| Re: Your Dormant Bank Account Could Put You In Trouble by 1money: 11:31am On Aug 05, 2015 |

Shouldn't the consumer protection agency or some other agency help customers in this regard?

Why would I continue paying for a dormant account after they took all the remaining money in it? 2 Likes |

| Re: Your Dormant Bank Account Could Put You In Trouble by seyoops4u: 11:31am On Aug 05, 2015 |

Bsc:

I left 5,000 in my dormant Diamond Bank account. Please who is owing who? yeah, they are owing you the last tym u checked, but when next you check u might have been owing them. Neva trust those banks mehn. |

| Re: Your Dormant Bank Account Could Put You In Trouble by hopeforcharles(m): 11:33am On Aug 05, 2015 |

steppin:

@Op,

That's for a current account not savings.

If you leave a current account dormant, there are bound to be charges in some banks.

Not True, they did the same to me on my savings account, imagine cutting my money from thousands to nill and still crediting me to the tune of 2500, just few months i got alert that i now have 625 naira remaing, i want to shut down that account and move to GTB, I dnt think i will have anything to do with Ecobank again. 1 Like |

| Re: Your Dormant Bank Account Could Put You In Trouble by FOREXMART(m): 11:33am On Aug 05, 2015 |

Tokotaya:

If you have a dormant bank account in Nigeria, you could be on CBN’s debtors’ list. Let me recast that, if you have a dormant account in Ecobank, you may already be a debtor, without knowing it. Your name may have been listed as having bad credit on the Credit Risk Management Bureau (CRMB)’s database with CBN. It’s not a demarketing attempt. It is purely my experience that others can learn from.

I had a current account in Ecobank around 2011. My ex-employer moved our salaries there based on a nice presentation made by the Branch Manager of the Bank at the time. However, the promises made were not met, so the salary account was moved elsewhere and we all thought it ended there.

More than three years later, I had left the company and was processing a loan with another bank. Near the completion of the deal, they called to tell me I was owing Ecobank. I was advised to sort it out with them before any progress could be made. I didn’t take any loan. The account didn’t have an overdraft facility. It was a basic current account from which you could never withdraw above your available balance at any point in time. How could I owe on the account?

I called their customer care and the lady insisted I must have taken a loan. I insisted I did not, and tried to convince her to look into the account to see what could have happened. She rudely cut the call!

I made a series of other calls and was linked to their Oke Afa, Isolo Branch where the account resided and was able to establish that it was my dormant account there that ran into negative. Ecobank made some routine charges on the account and when they depleted what was there, they made negative deduction of N119 and the negative started accumulating interest that had amounted to about N2,500 by late last year when I applied for a loan.

What manner of a bank would make deductions from a dormant account? I went to the bank and confronted them. An official explained that an account going dormant does not mean that charges could not be made on it. He said a man can be sleeping, but his bodily functions work nonetheless.

I paid off the money and obtained a letter of Non-indebtedness and took it to my new bank before they could process my loan. The great worry: what if I had not applied for a loan at another bank? How would I have known? Many decades later, may be as a pensioner, one may now apply for something and they will tell you there’s a debt of a couple of millions of naira you need to clear.

I’ve commenced the process of closing the account with Ecobank. Other dormant accounts I have are going too, even though some of the other banks are arguing that their own processes are different from Ecobank’s. They argue that typically, your dormant account holds the last balance there till you reactivate it. One said if at all any customer’s account goes into red, his bank had a standard procedure to call up the customer by phone to alert him. No one called me from Ecobank.

How much was N119 that Ecobank would go ahead to list me as having a non-performing loan instead of calling me to clear it. The totality of my experience with Ecobank has been horrible to say the least. To even collect the Letter of Non-Indebtedness was a war. It took nearly 3 weeks of constant harassment to get it ready and on the day I was to pick it up, I spent three and a half hours in their banking hall.

So folks, check up on all your current dormant accounts, especially those with Ecobank.

Thanks for the heads up. |

| Re: Your Dormant Bank Account Could Put You In Trouble by Nobody: 11:37am On Aug 05, 2015 |

Tokotaya:

If you have a dormant bank account in Nigeria, you could be on CBN’s debtors’ list. Let me recast that, if you have a dormant account in Ecobank, you may already be a debtor, without knowing it. Your name may have been listed as having bad credit on the Credit Risk Management Bureau (CRMB)’s database with CBN. It’s not a demarketing attempt. It is purely my experience that others can learn from.

I had a current account in Ecobank around 2011. My ex-employer moved our salaries there based on a nice presentation made by the Branch Manager of the Bank at the time. However, the promises made were not met, so the salary account was moved elsewhere and we all thought it ended there.

More than three years later, I had left the company and was processing a loan with another bank. Near the completion of the deal, they called to tell me I was owing Ecobank. I was advised to sort it out with them before any progress could be made. I didn’t take any loan. The account didn’t have an overdraft facility. It was a basic current account from which you could never withdraw above your available balance at any point in time. How could I owe on the account?

I called their customer care and the lady insisted I must have taken a loan. I insisted I did not, and tried to convince her to look into the account to see what could have happened. She rudely cut the call!

I made a series of other calls and was linked to their Oke Afa, Isolo Branch where the account resided and was able to establish that it was my dormant account there that ran into negative. Ecobank made some routine charges on the account and when they depleted what was there, they made negative deduction of N119 and the negative started accumulating interest that had amounted to about N2,500 by late last year when I applied for a loan.

What manner of a bank would make deductions from a dormant account? I went to the bank and confronted them. An official explained that an account going dormant does not mean that charges could not be made on it. He said a man can be sleeping, but his bodily functions work nonetheless.

I paid off the money and obtained a letter of Non-indebtedness and took it to my new bank before they could process my loan. The great worry: what if I had not applied for a loan at another bank? How would I have known? Many decades later, may be as a pensioner, one may now apply for something and they will tell you there’s a debt of a couple of millions of naira you need to clear.

I’ve commenced the process of closing the account with Ecobank. Other dormant accounts I have are going too, even though some of the other banks are arguing that their own processes are different from Ecobank’s. They argue that typically, your dormant account holds the last balance there till you reactivate it. One said if at all any customer’s account goes into red, his bank had a standard procedure to call up the customer by phone to alert him. No one called me from Ecobank.

How much was N119 that Ecobank would go ahead to list me as having a non-performing loan instead of calling me to clear it. The totality of my experience with Ecobank has been horrible to say the least. To even collect the Letter of Non-Indebtedness was a war. It took nearly 3 weeks of constant harassment to get it ready and on the day I was to pick it up, I spent three and a half hours in their banking hall.

So folks, check up on all your current dormant accounts, especially those with Ecobank.

o boy eh! That means say i no go save for my ecobank account be dat o whether savings or current i no even wan knw now. Imagine you deposit a million naira and you just received alert that says "dear customer having removed our continuous irrestible charges your account balance is #100.99k, do deposit more funds to increase your balance or else you know na..thank you" And you just rush go meet the manager for office, and the conversation comes up You: oga banker, i just deposited a million naira but i received an account balance of hundred naira, whats the meaning of all these Oga banker: well Mr oloripa, your account has been dormant for 8years now, but the charges are still on, oh you think you can run away from us, no you cant run away from our charges, whether your account balance is 1billion naira or 1 naira we dey charge you dey go, whether you are on the road or in your house we still dey charge you, whether you dey chop or you dey sleep dey snore like baboon charges still dey waka, even as we are talking now your account balance is no more #100 its now #15 and charges no gree stop o You: Ah! You dey madt ni Lol 5 Likes |

|

| Re: Your Dormant Bank Account Could Put You In Trouble by iwatchandlisten(m): 11:44am On Aug 05, 2015 |

Thank you OP. Eleyin di gan'o! Now time to take preventive action!

Chai, I hope my NYSC account in First Bank in Potiskum, Yobe state, which I simply ignored after my service there does not get this idea'o! "... a man can be sleeping, but his bodily functions work nonetheless". 1 Like |

| Re: Your Dormant Bank Account Could Put You In Trouble by Nobody: 11:46am On Aug 05, 2015 |

[quote][/quote] you have said it all.. All savings account too would also be charged for SMS alert. You have no case OP |

| Re: Your Dormant Bank Account Could Put You In Trouble by Imanda: 11:49am On Aug 05, 2015 |

Truflame:

The best bank in Nigeria is GTbank. Make thorough inquiries before transacting with other banks. They can really frustrate the living daylight in you GTB indeed. Even though i use them but my current account which has been dormant for over 4 yrs is being indebted till date. this is an eye opener. I need to close it b4 it runs in $ 3 Likes |

| Re: Your Dormant Bank Account Could Put You In Trouble by Nobody: 11:50am On Aug 05, 2015 |

AMI3:

Exploitation of d highest order. And how was he exploited, pray, tell! 1 Like |

| Re: Your Dormant Bank Account Could Put You In Trouble by dyomo(m): 11:50am On Aug 05, 2015 |

Ecobank is fond of making deductions on accounts, active or inactive. I think it's time for me to close my account with them. 1 Like |

| Re: Your Dormant Bank Account Could Put You In Trouble by InZA: 11:50am On Aug 05, 2015 |

Empress2014:

trouble or no trouble,my Uba account will soon be dormant and maybe dormant for life,if anybody call me say I owe them money, I go swear for their forefathers ni trouble or no trouble,my Uba account will soon be dormant and maybe dormant for life,if anybody call me say I owe them money, I go swear for their forefathers ni Let me guess why?   You're a serving corper in some distant Northern region and the only available bank closest to you is UBA....But you will soon pass out in October and forget about the account altogether. Did I get it  |

| Re: Your Dormant Bank Account Could Put You In Trouble by bosunjohns(m): 11:51am On Aug 05, 2015 |

Tokotaya:

If you have a dormant bank account in Nigeria, you could be on CBN’s debtors’ list. Let me recast that, if you have a dormant account in Ecobank, you may already be a debtor, without knowing it. Your name may have been listed as having bad credit on the Credit Risk Management Bureau (CRMB)’s database with CBN. It’s not a demarketing attempt. It is purely my experience that others can learn from.

I had a current account in Ecobank around 2011. My ex-employer moved our salaries there based on a nice presentation made by the Branch Manager of the Bank at the time. However, the promises made were not met, so the salary account was moved elsewhere and we all thought it ended there.

More than three years later, I had left the company and was processing a loan with another bank. Near the completion of the deal, they called to tell me I was owing Ecobank. I was advised to sort it out with them before any progress could be made. I didn’t take any loan. The account didn’t have an overdraft facility. It was a basic current account from which you could never withdraw above your available balance at any point in time. How could I owe on the account?

I called their customer care and the lady insisted I must have taken a loan. I insisted I did not, and tried to convince her to look into the account to see what could have happened. She rudely cut the call!

I made a series of other calls and was linked to their Oke Afa, Isolo Branch where the account resided and was able to establish that it was my dormant account there that ran into negative. Ecobank made some routine charges on the account and when they depleted what was there, they made negative deduction of N119 and the negative started accumulating interest that had amounted to about N2,500 by late last year when I applied for a loan.

What manner of a bank would make deductions from a dormant account? I went to the bank and confronted them. An official explained that an account going dormant does not mean that charges could not be made on it. He said a man can be sleeping, but his bodily functions work nonetheless.

I paid off the money and obtained a letter of Non-indebtedness and took it to my new bank before they could process my loan. The great worry: what if I had not applied for a loan at another bank? How would I have known? Many decades later, may be as a pensioner, one may now apply for something and they will tell you there’s a debt of a couple of millions of naira you need to clear.

I’ve commenced the process of closing the account with Ecobank. Other dormant accounts I have are going too, even though some of the other banks are arguing that their own processes are different from Ecobank’s. They argue that typically, your dormant account holds the last balance there till you reactivate it. One said if at all any customer’s account goes into red, his bank had a standard procedure to call up the customer by phone to alert him. No one called me from Ecobank.

How much was N119 that Ecobank would go ahead to list me as having a non-performing loan instead of calling me to clear it. The totality of my experience with Ecobank has been horrible to say the least. To even collect the Letter of Non-Indebtedness was a war. It took nearly 3 weeks of constant harassment to get it ready and on the day I was to pick it up, I spent three and a half hours in their banking hall.

So folks, check up on all your current dormant accounts, especially those with Ecobank.

|

| Re: Your Dormant Bank Account Could Put You In Trouble by Empress2014(f): 11:52am On Aug 05, 2015 |

|

| Re: Your Dormant Bank Account Could Put You In Trouble by InZA: 11:53am On Aug 05, 2015 |

Empress2014:

stop guessing,kindly go through my profile and read my posts and see what uba has done to me Aii Sorry. |

| Re: Your Dormant Bank Account Could Put You In Trouble by 2baga(m): 11:56am On Aug 05, 2015 |

Tokotaya:

If you have a dormant bank account in Nigeria, you could be on CBN’s debtors’ list. Let me recast that, if you have a dormant account in Ecobank, you may already be a debtor, without knowing it. Your name may have been listed as having bad credit on the Credit Risk Management Bureau (CRMB)’s database with CBN. It’s not a demarketing attempt. It is purely my experience that others can learn from.

I had a current account in Ecobank around 2011. My ex-employer moved our salaries there based on a nice presentation made by the Branch Manager of the Bank at the time. However, the promises made were not met, so the salary account was moved elsewhere and we all thought it ended there.

More than three years later, I had left the company and was processing a loan with another bank. Near the completion of the deal, they called to tell me I was owing Ecobank. I was advised to sort it out with them before any progress could be made. I didn’t take any loan. The account didn’t have an overdraft facility. It was a basic current account from which you could never withdraw above your available balance at any point in time. How could I owe on the account?

I called their customer care and the lady insisted I must have taken a loan. I insisted I did not, and tried to convince her to look into the account to see what could have happened. She rudely cut the call!

I made a series of other calls and was linked to their Oke Afa, Isolo Branch where the account resided and was able to establish that it was my dormant account there that ran into negative. Ecobank made some routine charges on the account and when they depleted what was there, they made negative deduction of N119 and the negative started accumulating interest that had amounted to about N2,500 by late last year when I applied for a loan.

What manner of a bank would make deductions from a dormant account? I went to the bank and confronted them. An official explained that an account going dormant does not mean that charges could not be made on it. He said a man can be sleeping, but his bodily functions work nonetheless.

I paid off the money and obtained a letter of Non-indebtedness and took it to my new bank before they could process my loan. The great worry: what if I had not applied for a loan at another bank? How would I have known? Many decades later, may be as a pensioner, one may now apply for something and they will tell you there’s a debt of a couple of millions of naira you need to clear.

I’ve commenced the process of closing the account with Ecobank. Other dormant accounts I have are going too, even though some of the other banks are arguing that their own processes are different from Ecobank’s. They argue that typically, your dormant account holds the last balance there till you reactivate it. One said if at all any customer’s account goes into red, his bank had a standard procedure to call up the customer by phone to alert him. No one called me from Ecobank.

How much was N119 that Ecobank would go ahead to list me as having a non-performing loan instead of calling me to clear it. The totality of my experience with Ecobank has been horrible to say the least. To even collect the Letter of Non-Indebtedness was a war. It took nearly 3 weeks of constant harassment to get it ready and on the day I was to pick it up, I spent three and a half hours in their banking hall.

So folks, check up on all your current dormant accounts, especially those with Ecobank.

its an eye opener |

| Re: Your Dormant Bank Account Could Put You In Trouble by babyfaceafrica: 11:56am On Aug 05, 2015 |

I don't think its all banks,I have two dormant accounts first and zenith......zenith on iths own has not sent me ny message since three years it gone dormant so I don't knoe whts up..so balnce,no atm charges nothing,the just refused to communicate..my dormant first bank account of a yr was reactivated and I put in 5k and nnothing has happened the didn't deduct any fees I even withdrew 2k yesterday..so I guess its ecobank and some other banks |

| Re: Your Dormant Bank Account Could Put You In Trouble by firfinch(m): 11:58am On Aug 05, 2015 |

TunjiMsp:

even on savings remember you do pay for SMS alert Eco bank is becoming something else. They even deduct money from savings account monthly. They charge over 100 naira against your account, apart from sms alert charges. You can imagine paying for 11 sms when you actually got 4 in a particular month! I was forced to withdraw all my balance before july ended. I'm taking my money to another bank. I wonder why you will be charged when you have their required minimum balance. This act does not encourage keeping money in the bank. If I keep loosing money for saving my money with Ecobank, then what is the essence of keeping my money with them? Money that is supposed to generate interests for me keep decreasing. The appropriate bodies should look into this matter, and stop this extortion by #Ecobank ng. 1 Like |

| Re: Your Dormant Bank Account Could Put You In Trouble by plendil: 11:59am On Aug 05, 2015 |

I dont get it. How can an account go into negative when it has no overdraft facility? Even worse, how the **** can a SAVINGS account be debited into the negative zone    2 Likes |

| Re: Your Dormant Bank Account Could Put You In Trouble by Excellent7(m): 11:59am On Aug 05, 2015 |

Faita:

There is a sense in which I can sympathize with the banks. Maintaining records must cost something. When you make someone responsible to protect your wealth or to be on standby to receive your wealth for protection or for further transport on to another receiver, I think you cost them some energy.

My annoyance with this method of business is that the service providers start out nearly or completely muting the idea that serving you will cost you money. They do that to keep you around. Then when other supporting revenue streams start to fail, they begin to employ a mixture of deceit and abrasive logic to take your money from you. At worst, they act like this Ecobank case where they don't even alert you that they are charging you anything until it's become a major problem for you. And suing them then becomes a very messy business.

A relative has an account with Ecobank and each time I've had to deal with them in his behalf I have found them less than appealing. I really wonder how their customers endure them. My experience though is that all these banks have serious customer service problems. They are very poor at taking care of their customers' interests. It makes me think that banking isn't their real business.

Could someone do an in-depth exposé on the banking industry, for heaven's sake?

I think people should seriously consider keeping personal updated records of their bank accounts and ensure to deactivate them as soon as they find them unnecessary. Chances are they will cost you something eventually to keep holding on to them.

Btw, thanks, OP, for sharing the information. It saves us all a lot of undue stress. This is predatory corporate practice against customers. This is not a good corporate practice at all. These banks are shooting themselves on the leg without knowing it, and tomorrow they will send marketers to market products to a subset of the banking population that have had unsatisfactory experience from them, and be wondering why the marketers are coming back empty handed. The best way to sell a brand is to offer fair and quality products and services. Customers should be appropriately informed of terms and conditions when opening accounts and whenever terms change, but unfortunately this is not always done when they send of marketers with superlative targets. @OP, thanks for sharing. I have a number of dormant accounts i have not used in years as I am not in the habit of closing accounts. Next time I make it back, I intend to close anyone that has been preying on my funds. Personally, once I am convinced a brand is selfish, unfair and predatory, I stop patronizing. 1 Like |

| Re: Your Dormant Bank Account Could Put You In Trouble by hormobollar(f): 12:00pm On Aug 05, 2015 |

@Op thanks for the info |

| Re: Your Dormant Bank Account Could Put You In Trouble by ladygudhead(f): 12:02pm On Aug 05, 2015 |

ehisdan:

Ecobank is a scrab bank that need to be eradicated asap. Oceanic bank was bad, i thought merging them with Ecobank will be better rather it became worse. I left the bank almost a year now with some money in d account. But now my account balance is -#853, they dnt send me alert. What then is d deduction for?. I love #fidelity bank# pls o.was dat ur dormant Acc with Eko a savings or current Acc? |

| Re: Your Dormant Bank Account Could Put You In Trouble by SweetSoup(m): 12:12pm On Aug 05, 2015 |

steppin:

@Op,

That's for a current account not savings.

If you leave a current account dormant, there are bound to be charges in some banks. bro i left a saving of 1500naira with this same ecobank dormant for 5years after they kept charging for promotional messages wey no consine me. The account as at today has a debit bal of -206 naira, i went to complain and was advice to reactivate it, pay the debit bal and close it if i choose. |

| Re: Your Dormant Bank Account Could Put You In Trouble by Nobody: 12:12pm On Aug 05, 2015 |

Truflame:

The best bank in Nigeria is GTbank. Make thorough inquiries before transacting with other banks. They can really frustrate the living daylight in you Gtbank owe me 30k , I used an ATM somewhere in India, they wouldn't refund it, like it wasn't enough I used a USD card and got a false debit of $25, gtbank is useless they just haven't shown many people yet, till it hits them anyways, I don learn now  3 Likes |

| Re: Your Dormant Bank Account Could Put You In Trouble by Gboliwe: 12:15pm On Aug 05, 2015 |

No wonder even after filling a form in firstbank to close my account, they have refused to do so. This is so I can remain indebted to them. Chai! I should make out time to go make some noise there since that's the only language they understand. 4 Likes |

| Re: Your Dormant Bank Account Could Put You In Trouble by doofanc: 12:28pm On Aug 05, 2015 |

SweetSoup:

bro i left a saving of 1500naira with this same ecobank dormant for 5years after they kept charging for promotional messages wey no consine me. The account as at today has a debit bal of -206 naira, i went to complain and was advice to reactivate it, pay the debit bal and close it if i choose. Surprising |

| Re: Your Dormant Bank Account Could Put You In Trouble by doofanc: 12:30pm On Aug 05, 2015 |

Gboliwe:

No wonder even after filling a form in firstbank to close my account, they have refused to do so. This is so I can remain indebted to them. Chai! I should make out time to go make some noise there since that's the only language they understand. Funny I was told by a banker friend that you can even close an account, that dormacy is a form of closure. |

| Re: Your Dormant Bank Account Could Put You In Trouble by doofanc: 12:35pm On Aug 05, 2015 |

SweetSoup:

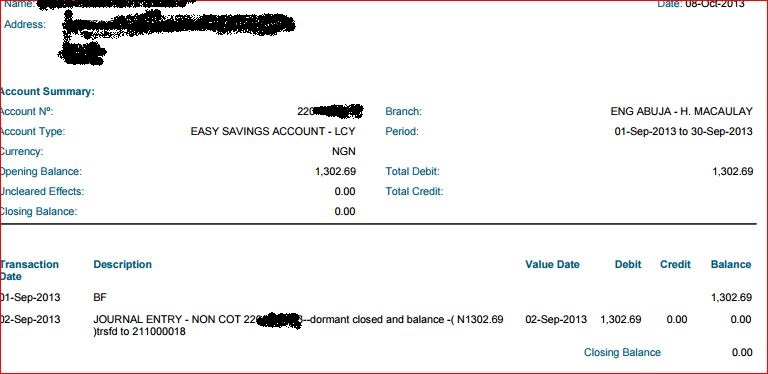

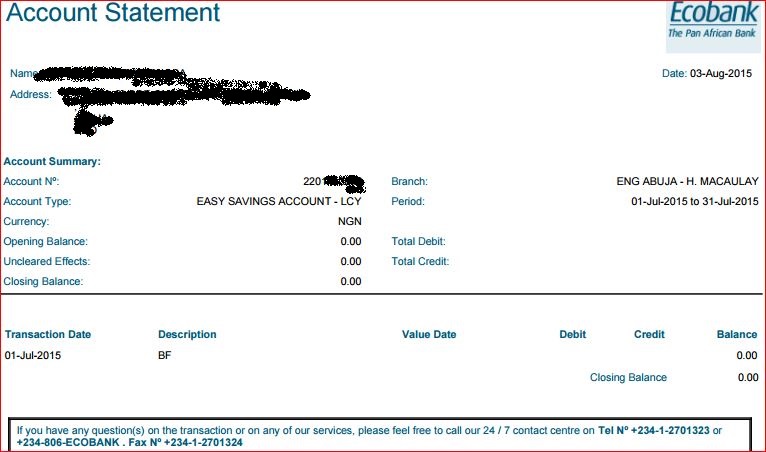

bro i left a saving of 1500naira with this same ecobank dormant for 5years after they kept charging for promotional messages wey no consine me. The account as at today has a debit bal of -206 naira, i went to complain and was advice to reactivate it, pay the debit bal and close it if i choose. I wnet back to check my the records of my ecobank account. I last used it around 2010, and it became dormat (see below). Then in 2013 they withdrew the remaining balance without warning (thunder fire them  ) and declared it inactive. see attached. the funny thing is almost 3 years after thy still send me notification, but the balace has not gone below zero. I believe thats how a savings account should be. 1 Like

|

| Re: Your Dormant Bank Account Could Put You In Trouble by uvalued(m): 12:38pm On Aug 05, 2015 |

thanks thinking of uba account and this means i will be careful opening any account. i remember diamond advert to start an account... runs away |

| Re: Your Dormant Bank Account Could Put You In Trouble by Nobody: 12:47pm On Aug 05, 2015 |

i can never open an ecobank account. never heard any good news about them 1 Like |

| Re: Your Dormant Bank Account Could Put You In Trouble by Gboliwe: 12:49pm On Aug 05, 2015 |

doofanc:

Funny I was told by a banker friend that you can even close an account, that dormacy is a form of closure. Don't buy that trash. Mine has been dormant since 2013 yet they send me SMS alert, interest alert and wishes every time. These they deduct/add every month. They'll continue doing this till the N800 I left in the account is finished. Lol. Then, they'll start the "debt" account for me. It won't happen! 2 Likes |

| Re: Your Dormant Bank Account Could Put You In Trouble by SweetSoup(m): 1:31pm On Aug 05, 2015 |

doofanc:

I wnet back to check my the records of my ecobank account. I last used it around 2010, and it became dormat (see below). Then in 2013 they withdrew the remaining balance without warning (thunder fire them  ) and declared it inactive. see attached. the funny thing is almost 3 years after thy still send me notification, but the balace has not gone below zero. I believe thats how a savings account should be. ) and declared it inactive. see attached. the funny thing is almost 3 years after thy still send me notification, but the balace has not gone below zero. I believe thats how a savings account should be. Mine is a savings account, i would create time and go to my branch to do the needful. |

) and declared it inactive. see attached. the funny thing is almost 3 years after thy still send me notification, but the balace has not gone below zero. I believe thats how a savings account should be.

) and declared it inactive. see attached. the funny thing is almost 3 years after thy still send me notification, but the balace has not gone below zero. I believe thats how a savings account should be. trouble or no trouble,my Uba account will soon be dormant and maybe dormant for life,if anybody call me say I owe them money, I go swear for their forefathers ni

trouble or no trouble,my Uba account will soon be dormant and maybe dormant for life,if anybody call me say I owe them money, I go swear for their forefathers ni