| Re: Forex Trade Alerts: Season 21 by blackman007: 5:27pm On Jan 02, 2021 |

Shevychen2:

Some random pointers for the new year. (may not appeal to everyone though):

-Your stop loss is useless if you don't practice proper position sizing. What will happen to your account if a flash crash jumps your stop loss and sends your positions to -2000 pips negative? Position sizing goes beyond saying I risk 2% per trade. How much have you exposed to the market, even without a flash crash? If you'll lose more than a combined 10% of your account if all your opened trades ends as losses. That account may not last long.

-Ditch conventional indicators. Especially all those shiny arrows that are all based on moving averages.There is a 99% chance they won't work for you. You'll keep running around in circles with them until you either quit trading or you dump them.

-Embrace higher time frames. This is even more important now that sharp intraday market swings are common. You'll find your trade 70pips up, then one tweet or one news sends it back down to -40. On the higher time frame (daily, weekly, monthly), the big picture move will continue after the effects of that tweet or news has cleared. Seriously, if you learn how to look at the big picture, you'll be unstoppable. However, what qualifies as big picture will vary from one person to another. You also need to make sure your strategy always reacts quick enough to major trend changes even when you trade higher time frames. This part is tricky, but when you nail it down, you'll know.

-Don't pay too much attention to correlation. Most forex pairs are correlated somehow at the end of the day. Even if you choose to trade only GBPAUD, CHFJPY, and EURUSD, they are still correlated indirectly. Instead of avoiding correlation, embrace it and spread your risk properly.

-Don't trade one pair. That's giving too much power to one instrument. Your account will literally depend on how that instrument moves. Aim for around 5-15 pairs and maybe (if your account can carry it) 2-3 metals and the two major ndices in your watch list. The currency pairs should be decent movers that are not too volatile or too slow. Like USDZAR, EURGBP, CADCHF etc. The slow ones will move 20 pips in one week. The volatile ones can have 30-50 pips spreads.

As you get more entries from your list, close out partial positions to balance out your overall risk exposure.

-You won't buy skyscrapers with your less than $1000 account in one year. There's a higher chance of crashing it if you want to push the limits and make as much money as possible. You need at least $100k to start dreaming about using profits from one year of trading to build houses and that's assuming you have a strategy that will allow you make 50-100% of that every year COMFORTABLY without panic, fear etc tampering with your trading results. Of course you can find some Chinese guy or something that turned 1k to 1m USD in one year from time to time.. Can YOU do it?

With solid medium risk trading, it will take at least 10 years of compounding to convert that small account to something big. Unless you show skill early enough and start focusing on attracting investors (always the best way to go).

Remember, these pointers are not for everyone. Pick what you want, discard what you don't like. I don't have power to argue anything o. Happy New Year to everyone.

Food for thought  |

| Re: Forex Trade Alerts: Season 21 by Nobody: 5:35pm On Jan 02, 2021 |

|

| Re: Forex Trade Alerts: Season 21 by Karleb(m): 5:37pm On Jan 02, 2021 |

2 Likes |

| Re: Forex Trade Alerts: Season 21 by Donvic4u(m): 5:44pm On Jan 02, 2021 |

Still need btc 153 only |

| Re: Forex Trade Alerts: Season 21 by Donvic4u(m): 5:45pm On Jan 02, 2021 |

Theyoungmaster:

I can link you up to someone. Though I doubt if he'd agree to sell. He buys most often. You can try your luck. Pm via signature. Not on WhatsApp sir. Only telegram |

| Re: Forex Trade Alerts: Season 21 by holarindey(m): 6:02pm On Jan 02, 2021 |

|

| Re: Forex Trade Alerts: Season 21 by Karleb(m): 6:21pm On Jan 02, 2021 |

holarindey:

I trade GU/GC only and it works for me. Focusing on 5-15 pairs and metals will be too much for me� It's all about trader differences. |

| Re: Forex Trade Alerts: Season 21 by Harnytee27(m): 6:30pm On Jan 02, 2021 |

Most traders on this forum are technical traders,ain't we incorporating fundamental analysis to our trade

I can always update fundamental news of major currency at will 3 Likes |

| Re: Forex Trade Alerts: Season 21 by Harnytee27(m): 6:33pm On Jan 02, 2021 |

Once In a while I will update some psychological quote for beginner's and pro

Theyoungmaster u are on my watch list because u trade like me 1 Like |

| Re: Forex Trade Alerts: Season 21 by blackman007: 7:29pm On Jan 02, 2021 |

Mrbillionaire:

EU range for Friday Yes the sell might be a retracement, to later continue the overall up trend, the retacement might even look like a full blown down trend on the lower timeframes |

| Re: Forex Trade Alerts: Season 21 by holarindey(m): 7:59pm On Jan 02, 2021 |

Karleb:

It's all about trader differences. Exactly |

| Re: Forex Trade Alerts: Season 21 by ZedFX(m): 8:24pm On Jan 02, 2021 |

Shevychen2:

Some random pointers for the new year. (may not appeal to everyone though):

-Your stop loss is useless if you don't practice proper position sizing. What will happen to your account if a flash crash jumps your stop loss and sends your positions to -2000 pips negative? Position sizing goes beyond saying I risk 2% per trade. How much have you exposed to the market, even without a flash crash? If you'll lose more than a combined 10% of your account if all your opened trades ends as losses. That account may not last long.

-Ditch conventional indicators. Especially all those shiny arrows that are all based on moving averages.There is a 99% chance they won't work for you. You'll keep running around in circles with them until you either quit trading or you dump them.

-Embrace higher time frames. This is even more important now that sharp intraday market swings are common. You'll find your trade 70pips up, then one tweet or one news sends it back down to -40. On the higher time frame (daily, weekly, monthly), the big picture move will continue after the effects of that tweet or news has cleared. Seriously, if you learn how to look at the big picture, you'll be unstoppable. However, what qualifies as big picture will vary from one person to another. You also need to make sure your strategy always reacts quick enough to major trend changes even when you trade higher time frames. This part is tricky, but when you nail it down, you'll know.

-Don't pay too much attention to correlation. Most forex pairs are correlated somehow at the end of the day. Even if you choose to trade only GBPAUD, CHFJPY, and EURUSD, they are still correlated indirectly. Instead of avoiding correlation, embrace it and spread your risk properly.

-Don't trade one pair. That's giving too much power to one instrument. Your account will literally depend on how that instrument moves. Aim for around 5-15 pairs and maybe (if your account can carry it) 2-3 metals and the two major ndices in your watch list. The currency pairs should be decent movers that are not too volatile or too slow. Like USDZAR, EURGBP, CADCHF etc. The slow ones will move 20 pips in one week. The volatile ones can have 30-50 pips spreads.

As you get more entries from your list, close out partial positions to balance out your overall risk exposure.

-You won't buy skyscrapers with your less than $1000 account in one year. There's a higher chance of crashing it if you want to push the limits and make as much money as possible. You need at least $100k to start dreaming about using profits from one year of trading to build houses and that's assuming you have a strategy that will allow you make 50-100% of that every year COMFORTABLY without panic, fear etc tampering with your trading results. Of course you can find some Chinese guy or something that turned 1k to 1m USD in one year from time to time.. Can YOU do it?

With solid medium risk trading, it will take at least 10 years of compounding to convert that small account to something big. Unless you show skill early enough and start focusing on attracting investors (always the best way to go).

Remember, these pointers are not for everyone. Pick what you want, discard what you don't like. I don't have power to argue anything o. Happy New Year to everyone.

much attention to higher timeframes less focus on correlation I have read those well |

| Re: Forex Trade Alerts: Season 21 by ZedFX(m): 8:26pm On Jan 02, 2021 |

Harnytee27:

Most traders on this forum are technical traders,ain't we incorporating fundamental analysis to our trade

I can always update fundamental news of major currency at will it'll be appreciated. hopefully it should give bias as technicals give. cause at times fundamentals is all about talks. |

| Re: Forex Trade Alerts: Season 21 by Thunday1005(m): 8:29pm On Jan 02, 2021 |

Shevychen2:

Some random pointers for the new year. (may not appeal to everyone though):

-Your stop loss is useless if you don't practice proper position sizing. What will happen to your account if a flash crash jumps your stop loss and sends your positions to -2000 pips negative? Position sizing goes beyond saying I risk 2% per trade. How much have you exposed to the market, even without a flash crash? If you'll lose more than a combined 10% of your account if all your opened trades ends as losses. That account may not last long.

-Ditch conventional indicators. Especially all those shiny arrows that are all based on moving averages.There is a 99% chance they won't work for you. You'll keep running around in circles with them until you either quit trading or you dump them.

-Embrace higher time frames. This is even more important now that sharp intraday market swings are common. You'll find your trade 70pips up, then one tweet or one news sends it back down to -40. On the higher time frame (daily, weekly, monthly), the big picture move will continue after the effects of that tweet or news has cleared. Seriously, if you learn how to look at the big picture, you'll be unstoppable. However, what qualifies as big picture will vary from one person to another. You also need to make sure your strategy always reacts quick enough to major trend changes even when you trade higher time frames. This part is tricky, but when you nail it down, you'll know.

-Don't pay too much attention to correlation. Most forex pairs are correlated somehow at the end of the day. Even if you choose to trade only GBPAUD, CHFJPY, and EURUSD, they are still correlated indirectly. Instead of avoiding correlation, embrace it and spread your risk properly.

-Don't trade one pair. That's giving too much power to one instrument. Your account will literally depend on how that instrument moves. Aim for around 5-15 pairs and maybe (if your account can carry it) 2-3 metals and the two major ndices in your watch list. The currency pairs should be decent movers that are not too volatile or too slow. Like USDZAR, EURGBP, CADCHF etc. The slow ones will move 20 pips in one week. The volatile ones can have 30-50 pips spreads.

As you get more entries from your list, close out partial positions to balance out your overall risk exposure.

-You won't buy skyscrapers with your less than $1000 account in one year. There's a higher chance of crashing it if you want to push the limits and make as much money as possible. You need at least $100k to start dreaming about using profits from one year of trading to build houses and that's assuming you have a strategy that will allow you make 50-100% of that every year COMFORTABLY without panic, fear etc tampering with your trading results. Of course you can find some Chinese guy or something that turned 1k to 1m USD in one year from time to time.. Can YOU do it?

With solid medium risk trading, it will take at least 10 years of compounding to convert that small account to something big. Unless you show skill early enough and start focusing on attracting investors (always the best way to go).

Remember, these pointers are not for everyone. Pick what you want, discard what you don't like. I don't have power to argue anything o. Happy New Year to everyone.

Always on point |

| Re: Forex Trade Alerts: Season 21 by ZedFX(m): 8:29pm On Jan 02, 2021 |

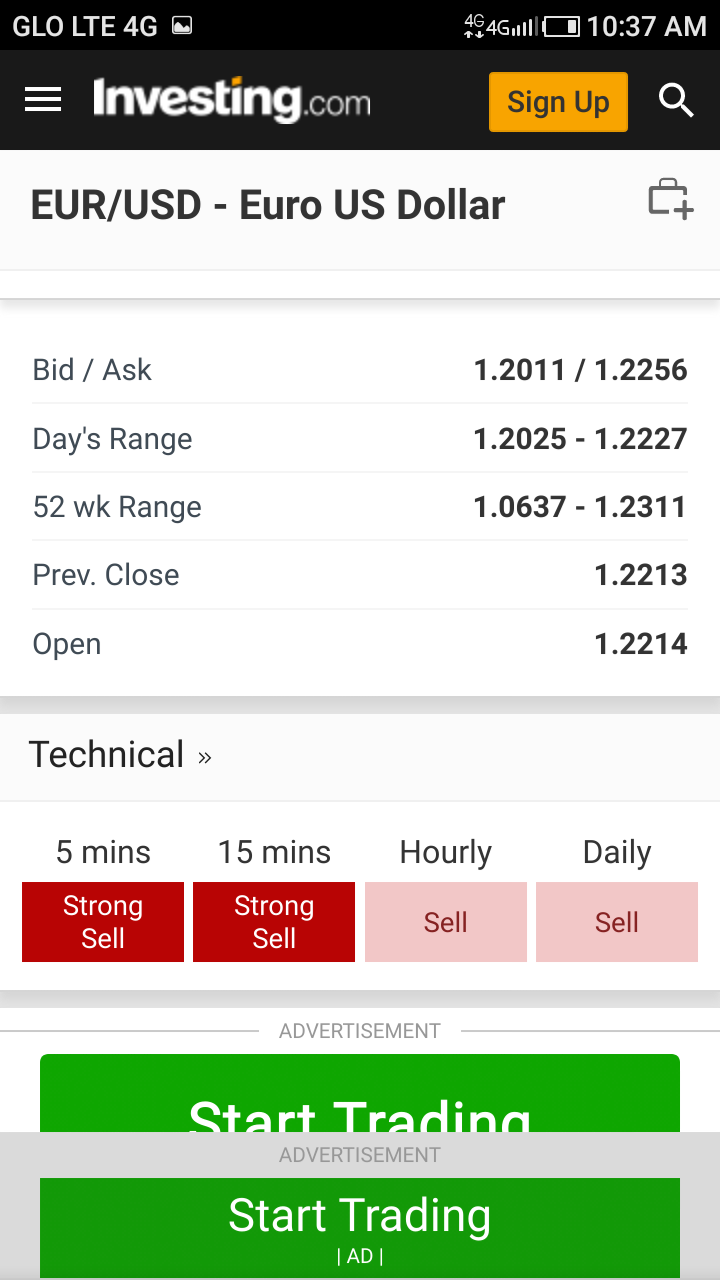

djwalata:

Eur sold off in all its pairs.

EurUsd closed on Thursday at 1.2215

Opened on Friday at 1.2136

Friday's high at 1.2227

Low at 1.2025

Closed at 1.2134

your Friday high is lower than the open? |

| Re: Forex Trade Alerts: Season 21 by highcurrent: 8:40pm On Jan 02, 2021 |

holarindey:

Currency pairs or crypto?

mostly crypto. |

| Re: Forex Trade Alerts: Season 21 by ZedFX(m): 8:52pm On Jan 02, 2021 |

holarindey:

I trade GU/GC only and it works for me. Focusing on 5-15 pairs and metals will be too much for me� I'm more into trading of many pairs. when I started, I had issues, in the sense that: 1. I traded using 1 hour timeframe in particular and missed setups because, I can spend up to 30 Minutes flipping through the pairs at it was not easy keeping tabs on them. 2. many pairs equals many setups and a bit of correlation. which do you go for? there's solution for those. 1. Higher timeframes 2. splitting max risk by number of setups currently I trade major USD pairs, major EUR pairs, major JPY pairs and AUDNZD (my fav) 2 Likes |

| Re: Forex Trade Alerts: Season 21 by Harnytee27(m): 9:04pm On Jan 02, 2021 |

ZedFX:

it'll be appreciated.

hopefully it should give bias as technicals give.

cause at times fundamentals is all about talks. Okay sir |

| Re: Forex Trade Alerts: Season 21 by Harnytee27(m): 9:46pm On Jan 02, 2021 |

TRADING BREAKDOWN

For all newbies and pro's, to be profitable

Strategy(technical/fundamental) is 10% skill

Risk management is 30% skills

Psychology is 60% skills

So don't focus on one |

| Re: Forex Trade Alerts: Season 21 by Theyoungmaster(m): 9:48pm On Jan 02, 2021 |

Donvic4u:

Not on WhatsApp sir. Only telegram Alright. How do I connect with you over there? |

| Re: Forex Trade Alerts: Season 21 by Theyoungmaster(m): 9:50pm On Jan 02, 2021 |

Donvic4u:

Not on WhatsApp sir. Only telegram 153 btc or $153 worth of btc |

| Re: Forex Trade Alerts: Season 21 by IMAliyu(m): 9:53pm On Jan 02, 2021 |

Shevychen2:

Some random pointers for the new year. (may not appeal to everyone though):

-Embrace higher time frames. This is even more important now that sharp intraday market swings are common. You'll find your trade 70pips up, then one tweet or one news sends it back down to -40. On the higher time frame (daily, weekly, monthly), the big picture move will continue after the effects of that tweet or news has cleared. Seriously, if you learn how to look at the big picture, you'll be unstoppable. However, what qualifies as big picture will vary from one person to another. You also need to make sure your strategy always reacts quick enough to major trend changes even when you trade higher time frames. This part is tricky, but when you nail it down, you'll know.

Nice write up. Something to take to heart in this new year and trading season. On this part, To trade the Higher timeframes (daily+) I believe you need a larger account and not the small #100 accounts. Because sometimes even a tight SL can be quite large for such small accounts. |

|

| Re: Forex Trade Alerts: Season 21 by holarindey(m): 12:43am On Jan 03, 2021 |

ZedFX:

I'm more into trading of many pairs.

when I started, I had issues, in the sense that:

1. I traded using 1 hour timeframe in particular and missed setups because, I can spend up to 30 Minutes flipping through the pairs at it was not easy keeping tabs on them.

2. many pairs equals many setups and a bit of correlation.

which do you go for?

there's solution for those.

1. Higher timeframes

2. splitting max risk by number of setups

currently I trade major USD pairs, major EUR pairs, major JPY pairs and AUDNZD (my fav) Sounds perfect � |

| Re: Forex Trade Alerts: Season 21 by Fmusty: 8:08am On Jan 03, 2021 |

Watchlist for this new week, 4th - 8th January, 2021.

I have what I am looking for in all pairs, I will only enter if I see price action confirming what I want, else discard and re-analysis, not to litter here with screenshot, I shared 3 of them here.

If you have any pair you prioritise for entering this week, you can share here, let's rub minds.

Technical analysis ideas sharing only, not interested in Forex trade signal

Cheers 3 Likes

|

| Re: Forex Trade Alerts: Season 21 by hidhrhis(m): 9:13am On Jan 03, 2021 |

May 2021 favor us all by GOD's grace

With the help of the elders in the group ive filtered a lot of noise from the way i trade but na Journey and we go continue to improve

Anytime they post trades and it relate to my ways of trading which im still finding difficult to understand i will just screenshot the picture DM then start begging them to explain what they saw and it went a long way to improve me

To the guys that are just starting from what is forex i implore u to ask a lot of questions from our elders or else u go burn oooo i mean really bad

if u cant ask them publicly, ask them privately

I trade with the close of the candle in which the wick is another part of the movement that gives separate meaning and i determine weakness and strongness before making any decision

We all do the same thing but our ways of executing it is what set us all apart

If plan did not play out i will restrategise cos im waiting for price to come to my hit zone 2 Likes

|

| Re: Forex Trade Alerts: Season 21 by ProsperoTrading: 9:21am On Jan 03, 2021 |

My outlook on gold. Bullish. I stand to be corrected

|

| Re: Forex Trade Alerts: Season 21 by hidhrhis(m): 9:26am On Jan 03, 2021 |

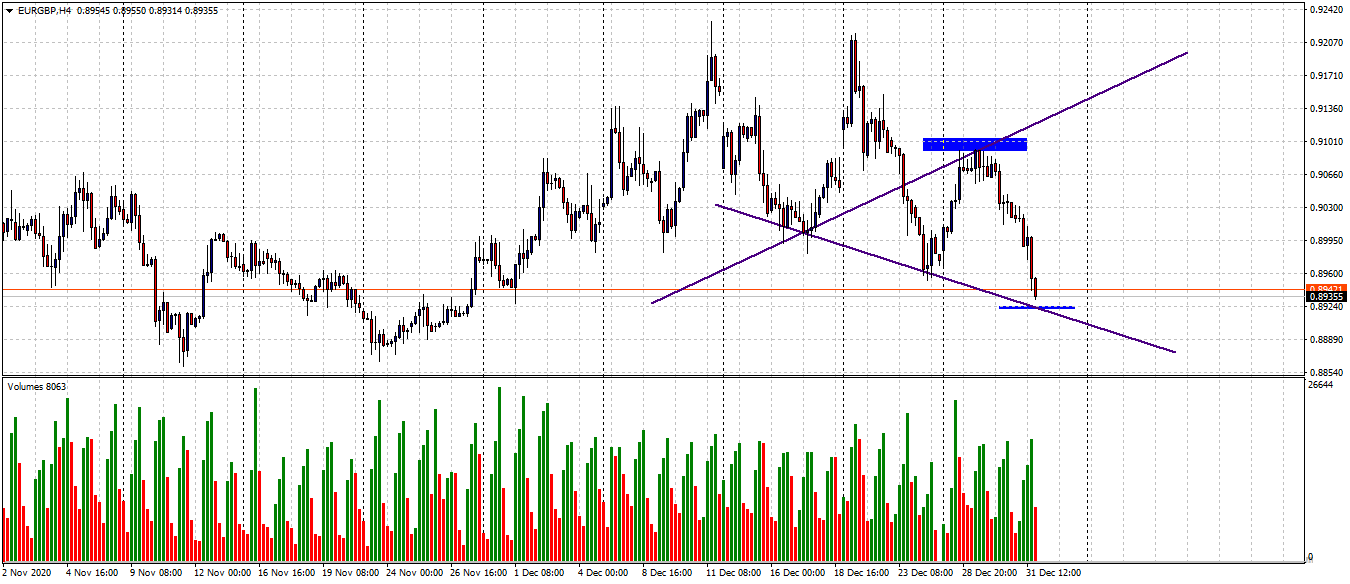

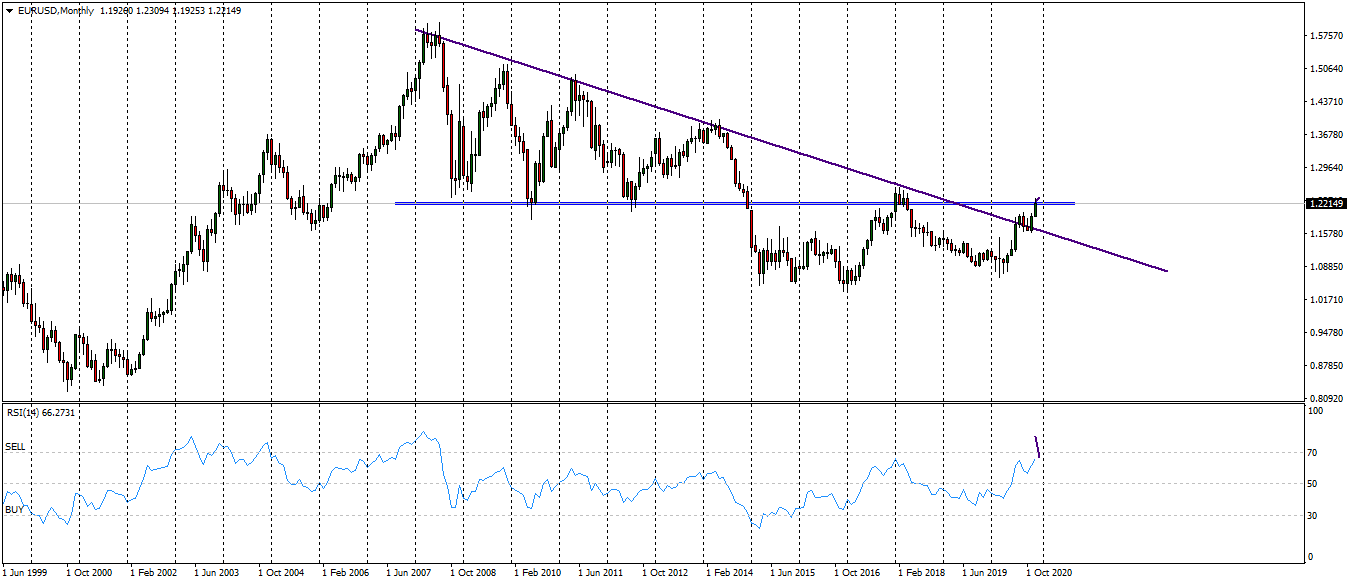

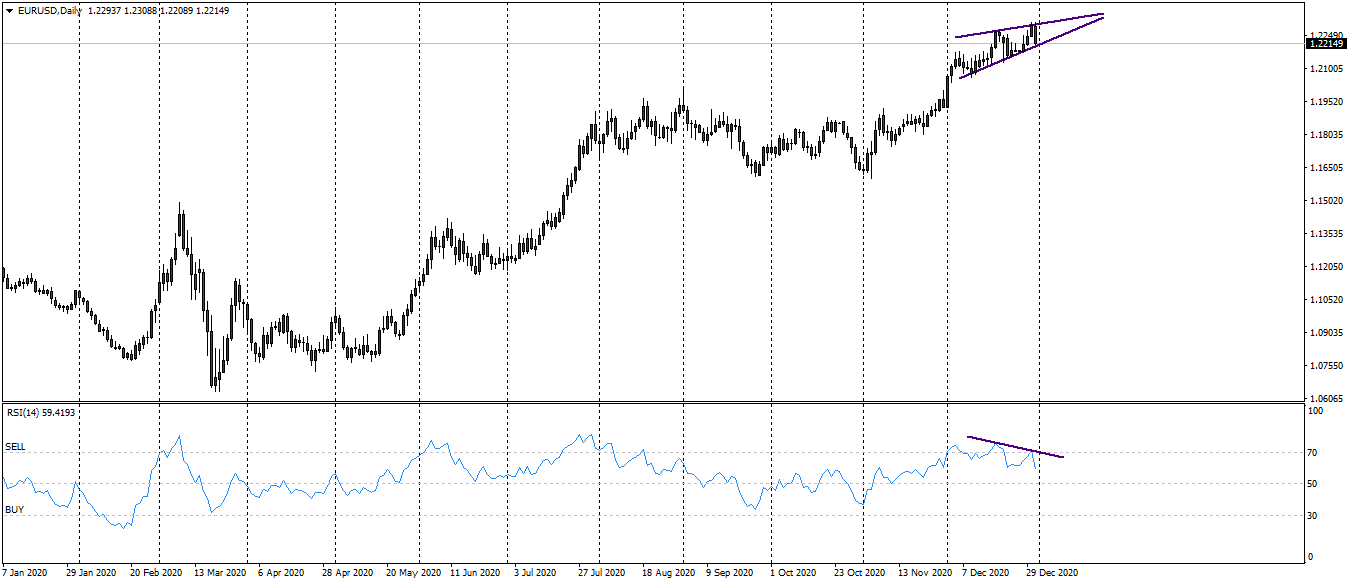

EURUSD

For price to close at that level on the monthly time frame im anticipating for a pull back which signifies for a sell on the lower time frame but the sell to be validated price must break out of 2 zones

The daily time frame formed a divergence which to me signifies a form of weakness with a bearish candle that engulfes the last bullish candle but what really matters is the break out

it may break up which signifies the continuation of the buy and it may break downward but what matters is if there is a break out

The same theory applies to the 4hr which is my point of execution

it must break out and close below the trendline or it continue to surge upward

next week will determine the answer

|

| Re: Forex Trade Alerts: Season 21 by hidhrhis(m): 9:28am On Jan 03, 2021 |

The same theory

waiting for where it will break

|

| Re: Forex Trade Alerts: Season 21 by boom99(m): 10:16am On Jan 03, 2021 |

My people I want you to help me answer this question way they bug me.

I have noticed that when ever I trade( demo) with large capital I hardly make losses. For instance I have been trying out a strategy for a month now, I have made just one loss.

Whenever I trade with large lotsize, I trade less and I make huge profit. But when ever I use less capital, say 500dollars I blow the account. Bosses wey Don tey for this business please clearify me on what to do |

| Re: Forex Trade Alerts: Season 21 by Gasive: 10:33am On Jan 03, 2021 |

ProsperoTrading:

My outlook on gold. Bullish. I stand to be corrected I had a bull bias before but those multiple rejections at the top may be a sign of no momentum. Here's what I see now, but a break above 1910 will nullify the analysis and confirm the bulls.

|

| Re: Forex Trade Alerts: Season 21 by Crixxx: 12:16pm On Jan 03, 2021 |

Bosses what's y'all thought on btc?

|