market Pick Alerts by OakPearl(m): 2:03pm On Nov 29, 2019 |

The market is unusually busy on a Friday. Not surprised these days, anything can happen with portfolio re-balancing: after all, even Arsenal don sack their coach!  |

| Re: Nigerian Stock Exchange Market Pick Alerts by Samuelgr8: 2:06pm On Nov 29, 2019 |

Good day house. Pls is anything wrong with Zenith Bank? for some time now the offer been far higher than the bid, even when his broda GTB been showing signs of upward, its price been under. I really need to know...... Thanks so much DeRuggedProf:

TERM OF THE MONTH

ZENITHOPHOBIA: The fear of price advancement.....

Hope there is no security lending program exclusively for ZENITH.....  |

| Re: Nigerian Stock Exchange Market Pick Alerts by nna777: 2:14pm On Nov 29, 2019 |

Mcy56:

UACN on fireeeee............. 8naira now  Those last minute guys will finally push it to #8. They came but decided to leave it at #7.65. Monday will be another day. slow and steady. |

| Re: Nigerian Stock Exchange Market Pick Alerts by nna777: 2:16pm On Nov 29, 2019 |

onegentleguy:

It happened with NEIMITH, it has just stated out in UACN... and will soon happen in ETI.

Before some folks will see what we have seen, the price of that coy would've nearly doubled !!

We are here. You have said enough. He who had ears let him hear what has been spoken. 1 Like |

| Re: Nigerian Stock Exchange Market Pick Alerts by Nobody: 2:19pm On Nov 29, 2019 |

Mcy56:

Hhmmm. Let me try........Pls know that I'm still learning also.

My ogas will be able to fine-tune it better and add quality to my answers if they're chanced

1. Knowing best stock to buy depends majorly on how healthy the coy is thru their quarterly financial reports. There are analysts who specializes in interpreting these results and can advice if its good, better, improving or simply not doing well. They also give recommendations on whether to buy/hold/sell any of these stocks. Also, some special news may trigger purchase of some stocks, maybe take over or acquisition news, etc.

2. Yes, there are strategies, like buying low and sell high, bear/bull period watch, watch your emotions, be greedy when others are fearful, always monitor performance of your stock, etc. Though I dont know about forex and therefore cant be able to relate it here.

3. Yes. You can start with as low as 5,000 depending on the stock broker you chose to open trading account with. Some dont collect such low amount for a start. Reason Morgan Capital or Mytradebook is recommended here. You can however maximize your profits if you continue to increase your fund by funding your trading account.

4. The likes of Afrinvest, Morgan, Meristem, Greenwich, etc are all registered stock brokers which you can open account with in other to trade. They give regular reports and stock recommendations BUT dont follow it verbatim without carrying out your due diligence. You can ask about it here to get experts' opinions. You dont stop reading comments and financial books. Follow some ogas here. Check this moniker, infinitisi, he has loads of e-books to read too.

Most importantly, continue to follow this thread. We have seasoned experts and gurus here who are always helping and ready to help. They analyse these stocks and give buy/sell recommendations as well. That's it from me for now. Good luck.  How do you read charts? Do most people here trade fundamentals? |

| Re: Nigerian Stock Exchange Market Pick Alerts by Nobody: 2:20pm On Nov 29, 2019 |

DeRuggedProf:

TERM OF THE MONTH

ZENITHOPHOBIA: The fear of price advancement.....

Hope there is no security lending program exclusively for ZENITH.....  From zenith to Uacn and now to Honeywell yet zenith trading below the price I sold. Honeywell is now 1.10 may even close at 1.12. This is error.......prayer point brethren |

| Re: Nigerian Stock Exchange Market Pick Alerts by Nobody: 2:21pm On Nov 29, 2019 |

fxuser:

FUGAZ (example)

A 200-ema Check (40week –ema)

200 -ema is a long term moving average and a strong indicator of trend . Above is bullish , below is bearish , very slow as its represents the average of the last 200 days closing prices (for nse the 50 is a solid indicator , due to low volume nature etc). Price have been below for months.

Banks Above 200-ema proper

- UBA (golden cross)

- Access (golden cross tey tey)

- FBN (golden cross loading)

Just Under testing the 200-ema (but above the 50-ema)

- Zenith (needs to close abv 19, but abv 50-ema)

- GTB (needs to close above N30)

Trend Analysis

- All bullish with further upside to come , sit tight font get shaken out by daily NOISE

- When price is above long term MA’s , poor entries are forgiven , just stay put esp long term holders

- Pull backs above long term EMA are entry opportunities

(like dis week, if ur selling now , u will likely buy higher , snr ogas will explain better in normal language lol)

RISK MGT / STOP

- A close below the 50-ema is a big warning (take all profits, no story) , a break below 200-ema is get out for long term holders

A blessed month ahead Bro How you take dey see charts? Please I’ve tried Investing com but e no fresh. Please I need help on free charts |

| Re: Nigerian Stock Exchange Market Pick Alerts by nna777: 2:25pm On Nov 29, 2019 |

|

| Re: Nigerian Stock Exchange Market Pick Alerts by mendes911: 2:26pm On Nov 29, 2019 |

A seller is hell bent on selling UBA and an equally willing buyer is bent on buying at N7.05.

We will see who wins by next week. |

| Re: Nigerian Stock Exchange Market Pick Alerts by Nobody: 2:28pm On Nov 29, 2019 |

nna777:

Those our Chinese guys are back    . . When they finally remove the happiness of shareholders(2.50) from the share price. It's goodbye Janet. |

| Re: Nigerian Stock Exchange Market Pick Alerts by mendes911: 2:29pm On Nov 29, 2019 |

Access Bank MM.

SHM. |

| Re: Nigerian Stock Exchange Market Pick Alerts by PETERiCHY(m): 2:32pm On Nov 29, 2019 |

locodemy:

Honeywell ministry is not disappointing.

You can remain there while I remain here for my usual 15%. Stop looking for the living among the dead.

|

| Re: Nigerian Stock Exchange Market Pick Alerts by Nobody: 2:35pm On Nov 29, 2019 |

PETERiCHY:

Stop looking for the living among the dead Wow. |

| Re: Nigerian Stock Exchange Market Pick Alerts by Nobody: 2:38pm On Nov 29, 2019 |

Fcmb..........Hmmmm.........well,let me be going.

Anyone who sees result should halla me oooo.

I have a fast fingers these days....... |

| Re: Nigerian Stock Exchange Market Pick Alerts by DeRuggedProf: 2:40pm On Nov 29, 2019 |

1 Like |

| Re: Nigerian Stock Exchange Market Pick Alerts by Mcy56(f): 2:41pm On Nov 29, 2019 |

nna777:

Those last minute guys will finally push it to #8.

They came but decided to leave it at #7.65. Monday will be another day. slow and steady. It closed at N8. You know those guys knows how to keep the price under until they can fill their desired qties.  It's slow and steady, we'll get to 10...........then 20.................then 50..........................then 96.   1 Like |

| Re: Nigerian Stock Exchange Market Pick Alerts by Mcy56(f): 2:43pm On Nov 29, 2019 |

locodemy:

From zenith to Uacn and now to Honeywell yet zenith trading below the price I sold.

Honeywell is now 1.10 may even close at 1.12. This is error.......prayer point brethren Loco comparing Honey well with UACN. Issokay ooo.  |

| Re: Nigerian Stock Exchange Market Pick Alerts by OakPearl(m): 2:44pm On Nov 29, 2019 |

|

.

.