| 10 Ways To Recognize Ponzi Schemes by Financialslot1: 12:16pm On Jun 17, 2021 |

The Ponzi scheme is one of the oldest, most notorious investment frauds in the world, with over eight thousand (3,000) schemes across the world in the past decade.

At the very start, a Ponzi scheme sells the illusion of a sustainable business so long newer investors are periodically introduced into its system and older investors do not request full repayment. In order to attract investors, Ponzi scheme promoters promise enormous returns and pay them in order to set their balls rolling.

Charles Ponzi, an Italian whom the scheme is named after gained prominence as far back as the 1920s by promising investors in North America a 50% and a 100% profit within 45 days and 100 days respectively. Although Ponzi was not the originator of the now-global notorious investment scheme, he got so good at it and grew on him that people named the fraudulent scheme after him.

Despite being a notorious investment fraud that can easily be recognized from hundreds of miles away, Ponzi schemes keep growing even in today’s world, with the same noticeable tricks, promises and “100% guarantees” that makes it difficult to miss.

To a layman, all Ponzi scheme adopt the “rob Peter to pay Paul” model; earlier investors are paid “their profits” using the investments of later investors. To survive, and continue to function properly, newer investors must be injected into the scheme periodically for their money to be shared amongst earlier investors. If this is unattainable, the system will inevitably crash, leaving investors at a loss. Below is how to identify them:

1. Abnormally high returns

The first telltale sign of any Ponzi scheme is the abnormally high returns on investments (ROIs) Ponzi promoters promise. Although Ponzi schemes can take on several forms and might look unique at first, the intrinsic theme remains the same; investors are assured that they will make so much in a short time and their ROI can almost be doubled. When compared to other investment types, Ponzi schemes have a way of creating a false sense of shortcut to success when in reality it is far from being a legitimate deal. Always remember this adage; “if it is too good to be true, it is probably a fraud.”

2. “Guaranteed high returns”

Other than the fact that Ponzi schemes are comfortable with promising incredibly high investment returns, another way to recognize them is the promise of “guaranteed high returns”. Ponzi schemes promise this in order to calm potential investors and trigger deep-seated investors’ greed and equip their mindset that the scheme can’t fail. In reality, no returns can be considered guaranteed because the most decent of all investments carry some associated risks.

3. Vague business model

If after 5 minutes, you are still left in confusion about a business model, then bolt! Every investment business model should not be complicated that it would take up to 20 minutes to explain. And because Ponzi scheme promoters do not like to give people the idea that their business is a Ponzi scheme from the start, they are forced to adopt semantics and play around with big words such as ‘high yield investment’, ‘hedge future trading’, etc. The goal is often to intimidate and mesmerize potential investors from knowing what their business is genuinely all about. According to Warren Buffet, you should “Never invest in a business you can’t understand.” A good rule of thumb you must never ignore if your money means anything to you.

4. The need for more investors

Ponzi schemes are like Pyramid schemes and need newer investors in order to survive and remain operational. Because of this, investors are often compelled to bring in newer investors in order to get paid faster. If they don’t tell you this, Ponzi scheme promoters often wrap sweet rewards around referrals in order to motivate existing investors and convince others into hopping on the train. If this is the case with any investment you find yourself in, your investment sense should be tingling already.

5. Credibility via association/hierarchy

Most Ponzi scheme promoters love to create an atmosphere of exclusivity by pulling in potential investors into their smaller circle as a way of building trust and allaying investors’ fear. If this isn’t happening, they opt for the “association by hierarchy” method in order to delegate or grant exclusive access to older or earlier investors. This method creates an illusion of a serious business with a proper structure where the top “executives” or “CEO” can’t be reached easily but information still runs freely because only a few have access to them. In a period of panic when investors might want to hear directly from the “CEO”, the Ponzi promoter comes out, address the situation as normal and goes back in.

6. Unlicensed/Registered investment companies

Every state and federal security law require that investment companies should be registered and licensed but this is never the case with Ponzi schemes. Most Ponzi schemes are usually owned by individuals who mask them under already registered company names as a way of deceiving potential investors that their companies are registered with the CAC when, in fact, they are not registered as an investment company. Never fall for this!

7. The pressure to act immediately

A good investment company will always be around for as long as the company stands but because Ponzi schemes are designed to be short-lived. Their promoters tend to create a false sense of urgency; creating the impression that the investment scheme is time-limited. Since the scheme is shrouded in a tent of secrecy, potential investors are often advised to “act now” in order not to miss a “lifetime of opportunity”. Asking people to invest and act immediately is foreign to sound investing principles and the idea of one should be greatly considered a red flag.

8. The pressure to reinvest

Ponzi schemes are destined to collapse from the get-go but how long they can survive is largely dependent on how well investors keep monies within the scheme. A Ponzi scheme will collapse when the income is not regular or when investors withdraw their investments and fail to put their monies back in. In a bid to curb this, Ponzi scheme promoters tend to offer mouth watering incentives to investors who do not cash out. While investors are deceived into believing that their money is put to good use and their investments are breaking grounds, the obvious truth is that most Ponzi scheme promoters do not invest in anything on behalf of investors. If an investment scheme asks you not to cash out because there are rewards, then that is all the proof you need that you are dealing with a Ponzi scheme.

9. Consistently high performance

It is very normal to see investment markets fluctuate or rise and fall over a period of time. As a matter of fact, investment market fluctuations will likely affect your returns in any reputable investment company. This is because there are risks with investments and it won’t be Christmas every day, no thanks market fluctuations. Strangely, this is never applies to Ponzi schemes because they are known to be consistent even in the face of a global meltdown. The trick? So long newer investors keep coming in then the scheme is perfectly fine. At all cost, avoid investments that promises to deliver regardless of overall market conditions.

10. Absence of physical address

Most Ponzi schemes start and end on the internet. And because their owners understand what their aim is, they, as much as possible, avoid a physical location where people can walk into and properly get them arrested when it all goes South. However, newer Ponzi scheme promoters are becoming even more daring with each passing day that some now get office spaces and hire staff in order to look legitimate. Regardless, of whatever form they adopt, there’s always a way out for you as an investor in order not to part with your hard earned money. As a potential investor, it is not out of place to find out the nature of an investment and proof. For example, if a company says it is into charcoal exportation, then by all means request to see their warehouses and documents to back up their claim. If an investment company says it is into agritech, then find out where their farm or poultry is located. Another thing to note is the age of the “investment” company. If it is less than two years old perhaps your sixth sense should reverberate non-stop.

Wrapping Up

Ponzi schemes can take on various forms and formats and it is never enough to bank on the words of friends and family members just because they invested and are reaping their benefits. Often times, the earliest investors and the Ponzi scheme operators get to enjoy the scheme before it all falls apart. Always ask questions, read reviews, under business models, etc., before deciding whether or not you want to put your money into any investment scheme. Most importantly, avoid greedy. Ponzi scheme promoters bait potential investors and the greedy ones always fall hard. It never ends well with Ponzi schemes. Source: https://financialslot.com/ways-to-recognize-ponzi-schemes/ 24 Likes 5 Shares

|

| Re: 10 Ways To Recognize Ponzi Schemes by Sanchez01: 12:33pm On Jun 17, 2021 |

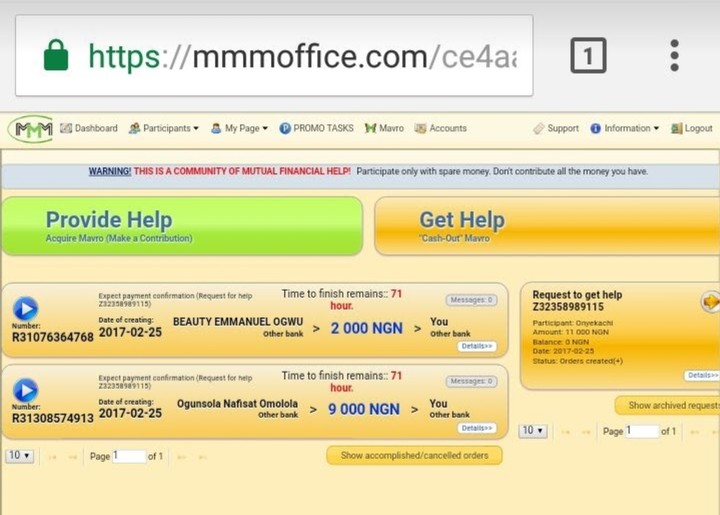

Insightful! That number 5 is a major red flag. I recall MMM of yesteryears and how some attained the position of "Guiders" (whatever it means). It was a Guider who convinced me to join only for the scheme to crash the moment my money went in.  Unfortunately, Ponzi schemes will always thrive despite these signs because people are greedy and want to make so much by doing so little. 23 Likes 2 Shares |

|

| Re: 10 Ways To Recognize Ponzi Schemes by Jeromejnr(m): 2:01pm On Jun 17, 2021 |

Well, once it has the word "Global".

And the people introducing you to it are wearing coat with worn out shoes. 58 Likes 2 Shares |

| Re: 10 Ways To Recognize Ponzi Schemes by design106: 2:01pm On Jun 17, 2021 |

Tis like I need this oh so I can get in early and run out. As everybody wants to mad, let us mad together. 3 Likes 1 Share |

|

| Re: 10 Ways To Recognize Ponzi Schemes by babyfaceafrica: 2:01pm On Jun 17, 2021 |

Racksterli and co 13 Likes |

| Re: 10 Ways To Recognize Ponzi Schemes by dynicks(m): 2:01pm On Jun 17, 2021 |

They kick start without prior notice or advert!!

like play like play, person don collect 100k for business wey just start few seconds ago

38 Likes 4 Shares

|

| Re: 10 Ways To Recognize Ponzi Schemes by Calmthunder(m): 2:01pm On Jun 17, 2021 |

Waiting for more tips... Plus a list of Ponzi schemes. 1 Like 1 Share |

| Re: 10 Ways To Recognize Ponzi Schemes by socialmediaman: 2:01pm On Jun 17, 2021 |

If that your friend who hasn’t changed his shoes in years is the one marketing it, run run run

…but anyway, people will continue to be greedy, anything to make up for life’s challenges, poor choices and bad economy 2 Likes 1 Share |

| Re: 10 Ways To Recognize Ponzi Schemes by Nobody: 2:02pm On Jun 17, 2021 |

U r telling the wrong people. They will read pieces like this a hundred times, let them just hear there is a new one in town....u will see them and their thread here on NL, praising it and attacking everybody that comes to be a voice of reasoning. Then as usual after 3-4months the thread go enter coma and eventually be buried. The cycle continues. 16 Likes 1 Share |

| Re: 10 Ways To Recognize Ponzi Schemes by Nobody: 2:02pm On Jun 17, 2021 |

What scared me off ponzis was watching what happened in one former east european nation that, on abandoning communism in the 90's welcomed free enterprise....leading to an influx of fraudsters.....who used ponzis to drain people of their money. The resultant crisis led to war.

Also, there was the story of one guy who operated a ponzi in Colombia in 2004..and who fled to the US with bags of dollars....leaving people crying.

As for Mavrodi...I heard about that guy from the early 2000's....and it was always nothing good. SO when I heard his MMM had landed in Nigeria, of course...I stayed away.

Better to do legit investment. 25 Likes 1 Share |

| Re: 10 Ways To Recognize Ponzi Schemes by WoodWorkingBox: 2:02pm On Jun 17, 2021 |

Fun enough , that is what most Nigeria likes .. check our signature on how to get free airtime 2 Likes |

| Re: 10 Ways To Recognize Ponzi Schemes by Nobody: 2:02pm On Jun 17, 2021 |

3 Likes |

| Re: 10 Ways To Recognize Ponzi Schemes by 11thGoldTREE: 2:03pm On Jun 17, 2021 |

Even nairaland is a ponzi scheme hahahaha 1 Like 1 Share |

| Re: 10 Ways To Recognize Ponzi Schemes by amiibaby(f): 2:03pm On Jun 17, 2021 |

Ok |

| Re: 10 Ways To Recognize Ponzi Schemes by godwinkessi: 2:03pm On Jun 17, 2021 |

Ponzi people don do me shege but still it shall

Not be well with Onionbandit in this life 2 Likes 1 Share |

| Re: 10 Ways To Recognize Ponzi Schemes by benratigan3(m): 2:03pm On Jun 17, 2021 |

Truth be told,we re all greedy for nothing.

Ponsi scheme

Loan app

Yahoo

Etc all the same stuff 3 Likes 1 Share |

| Re: 10 Ways To Recognize Ponzi Schemes by SavageResponse(m): 2:03pm On Jun 17, 2021 |

Some people will see all these signs and still fall cos of their overwhelming greed 2 Likes 1 Share |

| Re: 10 Ways To Recognize Ponzi Schemes by slawormiir: 2:04pm On Jun 17, 2021 |

Damnnn niggarrrr

Isoright |

| Re: 10 Ways To Recognize Ponzi Schemes by TOPCRUISE(m): 2:05pm On Jun 17, 2021 |

When they are hungry and the signs are there that this is a Ponzi scheme but they want the money so fast, those 10 ways becomes thrash. Silently and codedly they will go ahead. Their innerbeing response to their situation is something must kill a man.  1 Like 1 Share |

|

| Re: 10 Ways To Recognize Ponzi Schemes by Nobody: 2:05pm On Jun 17, 2021 |

Hmm! MMM does years eh! |

| Re: 10 Ways To Recognize Ponzi Schemes by Nobody: 2:05pm On Jun 17, 2021 |

Well honestly it would get worse... The future is trading .. with the overtake of Artificial intelligence over regular jobs and alongside no headway to depopulation which the world capitalists are strongly looking into using various means..

The future is trading investments and shares into various companies to generate interests and profits because employment would be always at all time low..

It's going to get worse really especially for developing countries. 6 Likes 4 Shares |

| Re: 10 Ways To Recognize Ponzi Schemes by Kobicove(m): 2:05pm On Jun 17, 2021 |

There should be a very lengthy jail sentence for people who set up Ponzi Schemes and defraud innocent citizens  1 Like 1 Share |

| Re: 10 Ways To Recognize Ponzi Schemes by wealthyhenry(m): 2:05pm On Jun 17, 2021 |

Greed. Greed. Greed. Na only greedy and lazy people dey fall for ponzi schemes. 3 Likes 1 Share |

| Re: 10 Ways To Recognize Ponzi Schemes by FBIBOT(m): 2:06pm On Jun 17, 2021 |

People go still join.... Awon ti forsage  3 Likes 2 Shares |

| Re: 10 Ways To Recognize Ponzi Schemes by okomile(f): 2:07pm On Jun 17, 2021 |

|

| Re: 10 Ways To Recognize Ponzi Schemes by AntiChristian: 2:07pm On Jun 17, 2021 |

Ponzi Scheme is Haram because of the ambiguity and it's gambling/Riba' like nature!

Don't be greedy!

Be Sensible! 2 Likes 2 Shares |

| Re: 10 Ways To Recognize Ponzi Schemes by Nobody: 2:08pm On Jun 17, 2021 |

TOPCRUISE:

When they are hungry. And want the money so fast, all this is thrash and their response is something must kill a man Most of the Nigerians who invest in Ponzis are not hungry...because anyone who had N1million to put in MMM is not a hungry person.Greed is more like it. Plus Nigerians have and do not do research. Me, I refused to go near MMM...because I have been hearing about Mavrodi for over 10 years before he landed in Nigeria...and it was NOTHING GOOD AT ALL. 5 Likes 1 Share |

| Re: 10 Ways To Recognize Ponzi Schemes by Goldenheart(m): 2:08pm On Jun 17, 2021 |

mmm dashboard that year! 2016/17 18 Likes 2 Shares

|

| Re: 10 Ways To Recognize Ponzi Schemes by OnionBandit(f): 2:08pm On Jun 17, 2021 |

godwinkessi:

Ponzi people don do me shege but still it shall

Not be well with Onionbandit in this life 2 Likes

|