Politics / Emeka Ihedioha's Aide, Elias Igboayaka Dikeigbo Arrested For Robbery, Kidnapping by jerrybone(f): 6:41pm On Jul 07, 2024 Politics / Emeka Ihedioha's Aide, Elias Igboayaka Dikeigbo Arrested For Robbery, Kidnapping by jerrybone(f): 6:41pm On Jul 07, 2024 |

Elias Igboayaka Dikeigbo, alleged kidnapping kingpin in Orlu has been arrested Saturday by the police in the area.

This followed a tip-off to the local Vigilante group of his Umuna community who earlier arrested some of his gang members who at interrogations, named Elias as their leader.

Elias has been moved from the Orlu Division of the Nigeria Police to the Police Anti Kidnapping Unit of the state’s Command, Owerri last yesterday’s evening.

Elias who serves as the Community Youth leader of his town has been named in several criminal activities in Orlu and its environs, and has been on the Police wanted list over series of armed robbery operations, including a recent kidnapping and diversion of a stock fish loaded truck. He later went underground during which his wife and some Kinsmen were arrested and taken to Awka in Anambra state.

Elias Igboayaka who has no visible business is said to have acquired properties suspected to be through proceeds from suspicious illegal and criminal businesses.

It is said that almost everybody in the area was aware of Elias’ dubious lifestyle, including his family members and traditional Rulers, but wers afraid to speak out for fear of their lives.

Upon arrest of his boys, confessions were freely made naming Elias as their leader. Police source said the suspects would be further quizzed by the anti kidnapping department of the Police in Owerri to ascertain their level of involvements in criminal activities happening in the area, especially kidnappings.

People of Orlu who spoke to this reporter said stories of missing children in Orlu have become reoccurring feature, even as series of kidnapping incidents in the town have become a weekly thing.

Some of the people spoken to were seen jubilating and appreciating both the Vigilante and the police for a job well done, even as they appealed to authorities not to release the suspect back to society as has been the case in his several arrests in the past.

Efforts made to reach the Police Public Relations Officer (PPRO) Imo Police Command, Mr. Henry Okoye proved abortive as his line was unavailable apparently due to network challenges by the telecommunications company.

Dikeigbo was the SA on Motor parks, Orlu zone to the immediate past Governor of Imo State, Rt. Hon. Emeka Ihedioha. https://theechonews.ng/2024/07/07/police-nab-ihediohas-aide-over-alleged-kidnapping-armed-robbery/ 9 Likes 2 Shares

|

Politics / "Uzodinma Has Written Results For 9 Lgas, Mobilizing 20 Soldiers Per LGA" - IAGG by jerrybone(f): 12:35pm On Nov 08, 2023 Politics / "Uzodinma Has Written Results For 9 Lgas, Mobilizing 20 Soldiers Per LGA" - IAGG by jerrybone(f): 12:35pm On Nov 08, 2023 |

The Imo Accountability For Good Governance Group (IAGG) is deeply concerned about recent developments in Imo State, where it has come to our attention that a Brigade commander, identified as U. Lawal, has allegedly listed 20 soldiers each to work for the re-election campaign of Governor Hope Uzodinma in all the local governments of the state on Saturday, November 11. In the Same vein, We have also learnt on Good Authority that Uzodinma has mobilized each Electoral Officer (EO) with $20,000 to compromise the elections to his favour. The deal was brokered by one Barr. Oluchi Nwaugo. Furthermore, the results of nine local governments have already been written by the compromised EOs. The local governments are Ideato north, Ideato south, Ikeduru, ngor okpala, Mbaitoli, Njaba, Nwangele and obowo and Isiala Mbano. This alarming development raises serious questions about the impartiality and integrity of the electoral process and the role of the military in politics. The use of military personnel for political purposes not only compromises the safety and security of the citizens but also undermines the principles of free and fair elections. IAGG calls on all relevant authorities to investigate this matter thoroughly and take immediate action to ensure that the upcoming election in Imo State is conducted in a transparent, free, and fair manner. The misuse of military personnel for political gain is unacceptable and detrimental to the democratic process. We urge the military leadership and all concerned stakeholders to uphold the rule of law and safeguard the democratic values that our nation holds dear. Imo State deserves an election where the will of the people is truly reflected, and the use of military personnel for political purposes should have no place in our democracy. IAGG remains committed to monitoring and advocating for good governance in Imo State and will continue to work towards ensuring that the principles of democracy are upheld. https://www.imohorn.com/uzodinma-mobilizing-20-soldiers-per-lga-to-compromise-elections-in-imo-has-written-results-for-9-lgas-group-raises-alarm/

|

Politics / Re: Imo Governor, Hope Uzodinma Accussed Of Falsifying His Certificate by jerrybone(f): 8:26am On Oct 31, 2023 Politics / Re: Imo Governor, Hope Uzodinma Accussed Of Falsifying His Certificate by jerrybone(f): 8:26am On Oct 31, 2023 |

jerrybone:

The long-standing controversy surrounding the educational background and records of Imo state Governor, Hope Uzodinma, has resurfaced, with court documents indicating doubts about the authenticity of his qualifications.

A cache of documents, including certified copies of records, affidavits, and court orders obtained by our correspondent, raises questions about the credibility of Governor Uzodinma’s educational qualifications.

Governor Uzodinma, who has ruled Imo state for over three years will be seeking re-election in the November governorship poll.

Before assuming the governorship, Uzodinma represented Imo West Senatorial district in the National Assembly between 2011 and 2019. During those years, the former federal lawmaker faced several court suits challenging his integrity and legitimacy to contest in the Senate.

While the outcomes of some of these cases remain unknown, recently acquired certified documents shed light on the controversial qualifications of the Governor.

Battle for Uzodinma’s certificate

One of the key challengers to the legitimacy of Uzodinma’s Senate seat was Ebubeagu Ekenulo, a renowned activist in the South East.

In a suit filed in 2013, Ekenulo requested the Federal High Court sitting in Lagos state to compel the West African Examinations Council (WAEC), the body responsible for issuing WASSCE certificates, to release Uzodinma’s records.

Both the WAEC head office and the regional office were listed as the first and second defendants, respectively.

The activist said he needed the information applied for to commence processes of recalling the said Uzodinma from the National Assembly at the time.

Ekenulo highlighted discrepancies in the information Uzodinma provided in his nomination form submitted at the Independent National Electoral Commission (INEC) office and the one he mentioned in a newspaper interview.

According to the INEC form, the former Senator stated that he sat for his WASSCE exam at Mgbidi Boys Secondary school in Imo state. However, in an interview published in ThisDay newspaper in 2012, he claimed among other things that he attended Government Secondary School Etche in Rivers State and obtained his “O levels WAEC” there.

“Ekenulo, in a sworn affidavit, stated, “I instructed my solicitors to apply to the Principal of Government Secondary School Etche, Rivers State for verification of the information, and the Principal replied to my solicitor’s letter, stating that Uzodinma Hope attended Government Secondary School Etche from 1978 to 1981 when he dropped out after Class 3 and did not sit for the West African School Certificate (WASC).”

Furthermore, he instructed his lawyer to write to WAEC to obtain a comprehensive list of all candidates who sat for the certificate examination at Mgbidi Boys Secondary School to verify the authenticity of Chief Hope Uzodinma’s claims but the request was denied.

The 1st and 2nd Defendants replied to my Solicitors through their Acting Head, Legal Department, one S. o. Ojo Esq., declined to avail me the information applied for on the ground that "it contains personal information of their candidates".

In the same year, Festus Keyamo also sued WAEC, seeking an order compelling WAEC to release to him the original copy of the West African Senior School Certificate of Mr. Uzodinma.

In a letter addressed to the Registrar of the examination body dated May 14, Mr. Keyamo had told the body that he had reliable information that Mr. Uzodinma did not graduate from Mgbidi Boys’ High School, Imo State, in 1982, where he allegedly obtained his WAEC Certificate.

“We hereby demand for the Certified True Copy of the WAEC Certificate (or SSCE result or WASSCE) of the said Hope Uzodinma, if any, within seven days of your receipt of this letter, pursuant to Section 1(1) and (2) and Section 4(a) of the FOI Act,” read the letter.

Court orders release of Uzodinma’s waec records

Following a lengthy court process, the Lagos State High Court, in 2016, ordered WAEC to provide the details sought by both Ekenulo and Keyamo.

The court, in 2016, ruled that WAEC is under obligation of the law to avail Mr Ekenulo the information he sought, adding that the body has contravened the Freedom of Information Act 2011 when it ignored, refused and failed to avail the plaintiff the information he applied for as required by law.

“A DECLARATION by this Honourable Court given the facts of this case and the law, that the plaintiff is entitled to be availed the information he sought from the 2nd defendant,”

“AN ORDER of this Honourable Court compelling the 2nd defendant to make available the information sought for by plaintiff to wit,” read the order given by the Presiding judge, R.N Ofili-Ajumogobia.

Group urges transparency

While it remains unclear if WAEC has availed Mr Ekenulo of the records or not, a civil society organisation in Imo state, Integrity for Governance in Imo (IGI), has urged the Governor to come out clean about his records.

Speaking on behalf of the group on Friday, the Lead Convener, Michael Okonkwo, said the concerns have lingered for too long.

He said; “How can we have a state Governor whose academic record is not genuine or is in doubts? He was also alleged to have claimed that he had a Higher National Diploma (HND) certificate from the Federal University of Technology Owerri (FUTO), a degree-award university. The people are demanding answers.”

The Group has also called on the ICPC to investigate Uzodinma.

FULL COURT DOCUMENTS BELOW;

https://www.imohorn.com/certificate-sage-court-documents-emerge-showing-that-hope-uzodinmas-qualifications-are-fake-photos/

|

Politics / Imo Governor, Hope Uzodinma Accussed Of Falsifying His Certificate by jerrybone(f): 8:23am On Oct 31, 2023 Politics / Imo Governor, Hope Uzodinma Accussed Of Falsifying His Certificate by jerrybone(f): 8:23am On Oct 31, 2023 |

The long-standing controversy surrounding the educational background and records of Imo state Governor, Hope Uzodinma, has resurfaced, with court documents indicating doubts about the authenticity of his qualifications.

A cache of documents, including certified copies of records, affidavits, and court orders obtained by our correspondent, raises questions about the credibility of Governor Uzodinma’s educational qualifications.

Governor Uzodinma, who has ruled Imo state for over three years will be seeking re-election in the November governorship poll.

Before assuming the governorship, Uzodinma represented Imo West Senatorial district in the National Assembly between 2011 and 2019. During those years, the former federal lawmaker faced several court suits challenging his integrity and legitimacy to contest in the Senate.

While the outcomes of some of these cases remain unknown, recently acquired certified documents shed light on the controversial qualifications of the Governor.

Battle for Uzodinma’s certificate

One of the key challengers to the legitimacy of Uzodinma’s Senate seat was Ebubeagu Ekenulo, a renowned activist in the South East.

In a suit filed in 2013, Ekenulo requested the Federal High Court sitting in Lagos state to compel the West African Examinations Council (WAEC), the body responsible for issuing WASSCE certificates, to release Uzodinma’s records.

Both the WAEC head office and the regional office were listed as the first and second defendants, respectively.

The activist said he needed the information applied for to commence processes of recalling the said Uzodinma from the National Assembly at the time.

Ekenulo highlighted discrepancies in the information Uzodinma provided in his nomination form submitted at the Independent National Electoral Commission (INEC) office and the one he mentioned in a newspaper interview.

According to the INEC form, the former Senator stated that he sat for his WASSCE exam at Mgbidi Boys Secondary school in Imo state. However, in an interview published in ThisDay newspaper in 2012, he claimed among other things that he attended Government Secondary School Etche in Rivers State and obtained his “O levels WAEC” there.

“Ekenulo, in a sworn affidavit, stated, “I instructed my solicitors to apply to the Principal of Government Secondary School Etche, Rivers State for verification of the information, and the Principal replied to my solicitor’s letter, stating that Uzodinma Hope attended Government Secondary School Etche from 1978 to 1981 when he dropped out after Class 3 and did not sit for the West African School Certificate (WASC).”

Furthermore, he instructed his lawyer to write to WAEC to obtain a comprehensive list of all candidates who sat for the certificate examination at Mgbidi Boys Secondary School to verify the authenticity of Chief Hope Uzodinma’s claims but the request was denied.

The 1st and 2nd Defendants replied to my Solicitors through their Acting Head, Legal Department, one S. o. Ojo Esq., declined to avail me the information applied for on the ground that "it contains personal information of their candidates".

In the same year, Festus Keyamo also sued WAEC, seeking an order compelling WAEC to release to him the original copy of the West African Senior School Certificate of Mr. Uzodinma.

In a letter addressed to the Registrar of the examination body dated May 14, Mr. Keyamo had told the body that he had reliable information that Mr. Uzodinma did not graduate from Mgbidi Boys’ High School, Imo State, in 1982, where he allegedly obtained his WAEC Certificate.

“We hereby demand for the Certified True Copy of the WAEC Certificate (or SSCE result or WASSCE) of the said Hope Uzodinma, if any, within seven days of your receipt of this letter, pursuant to Section 1(1) and (2) and Section 4(a) of the FOI Act,” read the letter.

Court orders release of Uzodinma’s waec records

Following a lengthy court process, the Lagos State High Court, in 2016, ordered WAEC to provide the details sought by both Ekenulo and Keyamo.

The court, in 2016, ruled that WAEC is under obligation of the law to avail Mr Ekenulo the information he sought, adding that the body has contravened the Freedom of Information Act 2011 when it ignored, refused and failed to avail the plaintiff the information he applied for as required by law.

“A DECLARATION by this Honourable Court given the facts of this case and the law, that the plaintiff is entitled to be availed the information he sought from the 2nd defendant,”

“AN ORDER of this Honourable Court compelling the 2nd defendant to make available the information sought for by plaintiff to wit,” read the order given by the Presiding judge, R.N Ofili-Ajumogobia.

Group urges transparency

While it remains unclear if WAEC has availed Mr Ekenulo of the records or not, a civil society organisation in Imo state, Integrity for Governance in Imo (IGI), has urged the Governor to come out clean about his records.

Speaking on behalf of the group on Friday, the Lead Convener, Michael Okonkwo, said the concerns have lingered for too long.

He said; “How can we have a state Governor whose academic record is not genuine or is in doubts? He was also alleged to have claimed that he had a Higher National Diploma (HND) certificate from the Federal University of Technology Owerri (FUTO), a degree-award university. The people are demanding answers.”

The Group has also called on the ICPC to investigate Uzodinma.

FULL COURT DOCUMENTS BELOW; https://www.imohorn.com/certificate-sage-court-documents-emerge-showing-that-hope-uzodinmas-qualifications-are-fake-photos/ 1 Like

|

Business / Tinubu Receives Petition Against Dangote Over $3.4 Billion Siphoned Through CBN by jerrybone(f): 2:02pm On Aug 20, 2023 Business / Tinubu Receives Petition Against Dangote Over $3.4 Billion Siphoned Through CBN by jerrybone(f): 2:02pm On Aug 20, 2023 |

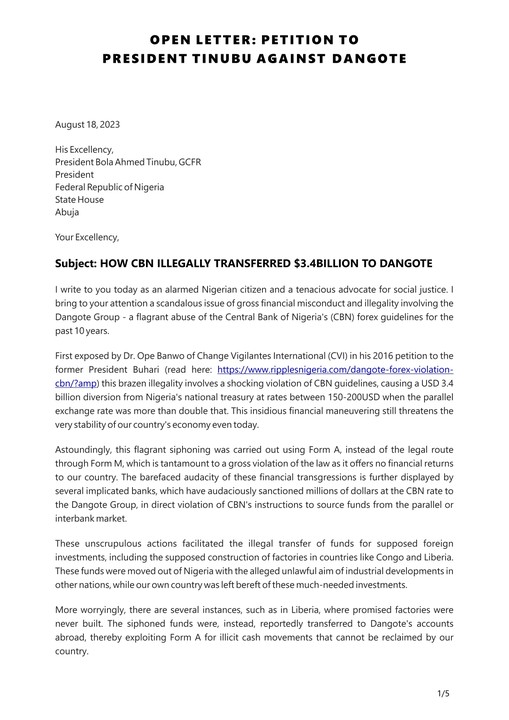

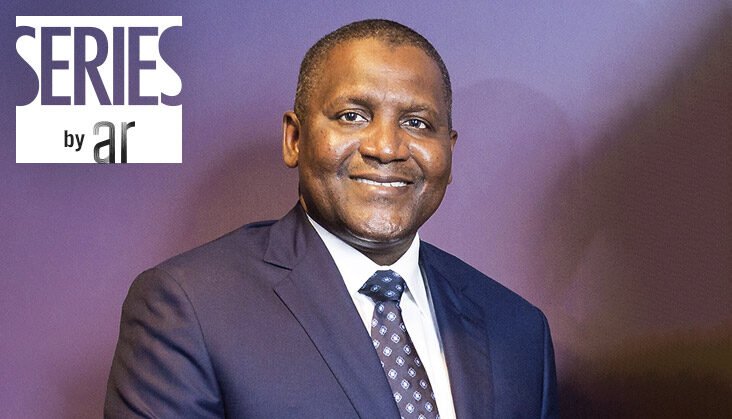

President Bola Ahmed Tinubu has received a Petition against Billionaire Businessman, Alhaji Aliko Dangote over $3.4 Billion allegedly siphoned through the Central Bank of Nigeria.

The petition, seen by POLITICS NIGERIA, filed by Ahmed Fahan, a Social Justice Advocate, alleged that Dangote grossly violated the Forex Guidelines of the CBN for years.

The petition was attached to a letter written to the President on August 18th, 2023.

The Letter read; "BRAZEN ILLEGALITY: HOW DANGOTE SIPHONED $3.4BILLION DOLLARS THROUGH THE CBN USING FORM A"

"I write to you today as an alarmed Nigerian citizen and a tenacious advocate for social justice. I bring to your attention a scandalous issue of gross financial misconduct and illegality involving the Dangote Group - a flagrant abuse of the Central Bank of Nigeria's (CBN) forex guidelines for the past 10 years."

"First exposed by Dr. Ope Banwo of Change Vigilantes International (CVI) in his 2016 petition to the former President Buhari(read here: https://www.ripplesnigeria.com/dangote-forex-violation-cbn/?amp) this brazen illegality involves a shocking violation of CBN guidelines, causing a USD 3.4 billion diversion from Nigeria's national treasury at rates between 150-200USD when the parallel exchange rate was more than double that. This insidious financial maneuvering still threatens the very stability of our country's economy even today."

"Astoundingly, this flagrant siphoning was carried out using Form A, instead of the legal route through Form M, which is tantamount to a gross violation of the law as it offers no financial returns to our country. The barefaced audacity of these financial transgressions is further displayed by several implicated banks, which have audaciously sanctioned millions of dollars at the CBN rate to the Dangote Group, in direct violation of CBN's instructions to source funds from the parallel or interbank market."

"These unscrupulous actions facilitated the illegal transfer of funds for supposed foreign investments, including the supposed construction of factories in countries like Congo and Liberia. These funds were moved out of Nigeria with the alleged unlawful aim of industrial developments in other nations, while our own country was left bereft of these much-needed investments."

More worryingly, there are several instances, such as in Liberia, where promised factories were never built. The siphoned funds were, instead, reportedly transferred to Dangote’s accounts abroad, thereby exploiting Form A for illicit cash movements that cannot be reclaimed by our country.

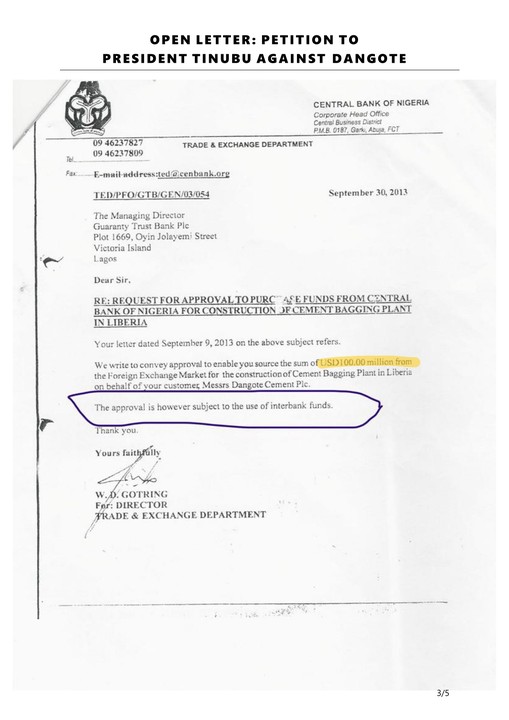

"It must be highlighted that the approvals sought from the CBN clearly stated that money sought by Dangote must be bought from the Interbank market - which means money outside the CBN. However, the funds were bought and transferred from the national treasury with the CBN, which was illegal. On a continued basis over the years and contrary to the approvals, Emefiele’s CBN continued illegally supplying money from Nigeria’s treasury at cheaper rates to Dangote Group (see some evidence attached). This is an illegality that must be righted. For instance in 2015, Form A number AA2541751 was used to transfer over 341million through telegraphic transfer (ECOBANK) in contravention of CBN directive to use interbank funds only for the Dangote Project in Cameroon whilst on February 12, 2016, Form A number AA2649626 was used to transfer over 420million for spare parts in Congo, also in contravention of the CBN directive."

"To further highlight the brazenness of these actions, it recently came to light that the suspended CBN Governor, Godwin Emefiele, had borrowed USD 1 billion from Afrexim Bank in the second quarter of 2023, USD 750 million of which was illegally funneled to Dangote at a concessionary rate. These funds were subsequently transferred to Dangote’s account abroad just as previously done in the past."

"Your Excellency, as the beacon of hope for our nation's financial integrity, your swift action is desperately needed to rectify these glaring injustices. We implore you to order a comprehensive and immediate investigation into these flagrant violations of our financial laws."

"We call upon you to ensure these stolen funds are returned and used for the betterment of our nation under your committed administration. This enforcement is essential not just to deter future violations but also to underscore the ethos of accountability and transparency that your administration represents. We enjoin you to direct the EFCC, ICPC, DSS and other relevant security agencies to investigate these illegal acts against our economy and ensure these funds are returned."

"The time for a new era has come—an era where the rule of law supersedes illicit privileges, and economic justice becomes our national cornerstone. By addressing this issue decisively, you will send a powerful message that corruption, in all its forms, will no longer be tolerated in our country."

"Thank you for your prompt attention to this urgent matter.

Yours faithfully,

Ahmed Fahad

A Concerned Nigerian and Social Justice Advocate".

Below are Documents attached to the letter; https://politicsnigeria.com/breaking-tinubu-receives-petition-against-dangote-over-3-4-billion-siphoned-through-cbn/ 16 Likes 6 Shares

|

Politics / Ihedioha Removed As Chairman Imo PDP Presidential Campaign Council by jerrybone(f): 5:58pm On Nov 24, 2022 Politics / Ihedioha Removed As Chairman Imo PDP Presidential Campaign Council by jerrybone(f): 5:58pm On Nov 24, 2022 |

. ... as NWC caution Charles Ugwu over illegal suspension of LGA Chairmen

_ advise Achike Udenwa to reconsider heading Imo Presidential Campaign Council

The Governorship ambition of former Imo state governor, Hon Emeka Ihedioha is said to have suffered setback following decision of the National Working Committee led by Sen Iyorcha Ayu standing down the controversial Imo PDP Presidential Campaign Council and Management Committee List.

Stakeholders of the party on Tuesday met with the National Working Committee at the Party's Secretariat, Wadata Plaza, Abuja on invitation by the NWC resulting from the petitions forwarded to the NWC for non inclusion of critical party leaders in the formation of the Imo PDP Presidential Campaign Council list. Addressing the NWC leaders from Imo who while addressing the National leadership of the party expressed displeasure on the controversial list forwarded to the NWC by the State Working Committee under the leadership of Engr Charles Ugwu.

While addressing members of the National Working Committee, at Wadata Plaza, Amb Kema Chikwe, a former National Woman Leader of the party, in the National Chairman, Sen Iyorcha Ayu that "the problem we have in Imo PDP is the SWC.

"They are compromised. They are a carry over from the former SWC in the state. Their activities are teleguided by Ihedioha. No governorship aspirant in the Imo state can openly declare to run for election under the platform of PDP for the singular reason that the ticket is secured for one man, that's indeed an insult. "I hereby advise that the NWC do the needful as it concerns the Imo state working committee of PDP to save the party from collapse"Also, a former state Chairman of the party and ex National Chairman of NPC, Chief Eze Duruiheoma said the state party chairman, Engr Charles Ugwu's statement describing Hon Emeka Ihedioha as the face of PDP in Imo state is an insult to sensibilities of our party leadership. "The PCC list sent to the NWC do not reflect the decision of the leadership of the party in the state. The Elders Council forum were not consulted, instead the list was prepared between the SWC and one man Ihedioha. Once you don't support the ambition of Ihedioha, you become their enemies and the next is suspension.

For the party to regain confidence of electorate in the state, the State Working Committee's continued stay in office is a threat to peace in the party" Contributing his voice, the Southeast Zonal Organising Secretary disclosed that "the Imo PDP SWC members are biased. "My LGA party chairman informed me of his suspension on directives of the SWC, his only offense is that he signed a petition forwarded to the NWC on grounds of financial misappropriation against the SWC.

"As I speak to you Mr Chairman over 17 LGA party Chairmen had received notices of suspension.

"I hereby announce to you Mr Chairman that the current Imo PDP SWC lacks the morality to lead the state to victory ahead of the 2023 general election".

Also, the National Secretary of the Party, Sen Samuel Anyanwu welcomed party faithful to the Wadata Plaza for the interactive session with the National Chairman. Also, he called for unity amongst the party members as he expressed displeasure on impunity ravaging the party in Imo. Anyanwu narrated his ordeal as the most disrespected National Working Committee member in the Country while admonishing the state working committee to stop intimidating party supporters who do not subscribe to their divide and rule antics. Reacting to the submission from invited stakeholders of the party, the National Chairman of the Peoples Democratic Party, PDP, Sen Iyorcha Ayu who called up on the state Chairman, Engr Charles Ugwu to confirm suspension of over seventeen LGA Chairmen of the party, responding, Ugwu denied knowledge of any suspension which led to the National Chairman directing that either there was any suspension or not, the State Working Committee has no right to suspend the LGA Chairmen instead any process for suspension must follow due process and forwarded to office of the National Working Committee for ratification, he said.

Furthermore, Sen Iyorcha Ayu appealed to former governor Achike Udenwa to reconsider leading the Imo PDP Presidential Campaign Council based on his experience and leadership status in the state while nothing that the Presidential Campaign Council List will be reviewed. https://www.thenaijatimes.com/ihedioha-removed-as-chairman-imo-pdp-presidential-campaign-council/ 2 Likes

|

Politics / Imo PDP Crisis Deepens As Party Suspends 35 Executives In Ikeduru, Ohaji Egbema by jerrybone(f): 3:04pm On Nov 20, 2022 Politics / Imo PDP Crisis Deepens As Party Suspends 35 Executives In Ikeduru, Ohaji Egbema by jerrybone(f): 3:04pm On Nov 20, 2022 |

The Crisis rocking the Peoples Democratic Party, PDP in Imo state has heightened following the Suspension of 35 Party Executives in Two Local Government Areas in the state.

In Ikeduru, 20 Executives were suspended for breaching Section 58(1)(A) of the party’s constitution. A statement from the party read;

“At a leadership meeting of Ikeduru LGA PDP held at the Party secretariat, Atta Ikeduru, we the officials and entire PDP in Ikeduru LGA received a report of the 7-Man disciplinary Committee set up to look into the allegations of breaches of the Constitution of our party as against the above named persons, hereby resolve as follows:”

“That the persons mentioned above were duly invited in writing to come and defend the allegations against them.”

“On three occasions that notices were sent to them but they obviously refused to attend the disciplinary hearings”

“Therefore, having satisfied that the provisions of section 57 of the Peoples Democratic Party’s Constitution has been followed hereby adopt the report of the Disciplinary Committee as a resolution and decision of PDP Ikeduru LGA suspending these named persons.”

“Let it be known that the above named suspended members of the party are free to explore Internal mechanisms of the party to appeal this decision.”

The following people were suspended in Ikeduru;

Hon Victor Nwosu – LGA Secretary

Nnamdi Ezeji – Org. Secretary

Samuel Nwokeocha – Publicity Secretary

Dr Collins Ejionu – Financial Secretary

Victor Oparaocha – Assistant Secretary

Enwerem Chimaobi – Treasurer

Mrs Caroline Onuoha – Assistant Publicity Secretary

Mrs Eugenia Njoku – Ex-Officio

Mrs Felicia Asimole – Ex-Officio

Friday Ayoka – Special Citizen

Tony Igwe – Atta Ward 1 Chairman

Mbama Akakem – Ngugo/Ekembara Ward Chairman

Vitus Anochie – Okwu/Ugiri-Ike/ Eziama Ward Chairman

Uzondu Francis – Inyishi/Umudim Ward Chairman

Martin Nwasoro – Atta Ward 2 Chairman

Ben Garu Onwu – Amakohia Ward Chairman

Chinanu Ugorji – Amata Ward Chairman

Nze John Anyanwu – Avuvu Ward Chairman

Godfrey Iwuji – Akabo Ward Chairman

Hon Reginald Obi – Uzoagba Ward

In Ohaji Egbema, The following individuals were also suspended for the same offense;

Uzoma Awaraji – Ward A Chairman

Aguocha Elias – Ward E Chairman

Uwakwe Anthony – Ward A Chairman

Opara Cyprian – Assa/ Obile Ward Chairman

Saturday Abel – Awara/Ikwerede Ward Chairman

Igwe Hypolitus – Umuagwo Ward Chairman

Esomonu Wosu – Ohuba Ward Chairman

Barr Chioma Anyanwu – Ohaji Egbema LGA Legal adviser

Christian Ojiaku – LGA Secretary

Nwadiaro Azuka – LGA Vice Chairman

Mrs Chinyere Iferobia – LGA Woman Leader

Uche Solomon – LGA Ex-Officio

Prisca Ejimadu – LGA Treasurer

Sunday Ukemezie – LGA Ex-Officio

Ogbuopi Johnbosco – LGA Ex-Officio

https://www.thenaijatimes.com/imo-pdp-crisis-deepens-as-party-suspends-35-executives-in-ikeduru-ohaji-egbema-lgas/ 1 Like 1 Share

|

Crime / SOS: How Thugs Extort Road Users In Sapon, Ogun State by jerrybone(f): 5:29pm On Aug 04, 2021 Crime / SOS: How Thugs Extort Road Users In Sapon, Ogun State by jerrybone(f): 5:29pm On Aug 04, 2021 |

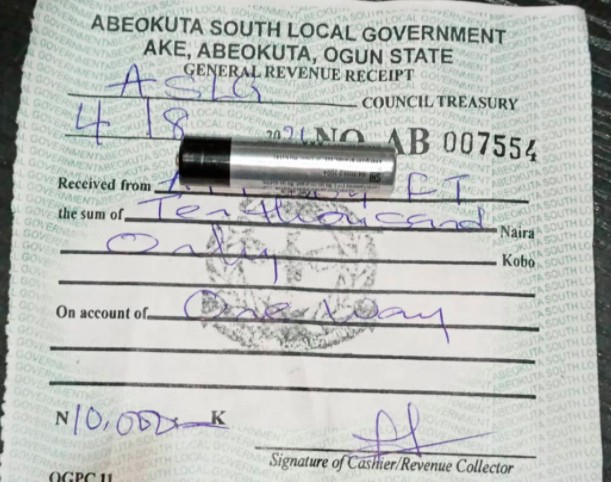

Wednesday August 4 passed like a dream to me. I have heard about the inadequacies of the Dapo Abiodun led Ogun state government but today hit me in the face and I still can’t believe it all

I was accosted at the Sapon area by people in mufti who looked more like robbers than government workers who claimed to be working for the Abeokuta South Local Government and I wondered what was happening because :

1. They had no uniforms

2. No name tags

3. No identification or ID cards

4. No face masks

They claimed I drove on one-way and the first thing I did was asked for the sign. They showed me some sign and I accepted and asked to go to their office as I was not interested in paying an undocumented bribe. I turned and saw that one of them (now wearing a lemon vest) had removed my number plate and I told him I was not going to go anywhere without it.

Another asked to get into my car and I told him he cannot if he isn’t wearing a facemask (National policy from the President himself) eventually, one of them went to buy one, my number plate was fixed and they led me to their “Office” close to CBN and asked me to park somewhere. I got down expecting to be led into an office to see how much the fine is only for me to be led to a restaurant. A lady said they will book a ticket for me and collect a fine.

TAKE ME TO YOUR OFFICE

I did not allow her finish and asked that I want to be taken to their office as it was not right. She said she is at the restaurant because she was monitoring the other cars and motorcycles arrested and I asked her to point the office to me so I can go pay my fine and she refused. I told her if she didn’t, I will simply go home. At this point, she asked that my car be chained. I ignored.

I kept insisting on going to their office and at this point the ignored until a man from another department came and told them to give me a booking so I can go pay to the local government headquarters in Ake. I was given the payment advice and I took a commercial motorcycle to Ake.

NO OFFICE

On getting to the headquarters, the revenue office told me they have an office where I was coming from that I was supposed to pay to and asked me to go back, they directed me to a certain MR Wasiu. I called him and he said he was in the complex where my car was impounded and he has an office there. I took another motorcycle back, I got back hoping to meet this MR Wasiu in his official office but I was shocked when he was sitting under a shed as he said he had no office and that place was just a make-shift place.

I now irritated, gave him the ticket and he asked me to pay 10,000. I gave him and he took the money in cash (against federal government directive on TSA)

The questions I have include:

1. Is it right for local government officials to collect stop motorists while not in uniform?

2. Is it legal to not wear a name tag or any form of identification?

3. Is it right for officials to be on the road without facemasks and outing citizens at risk?

4. Is it right to remove people’s number plate?

5. How can so-called officials work from a restaurant?

6. Why collect money in cash in violation of TSA? 32 Likes 5 Shares

|

Business / I Have Fired Hadiza Bala Usman – President Buhari by jerrybone(f): 7:08pm On Jul 21, 2021 Business / I Have Fired Hadiza Bala Usman – President Buhari by jerrybone(f): 7:08pm On Jul 21, 2021 |

Despite the ongoing investigation of a probe panel against the embattled Managing Director of Nigerian Ports Authority (NPA) Hadiza Bala-Usman, President Muhammadu Buhari has confirmed that the appointment of the erstwhile NPA boss has been terminated.

President Buhari stated this on 12th of July in an affidavit he submitted at the Federal High Court in Lagos, in response to a suit instituted against him by Elder Asu Beks, a maritime media chief executive.

The affidavit which was filed as Buhari’s preliminary objection was signed by Agan Tabitha, Civil Litigation Department of the Federal Ministry of Justice Abuja on behalf of Buhari’s Counsel; Mrs Maimuna Lami Shiru and Mrs C.I Nebo.

Recall that Asu Beks and two other plaintiffs; Mr Tompra Abarowei and Mr Miebi Senge on Thursday, March 25, 2021 filed the suit challenging the powers of President Muhammadu Buhari to unlawfully constitute the board of the NPA, as well as appointment of its Executive Directors without recourse to the statutory provisions of the Nigerian Ports Authority (NPA) Act.

Elder Beks, Chief Executive Officer of Maritime Media Limited, Publishers of Shipping World Magazine also joined the embattled Managing Director of NPA, Hadiza Bala Usman in the suit, saying that Buhari prematurely reappointed, six clear months before her tenure expires.

Meanwhile, the President had in May 2021 approved the suspension of Hadiza as NPA boss, while NPA’s executive director of finance and administration, Mohammed Bello-Koko was named to lead the organisation in acting capacity.

The suspension was to allow a probe of allegations of improprieties against Ms Usman to take place unhindered.The probe is at the instance of the supervising transport ministry, headed by Rotimi Amaechi.

However, in his response to the court, the president argued that “The alleged reappointment of the 3rd Defendant (Hadiza Bala Usman) upon which this Court is being called upon to adjudicate has since been terminated by the 1st Defendant (Buhari) and the instant suit overtaken by the event of that termination”

He also argued that the plaintiffs, Asu Beks and Co, have no “locus standi” to institute the suit in the first place and that the Federal High Court lacks the jurisdiction to entertain the suit.

Buhari also argued that the suit against him by Elder Asu Beks has become purely academic, and “That it is in the interest of Justice to dismiss the plaintiffs suit in its entirety or against the first defendant”

“We submit that it is clear from the Plaintiff‘s affidavit, the questions for determination as well as the reliefs sought. it is obvious that the Plaintiff neither suffered any injury as a result of the act or omission of the 1st Defendant”

“It is also evident that the claim against the Defendants is that the court should declare the alleged action of the 1st Defendant re-appointing, nominating and setting up of board of NPA illegal as it contravenes section 2 and 10 NPA Act Cap N126, LFN 2004, even without stating that they have suffered any personal damage beyond any other person as a result of the said appointment”

“My Lord. it is our submission that the Plaintiffs here does not possess the requisite locus standi to institute this action. Locus sandi denotes the right of a party to institute an action in a court of law”

In the suit number FHC/L/CS/485/2021, filed by Asu Beks through his lawyer, Mr Mike Ozekhome (SAN) apart from President Buhari, other defendants in the court action are the Minister of Transportation, the Managing Director of the NPA, Ms Hadiza Bala Usman and the Chairman, Board of NPA, Mr Emmanuel Adesoye.

The suit is being heard before Justice Tujjani Garba Ringim of the Federal High Court, Ikoyi

The plaintiffs held that the newly constituted Board of NPA has no Representative of the Ministry of Transportation as enshrined in the statues of the NPA Act and that it reflected complete disregard for professionalism and requisite expertise in shipping and ancillary maritime matters for its members.

https://investorsreel.com/i-have-fired-hadiza-bala-usman-buhari/ 3 Likes 2 Shares

|

Business / Dangote Refinery: Bailing Out The Unbailable - Investment Or Bailout? by jerrybone(f): 7:52pm On Jul 16, 2021 Business / Dangote Refinery: Bailing Out The Unbailable - Investment Or Bailout? by jerrybone(f): 7:52pm On Jul 16, 2021 |

It was hailed as the best thing to happen in the oil and gas sector especially in Nigeria – a serial importer of crude products. The year was 2013 and in September of that year, Aliko Dangote, Africa’s richest man, announced yet another of his gargantuan projects – the construction of the biggest single train refinery in the world with production expected to begin in 2016. Many delays and postponements later, the project has been bogged down by barely serviceable debts, poor planning, lack of centralized project management, mismanagement and has now become a huge albatross on Nigeria’s neck costing the country lots of FX and creating huge problems in return.

VALUATION

A project that started as a 9billion dollars project is now being valued at over 16 billion dollars, albeit incorrectly. Sampling expert opinion from leading players in the oil & Gas industry, it is estimated that a refinery of that size should ideally cost within the range of 11 to 12 billion dollars to build in Nigeria. Notwithstanding the conflicting figures, it was recently announced that the Nigerian National Petroleum Corporation, NNPC, will be taking a 20% stake in the uncompleted, non-functional Dangote Refinery at the cost of 3.8billion dollars. Whilst this baffled many, NNPC’s actions effectively over-valued the yet to be completed refinery to 19billion dollars.

PROJECT DELAYS OR PROJECT DELAY-ED

As at last count, the completion of the refinery had been moved eight times. Whilst some might say this is in character for Dangote Industries and their numerous projects across different sectors, the problem is deeper rooted. A contractor at the delayed refinery project, speaking under the condition of anonymity said that poor planning, underpayment of contractors, and a lack of proper project management with over 40 contractors on site has led to most of the delays. He also added that of the 40, none is willing to commission as there is no clear delegation of duty and over-decentralization leading to absolute chaos.

With these incessant delays, Banks are already calling in their loans. At the announcement of the project in 2013, Mr. Dangote said he had secured financing of 3.3billion dollars. This debt burden has now risen to 7billion dollars with debt servicing of almost 700million dollars per annum. Whilst Mr. Dangote has been able to restructure the facilities from various local and international banks twice so far, most banks have totally refused to restructure for the third time with principal repayment also falling due - as well as the annual interest payments.

Things have gotten so bad for the billionaire that even income from his other businesses are barely enough to cover the interest rates talk less of the principal. This has led Mr. Dangote to seek innovative ways, including state capture, to prop up his business now that the refinery project has been consistently delayed and he has run out of money to repay. Enter the NNPC Connection, Nigeria’s controversial PIB Amendment and the Crude Swap Saga.

THE NNPC CONNECTION – BAILING OUT THE UNBAILABLE

After taking FX at concessionary rates from the CBN, Nigeria is inexplicably tied at the apron strings to Mr. Dangote’s now-threatened refinery. Estimates by professional industry analysts and those close to the project put its completion date in 2024 or 2025.

Recently, the NNPC announced, under some obscure arrangement, that it was taking a 20% equity in the Dangote refinery at 3.8billion dollars. The NNPC was later to explain that it was giving only 1 billion in cash and the balance in crude.

Whilst this is a welcome development, Mr. Dangote will have a hard time doing anything tangible with the 1billion dollars cash which is barely enough to cover one years’ interest. With some principal payments falling due and the banks’ unwillingness to restructure in the face of an estimated completion timeline of 2024 at the earliest, Messrs. Dangote will need at least 3 to 4 billion to complete the project over the next few years even with this bailout. Both the way the refinery project has been carried out, and this subsequent NNPC bailout for Dangote refinery has turned Nigeria into a laughingstock on the global stage.

As for the controversial PIB bill currently before the Nigerian National Assembly, it is now clear to keen watchers that the reason the government wants to give a monopoly of importation for petroleum products into the country to Messrs. Dangote is so he can make the excessive and extra profits he needs to manage his rising debt profile for the refinery (under the guise of ongoing refinery projects). Guess who will bear the brunt of the higher costs in petroleum products at a time when subsidies are being reduced? The Nigerian people.

With his refinery project costs way overboard, banks breathing down his neck and NNPC’s strange bailout seemingly meagre to take care of the principal and interest payments for his debts, is the Dangote Refinery a dead project even before it is completed, or will time be kind and permit the completion of this project to which Nigeria has mortgaged huge FX from its treasury to see it kick off in good time? The chicken has come home to roost, it may seem.

Finally, with the one billion dollars going towards the repayment of principal and interests which are falling due in August, the manipulations by NNPC and politicians at the National Assembly has now become clear for all to see… As it stands, some government agencies and politicians are more than willing to mortgage the interests of the nation and masses to bail out the unbailable refinery project. Welcome to the Republic of Dangote!

David Bako is a seasoned Economist writing from Abuja

https://investorsreel.com/dangote-refinery-bailing-out-the-unbailable-funding-or-bailout/ 50 Likes 6 Shares

|

Business / NNPC 20% Acquisition: Dangote Refinery May Drag Nigeria Into Further Debt by jerrybone(f): 8:12am On Jun 01, 2021 Business / NNPC 20% Acquisition: Dangote Refinery May Drag Nigeria Into Further Debt by jerrybone(f): 8:12am On Jun 01, 2021 |

Is Nigeria ready to pile up more debts on a shaky, consistently postponed project whilst the economy is struggling? Africa’s largest state oil and gas company, Nigerian National Petroleum Company (NNPC) has recently hinted on its plan to acquire a 20 percent equity share (estimated at about $3bn) of the 650,000 barrels per day capacity refinery project of Africa’s richest Aliko Dangote.

This was disclosed by the corporation’s Chief Operating Officer, Refining and Petrochemicals, Mustapha Yakubu, who spoke at a conference recently.

“I can tell you today that we are seeking to have a 20 per cent minority stake in Dangote Refinery as part of our collaboration…”, Yakubu said.

Yakubu’s statement has sparked controversy amongst oil marketers and industry experts who opined that the NNPC proposal is too early and counter-productive to the revival of the moribund refineries owned by the country and may be detrimental to efforts to jumpstart the Nigerian economy reeling from high inflation, a recession and the global pandemic of 2020. They also opine that for a project whose valuation may be overinflated by about $9billion when compared to refineries of the same size across the world, it was unconscionable that the Government will have to borrow about $3billion to be 20% part owners of a refinery that has consistently missed delivery deadlines and which by the estimation of independent experts, may not be ready in the next three years.

What this effectively means is that by the time the project is up and running in Three years’ time, the government treasury will have incurred debts of almost the same amount it would take to build another refinery of a similar size using global cost estimates.

Dangote, who made his fortune from Cement production, first unveiled his plans for the refinery in September 2013, promising to complete it before 2016. He, however, did not start the construction of the facility until 2016, when he changed the location of the project to Lekki Free Zone, Lekki, Lagos State. More than three times, the businessman has changed the deadline for completion as many look forward to 2022, though it is widely acknowledged that the refinery may not be completed till about 3 years time.

Meanwhile, this paper examines the possible implications of the equity stake if finalised. Undoubtedly, new refineries will be a major breakthrough for Nigeria, one of the major exporters of crude oil and importers of Premium Motor Spirit (PMS) also known as petrol.

A partnership between NNPC and Dangote at this point is very questionable despite the fact that it may guarantee adequate supply of crude oil to the refinery and reduction in importation of petrol for NNPC. Our analyst recommendation would be for the project to be completed before such huge sums are dedicated to it by the NNPC as any investment at this point will be counterproductive.

Most importantly, there is the argument that industries in which Dangote operates have always received huge government subsidies, tax holidays and incentives without commensurate reduction in the prices of the commodities he sells. The question remains that with the refinery already benefiting from massive incentives, will it make further sense for the government to dip its hands into the already lean national purse or is this a bailout in disguise?

Industry experts are adamant that the move by the NNPC is too hasty, considering the fact that Mr Dangote has failed to meet up with the deadlines set on different occasions. This implies that a prolonged execution of the project might thwart the aim of the partnership and draw Nigeria into huge debt and debt servicing in the long run.

In an Interview with Punch Newspapers, the Chairman, Major Oil Marketers Association of Nigeria, Mr Adetunji Oyebanji, was of the opinion that the NNPC needed to clearly state the reasons for the proposed purchase of a 20 per cent stake in the privately-owned refinery. He said, “Dangote Group, owners of the Dangote refinery, should be allowed to operate the refinery efficiently as a private entity. Our experience is that government regulations and policies make decisions around investments like this political. Preferably, the equity should be sold directly to the Nigerian public.”

Some are also of the opinion that since the company financed the project through commercial loans and concessions from the Central Bank and FG, it would be preposterous to arrive at a sum as investment capital until the refinery begins operation.

It also needless to say that Nigeria has spent billions to revive its moribund refineries with little or no results to show for the humongous amount expended on them.

The Dangote-NNPC partnership however means that the country might have to jeopardize its revival of the government-owned refineries for which it has recently sought a loan to revamp one, whilst diverting its meagre resources to the private one.

Nigerians to bear the brunt

Havard Review Author and Tech Revolutionary, Ndubuise Ekekwe also criticized the move. He stated;

“This is the big revelation. Yes, the Nigerian government through NNPC, the national oil corporation, is planning to acquire 20% of equity in Dangote Refinery: “I can tell you today that we are seeking to have a 20% minority stake in Dangote Refinery .” So, magically, the Nigerian people have essentially solved any risk within Dangote Refinery as the world begins to move post-hydrocarbons. Depending on valuation, who knows, the company can even make “profit” before the first day of refining crude.”

“What do I mean? If Dangote Refinery invested $10 billion in that refinery, and now values the business at $50 billion and Nigeria takes 20% stake, it simply means that Dangote Refinery has recovered the $10 billion. Magic!”

“But how would Nigeria get the money to pay the refiner? We have a new revenue source called Recovered Loot: “The Minister of Finance and National Planning, Zainab Ahmed has revealed that the government has been borrowing from recovered loots to fund the budget. The minister also revealed that the government has not been able to repay back the loans taken so far.”

Monopoly

Mr Dangote’s businesses, from his investment in the maritime sector to manufacturing, sugar production and other areas, have over the years thrived on monopoly.

Major players in the oil and gas sector have feared that the equity share might result in another monopoly, wherein Mr Dangote will be the determinant of how much the end product will be sold in the market with prices likely to remain same or higher. Also, having enjoyed several concessions from the federal government in the past, he might hoodwink the government into accepting some obnoxious terms.

Recall that during the heat of the COVID-19 pandemic, only Dangote’s trucks were allowed free movement in and outside of the country, putting him ahead of competitors and other manufacturers in various industries.

The Africa’s richest has also been granted several waivers in different forms, which many feared to be detrimental to the economy of the country as it encourages monopoly and growth strangulation in those industries.

Verdict

Why the rush for NNPC to purchase 20% of a refinery that has consistently missed completion deadlines and is estimated to be overinflated by $9bn?

Nigeria via NNPC seeks to take a loan of about $3bn for 20% equity in Dangote refinery which in actual fact is almost half the real cost of the project going by global estimated cost of building similar sized refineries which puts the actual cost at about $8billion. What this portends for Nigerians is that by the time this project is completed in 2023 or 2024, the loan would have cost Nigerians over 4 to 5billion dollars (at current rates of 10 to 15%) including associated costs which could have built a refinery of a similar size. We are of the opinion that the NNPC has no business investing further funds into this project as the refinery already enjoys billions of Naira in Forex concessions by the CBN and other tax holidays for its special status.

The Federal Government should channel the funds to developing other nascent industries, and infrastructure to give much needed life to the economy.

From all indications, it may also be that Mr. Dangote’s project has run into cashflow trouble and this is an attempt at securing a bailout as costs overruns and project completion looks slower by the day. It is also important to note that Dangote’s recently announced projects in Nigeria within the last five years have mostly failed to materialize including his tomato processing plant in Northern Nigeria. https://investmentcable.com/nnpc-20-acquisition-dangote-refinery-to-drag-nigeria-into-further-debts/ 6 Likes 3 Shares

|

Politics / NPA: How Hadiza Bala-Usman disobeyed Presidential Directives Leading To Sack by jerrybone(f): 11:12am On May 12, 2021 Politics / NPA: How Hadiza Bala-Usman disobeyed Presidential Directives Leading To Sack by jerrybone(f): 11:12am On May 12, 2021 |

More details have emerged on certain actions of Hadiza Bala-Usman, the erstwhile Managing Director of the Nigeria Port Authority, that angered the Presidency, thus culminating into her sack.

Amid numerous allegations including financial impropriety, high-handedness and cronyism, Ms Bala-Usman, who held the position since 2016, was asked to step aside for a proper audit of the NPA's financials and investigation into her wrongdoings.

Ms Bala-Usman's suspension, initially announced by the Presidency on Thursday, was delivered in a letter addressed to her on Friday. The panel to carry out the investigation has been set up afterwards.

But, while Nigerians await the report of the probe, credible reports have exposed different shady acts of the ousted NPA boss, including her ties with Africa's richest, Aliko Dangote, which led to several concessions, at the expense of the government's revenue.

Earlier this week, it was widely reported that she had used her position to reduce fees as well as compel port operators to collect charges in Nigeria’s currency, the Naira, from only Mr. Dangote’s businesses whilst other importers continued to pay their charges in USD, which is the norm.

Also, reports have revealed her role in shortchanging Mr Dangote's rivals in the maritime sector in a bid to please her close friend.

Meanwhile, still in the eyes of the storm, a leaked memo obtained by this newspaper showed how Ms Bala-Usman violated a long standing presidential directive in 2019.

The NPA, in November 2019, revoked the land lease agreement signed with the Lagos Deep Offshore Logistics Base (LADOL), saying that the company violated the terms of the land lease at Tarkwa Bay, near Light House Beach in Lagos.

This led to brickbats and legal tussle between the company and the maritime agency until President Muhammadu Buhari waded in 2020.

It is widely acknowledged in various circles that her unilateral revocation of LADOL’s lease was done to favour her friend, Messrs Dangote – a childhood friend and longtime associate of a certain Senator (unnamed) who was also in Partnership with SHI. In the heat of the crisis, the office of the Attorney-General of the Federation and Minister of Justice, Abubakar Malami, in a leaked memo, argued that the revocation done by Bala-Usman-led NPA, was contrary to the Presidential Executive Order 2 on the need to support and promote local content.

This newspaper's analysis of the memo shows that the Justice minister was given his legal opinion on the matter, which will later be approved by the President.

Mr Malami also stated that multimillion-dollar investment of LADOL and other partners including Nigeria's Bank of Industry (BOI) will be in jeopardy if his legal opinion is not complied with.

Based on the minister's opinion, President Buhari, in an approval dated May 26, 2020 instructed him to write to the NPA and other stakeholders to comply with the prayers in Paragraphs 6a & b in the letter which stated that, "NPA be directed to comply with Mr. President’s subsisting approval for 25 years lease covering 114.552 hectares granted to Messrs Global Resource Limited since 2018”, and “Direct all relevant agencies to comply with the Legal Opinion attached hereto which is geared towards resolving the dispute, restoring investor confidence to the industry and bringing NPA's actions in conformity with extant laws and Federal Government's Policy on Local Content.”

While it was revealed in the letter that Hadiza had failed to comply with several legal opinion on the matter regarding the illegitimacy of the revocation, her actions also put over 50million dollars and 6.09billion in bank guarantees from Nigeria’s Bank of Industry, NCDMB and CBN in jeopardy as well as a USD250million investment by Messrs GRML/Ladol.

Were it not for the Government’s direct investment in the Shipyard and Zone over the years, perhaps LADOL may have lost out of the struggle with Hadiza, her lover and cronies?

Our sources within NPA and government circles further said that despite the President’s instructions and advice to Hadiza by those in the know, she refused to comply immediately.

This was said to have angered the Presidency as it was seen as an affront and undermining the President’s authority.

These actions are said to now be working against her as it was assumed that she had developed a ‘larger than life’ posture where she may have felt she was answerable to no one and more important than the President. https://investmentcable.com/npa-controversy-deepens-as-documents-reveal-how-hadiza-bala-usman-flouted-presidential-order/ 2 Likes 1 Share

|

Politics / How Hadiza Bala Breached NPA Rules, Exempted Dangote From Statutory Changes by jerrybone(f): 12:45am On May 10, 2021 Politics / How Hadiza Bala Breached NPA Rules, Exempted Dangote From Statutory Changes by jerrybone(f): 12:45am On May 10, 2021 |

The ousted Managing Director of the Nigeria Ports Authority, Hadiza Bala Usman, not only gave Africa's richest man, Aliko Dangote, an edge above his competitors using devious means, but also exempted him of sacrosanct charges, findings have shown.

Ms Usman, who had headed the lucrative agency since 2016, was on Wednesday suspended for alleged financial impropriety bordering on low remittance, misuse of office and bullying of operators. According to details of a letter sent to President Muhammadu Buhari by Nigeria’s transport minister, Rotimi Amaechi, the yearly remittance of operating surpluses by the NPA from 2016 to 2020 was “far short of the amount due for actual remittance.”

Mr Amaechi said within the stipulated years, the NPA recorded an outstanding unremitted balance of N165 billion (N165, 320, 962, 697). He thereafter suggested that the former NPA boss should step aside for the financial account of the agency to be investigated and audited.

Meanwhile, sources in the agency have said the travails of Ms Usman may not be unconnected to her buddy-buddy relationship with Mr Dangote, which had resulted in several waivers and exclusive benefits against the provision of the rules guiding the operations of NPA.

These actions, sources say, affected the revenue of the agency and consequently resulted in the the shortfalls in remittance as alleged by Mr Amaechi. While bank documents have shown her previous monetary transactions with the multi-billionaire, previous reports have exposed how Ms Usman hijacked terminals and suspended other's contracts in favour of Mr Dangote.

In a leaked memo, Ms Bala-Usman compelled port operators to not only give preferential rates to Mr Dangote but also ensure that only him paid his charges in Naira while others pay their port charges in dollars, violating the laid down tariff plan of the NPA.

This newspaper further learnt that operators who were uncomfortable with the cronyism exhibited by the erstwhile MD protested in 2019 but were rebuffed.

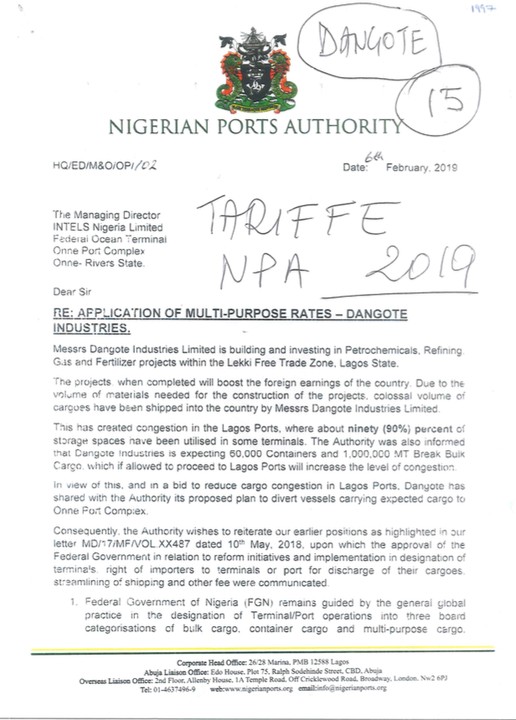

In response to the agitations, the NPA, in a memo dated February 6, 2019, justified its exclusion of Mr Dangote on the basis of his proposed refinery, expected to be completed before 2022.

Titled "RE: APPLICATION OF MULTI PURPOSE RATES – DANGOTE INDUSTRIES LTD", the memo affirmed that the agency cancelled the initial port charges applicable to cargoes for the Dangote refinery and compelled them to charge based on cargo type in line with multi-purpose tariff, which is lower and strange to operators.

“The Nigerian Ports Authority, and the Bureau of Public Enterprises are to streamline the payment of shipping and other fees at various terminals in a manner that ensures such fees are based on cargo type rather than on the basis of designation of terminals, to ensure that there is no loss of revenue due to the FGN based on terminals that importers choose to bring cargoes into the country."

"Hence, the Authority therefore directs that all cargoes of Messrs Dangote industries Limited and indeed all other importers being directed to Onne Port for customs clearance, specifically for these projects, and are Multi-purpose in nature to be treated by applying the same operational rates used by other Multipurpose Terminals," the memo read in parts.

Despite this concession and permission to pay in Naira as against other importers who pay in US Dollars, it was further revealed by sources within the NPA that Dangote Industries still owed about USD38million to the coffers of the NPA.

This exclusive benefit came in amongst many concessions already enjoyed by Dangote Industries to build its Refinery from the FG, CBN and Lagos State Government.

While reliable sources linked the gesture to Ms Usman’s personal relationship with Mr Dangote it remains unclear why the former NPA boss prioritised the billionaire's interest above revenue generation for the Federal Government, which was her core duty. https://investmentcable.com/exposed-how-hadiza-bala-breached-npa-rules-exempted-dangote-from-statutory-charges/ 1 Share

|

Business / Hadiza Bala-Usman: The Many "Sins" Of Suspended NPA MD by jerrybone(f): 11:28am On May 09, 2021 Business / Hadiza Bala-Usman: The Many "Sins" Of Suspended NPA MD by jerrybone(f): 11:28am On May 09, 2021 |

Amid disputation of impropriety, Hadiza Bala Usman was on Wednesday told to step aside as the Managing Director of the Nigeria Port Authority, a post she had held since 2016.

Usman, who has a stint in the public service, had occupied key positions in government including being a senior officer at the Bureau of Public Enterprises and a chief of staff to the incumbent Governor of Kaduna, Nasir El-Rufai in 2015. This made her familiar with the power blocs in the political sphere. The fact that she is a Fulani woman from Katsina, the home-state of President Muhammadu Buhari, who has a track record of shielding his loyalists, also dazed on-lookers.

“President Muhammadu Buhari has approved the recommendation of the Ministry of Transportation under Rt. Hon. Rotimi Amaechi for the setting up of an administrative panel of inquiry to investigate the Management of the Nigerian Ports Authority, NPA,” the president’s spokesperson, Garba Shehu, said, announcing her suspension.

According to Mr Amaechi, the yearly remittance of the agency dwindled under her watch with over 165 billion naira unremitted.

“In view of the above, I wish to suggest that the financial account of the activities of Nigerian Ports Authority be investigated for the period 2016 to 2020 to ascertain the true financial position and the outstanding unremitted balance of one hundred and sixty five billion, three hundred and twenty five million, nine hundred and sixty two thousand, six hundred and ninety seven Naira only (N165,320,962,679),” a leaked memo from the minister to the Presidency, read.

Beyond the fiscal reasons, these are the issues that culminated into the sack of Usman, an ally of the Presidency who wielded so much power in the maritime sector.

Fall out with Amaechi

Nigeria has a long history of political appointees clashing with their superiors in government and in most, the latter prevails over the former.

It happened in the case of Nasiru Ladan, former Director-General of National Directorate of Employment (NDE), whose path crossed with that of his then boss, Festus Keyamo, the state minister of Labour and Employment. Mr. Ladan was later ousted from office and replaced with Abubakar Nuhu Fikpo.

The same appears to have occurred in Usman’s case, who served alongside Amaechi in the Buhari campaign organisation.The relationship between the two hit the brink when Usman refused the renewal of certain contracts against the wish of her boss. This infuriated Amaechi who found Hadiza too influential to be controlled.

The Minister was however dumbstruck when she got a second term in 2019, against his wish. In consternation, Amaechi drew the battle lines.

‘Romance’ with Dangote

The close relationship between Usman and Aliko Dangote, Africa’s richest and a major player in the maritime industry, also culminated into her sack, sources reveal.

Using her office, the former MD afforded Dangote an edge over other competitors, revoking licences and terminating contracts in favour of her ‘friend’. This brought her into the bad books of companies like INTELs and many others who felt cheated. For instance, in 2019, she spearheaded the decommissioning of BUA Ports Terminals in Port-harcourt, despite court injunctions against such.

Also, in 2020, she confiscated some terminals formerly operated by Integrated Logistics Services’ (INTELs) in Onne ports complex, Rivers state and subsequently awarded them to Dangote through a proxy company, International Container Terminal Services (ICTS) Nigeria limited. Meanwhile, in January, a Nigerian newspaper, Peoples Gazette, uncovered how Dangote transferred N200 million to a bank account run by Usman during the build up of the 2015 general election.

The transactions were sent in two tranches from two different bank accounts of the Africa’s richest man to Ms. Bala Usman’s account with Access Bank, the newspaper reported.

“Ms. Bala Usman received the first N100 million transfer on February 6, 2015; while the second N100 million came through three days later on February 9. The transfers carried ambiguous descriptions that made it difficult to conclude their purpose.”

While both parties failed to clarify the transactions, many have posited that it brings to question the integrity of the former NPA MD.

Criticism of Buhari government

Despite serving under the current administration, Usman has publicly criticised the government, an action condemned by Buhari’s loyalists. She is the co-founder of the Bring Back Our Girls (BBOG) campaign, a group at the forefront of the advocacy for the release of the Chibok girls kidnapped in 2014.

But years after, it appears Usman was oblivious of the fact that she is now a government official, calling out her principal on social media.

“The state of insecurity in the country that has led to the kidnap of Kagara boys and Zamfara girls need to be addressed URGENTLY…We can’t go on like this! Rescue our children and Secure our country that’s all we ask ���…#SecureNorth #SecureNigeria,” she wrote in February over the worsening security situation in the country.

With no inkling of what the outcome of the investigation would be, no one can say for certain whether the former NPA MD will be recalled or not. https://investmentcable.com/round-up-the-many-sins-of-hadiza-bala-usman-suspended-npa-md/ 1 Like 1 Share |

Travel / Re: Motorcyclists Smuggle People Across Ogun/Oyo, With N100 Bribe - Politics Nigeria by jerrybone(f): 4:16pm On May 30, 2020 Travel / Re: Motorcyclists Smuggle People Across Ogun/Oyo, With N100 Bribe - Politics Nigeria by jerrybone(f): 4:16pm On May 30, 2020 |

Very Impressive Journalism!.. Keep up the good work Politics Nigeria...following you guys now. 31 Likes |

Health / Re: ANALYSIS: Is The Madagascan Herbal Drink A Cure For Malaria Or Coronavirus? by jerrybone(f): 5:52pm On May 19, 2020 Health / Re: ANALYSIS: Is The Madagascan Herbal Drink A Cure For Malaria Or Coronavirus? by jerrybone(f): 5:52pm On May 19, 2020 |

You obviously have an issue with them... I have been following the site and they are doing well...at least I have read several exclusives they did here on nairaland. your jealousy and dislike of the platform is apparent.Ayemileto:

Lol, it's not jealousy. And I'm not unfortunate.

I have read at least 2 fact check/ analysis from Politics Nigeria and I know what I'm saying when I said it will be filled up with rubbish and junks.

So, I see no reason why you're pained about my comment except you're one of them.

In fact, reading this one self, they didn't make any reasonable conclusion. They just gathered different stories we have read over time, and said they are analysing.

So, madam, I'm entitled to my opinion and you're entitled to yours.

Just get off my mention if you have nothing reasonable to say.

1 Like |

Health / Re: ANALYSIS: Is The Madagascan Herbal Drink A Cure For Malaria Or Coronavirus? by jerrybone(f): 5:39pm On May 19, 2020 Health / Re: ANALYSIS: Is The Madagascan Herbal Drink A Cure For Malaria Or Coronavirus? by jerrybone(f): 5:39pm On May 19, 2020 |

You are an unfortunate soul for writing this......Your hatred and jealousy will kill you. Ayemileto:

Wetin concern Politics Nigeria with Health?

Abi corona virus is now politics?

Meanwhile, na rubbish go dey there. All their fact checks are usually loads of junks. 1 Like |

Politics / Re: Seyi Tinubi: 3 Ways To Give Back That Doesn't Require A Financial Investment by jerrybone(f): 8:00pm On May 06, 2020 Politics / Re: Seyi Tinubi: 3 Ways To Give Back That Doesn't Require A Financial Investment by jerrybone(f): 8:00pm On May 06, 2020 |

dis guy sharp like him papa E sabi business true true #nairaninja#  3 Likes 1 Share |

Business / Court Set To Issue Warrant Arrest Against Access Bank MD, Herbert Wigwe by jerrybone(f): 9:24am On Sep 18, 2019 Business / Court Set To Issue Warrant Arrest Against Access Bank MD, Herbert Wigwe by jerrybone(f): 9:24am On Sep 18, 2019 |

Dr Herbert Wigwe, Managing Director of Access Bank Plc Justice Hakeem Oshodi of Lagos State High Court, Ikeja division said on Monday that a bench warrant would be issued for arrest of Mr Herbert Wigwe, the Group Managing Director of Access Bank Plc, and other defendants standing trial over alleged $6.3 million fraud in the court. The judge’s position was following absence of Wigwe and six other defendants, a situation that has been stalling arraignment of the accused persons whenever the matter came up for hearing. Other defendants in the matter are Access bank, Titi Oshuntoki, Chinyere Bishop-Adigwe, Cast Oil and Gas Limited, Seyi Sanni, Adekunle Adebayo, Sunny Amos Offiong and Augusta Energy. Aside Offiong and Access bank, which has been represented by one Robert Imowo, the other defendants have not been present in the court since the commencement of the trial. They were initially to be arraigned on May 2 this year on four-count of conspiracy to defraud, conspiracy to obtain money by false pretence, obtaining money by false pretence and stealing, but the arraignment was stalled due to the absence in court of Wigwe and six other defendants. According to the charge sheet, the defendants committed the offences alongside Tunji Amushan who is said to be at large. The defendants were also alleged to have conspired with Augusta Energy of Geneva, Switzerland, to defraud the complainant, Top Oil and Gas Development Ltd to the tune of over $6.3 million. The defendants allegedly obtained the funds from Top Oil and Gas Development Ltd, by falsely representing to be the Chairman of the company, Chief Don Obot Etiebet and other officers of the company, that Cast Oil and Gas Ltd had a contract with Augusta Energy of Geneva, Switzerland. The contract was allegedly for the supply of 10,000 metric tones of Automated Gas Oil (AGO), by Augusta Energy of Geneva to Cast Oil and Gas, the cost price of the product was $6.3 million and Top Oil and Gas Ltd, was the consignee of the products. It is further alleged that the defendants promised the complainant that Cast Oil and Gas Ltd will sell the said products on its behalf. The defendants are alleged to have promised to ensure that Top Oil and Gas Development Ltd recovered the money invested for the purchase, supply and importation of the said products. The prosecution alleges the defendants fraudulently induced the complainant to pay for a product that was not actually supplied nor imported into Nigeria, by Augusta Energy and that the defendants had fraudulently converted the funds to their own use and benefit. The offences contravene Sections 383 (2)(f), 390 (9) and 422 of the Criminal Code 2004 and Section 8 (a) of the Advance Fee Fraud and Other Related Offences Act of 2006 During the May 2 proceedings, Mr Paul Usoro (SAN), the defence counsel for Access Bank Plc, had informed the court that the bank had filed a preliminary objection challenging the court’s jurisdiction to hear the case. However, when the matter came up on July 8, 2019, Pius Akuta, a counsel from the office of the Attorney General of the Federation, had asked the court for permission to take over the matter from the Special Fraud Unit (SFU) of the Nigeria Police Force that earlier prosecuted the matter. Subsequently, the court ordered the office of the Attorney General of the Federation to take over the prosecution of the matter. In a twist of development, Akuta, during Monday’s proceedings, informed the court of the prosecutor’s decision to withdraw the matter, hinging on a position that the complainant is averse to continuation of matter. Insisting on the need to do the “right thing”, the judge adjourned the matter to December 2, 2019 for arraignment of the defendants, threatening to issue bench warrants for arrest of the defendants in event of their absence. https://www.pmnewsnigeria.com/2019/09/18/court-set-to-issue-warrant-arrest-against-access-bank-md/Cc: lalasticlala

|

Business / Innoson Reacts: Bench Warrant Against Me Is An Abuse Of Process Taken Too Far by jerrybone(f): 8:30pm On Jun 24, 2019 Business / Innoson Reacts: Bench Warrant Against Me Is An Abuse Of Process Taken Too Far by jerrybone(f): 8:30pm On Jun 24, 2019 |

The issuance of bench warrant against me by the Federal High Court Ikoyi Lagos, today, June 24th 2019 by Justice Ayokunle Faji is an abuse of process taken too far by the Court and made without jurisdiction. The order itself is a nullity and does not have grounds on law.Firstly, there is no prima facie case against me. The charge was based on suspected or trumped up action of Innoson Nigeria Ltd and Innoson Nigeria Ltd was a party originally to the charge but was discharged by the Court of Appeal.Secondly, there was no notice of trial served on me pursuant to the Administration of Criminal Justice Act.

The act provides that before the court should issue a bench warrant, there must be proof of service of the charge and the notice of trial on the person involved. But there is no notice of trial served on me and the question of whether I, Innocent Chukwuma has been served with the charge is still pending at the Supreme Court.

More importantly, the charge is also an abuse because of earlier similar suit in relation to the charge pending at different Federal High Courts.Thirdly, The said CHARGE NO: FHC/L/565/2015 which is a trumped up was filed by the police in 2015 and was equally withdrawn by the same police through its notice of withdrawal dated 17th February, 2016 duly filed at the Federal High Court Registry Lagos.GTB characteristically got the then Director of Public Prosecution of the Federal Republic of Nigeria (names withheld) to claim to have taken over the Charge/case using the name of the Attorney General of the Federation. This is after the Police have withdrawn the case.

Interestingly, that DPP involvement in this matter and his complicities therein led to his removal as the Director of Public Prosecution of the Federal Republic of Nigeria.The argument on whether the Office of the Attorney General is empowered to take over a case that the Police have originally withdrawn is still going on at the Supreme Court.The public should be aware that this latest order is being orchestrated by Guaranty Trust Bank in order to force me negotiate with the bank from a weaker position.

It will be recalled that in a decision of 27th February 2019 in Appeal No:SC.694/2014 between Guaranty Trust Bank PLC v Innoson Nig Ltd, the Supreme Court dismissed GTB’s appeal against the Court of Appeal’s judgment which ordered GTB to pay the judgment debt which with accrued interest is as at today over N9Billion.I therefore advice the bank for the benefit of its shareholders to quickly comply with the Supreme Court judgment and pay the over N9billion judgment debt.

Failure to do so within the short period of grace that Innoson Nigeria Ltd granted to the bank will lead to the final execution of the Writ of Fifa against Guaranty Trust Bank.Meanwhile, I have appealed against the Order of Bench Warrant to the Court of Appeal and have as well filled a Motion for Stay of Execution of the Order. 49 Likes 4 Shares

|

Crime / Re: Twitter User Raises Alarm After N810,000 Is Stolen From Zenith Bank Account[pic] by jerrybone(f): 1:03am On Jun 07, 2019 Crime / Re: Twitter User Raises Alarm After N810,000 Is Stolen From Zenith Bank Account[pic] by jerrybone(f): 1:03am On Jun 07, 2019 |

photo

|

|

Crime / Twitter User Raises Alarm After N810,000 Is Stolen From Zenith Bank Account[pic] by jerrybone(f): 12:34am On Jun 07, 2019 Crime / Twitter User Raises Alarm After N810,000 Is Stolen From Zenith Bank Account[pic] by jerrybone(f): 12:34am On Jun 07, 2019 |

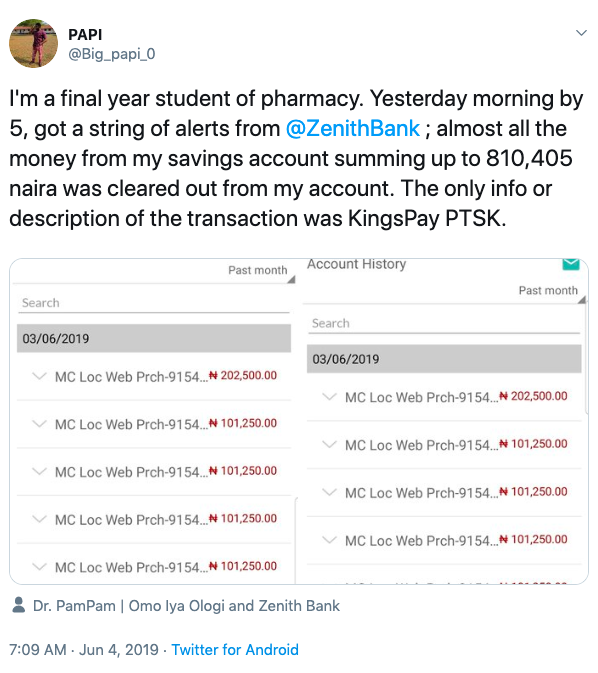

A twitter User, @Big_Papi_0 has raised alarm after N810,000 was swiped from his Zenith Bank account by suspected Fraudsters.

He wrote on Twitter;