News And Technical Analysis From Instaforex - Business (13) - Nairaland

Nairaland Forum / Nairaland / General / Business / News And Technical Analysis From Instaforex (46622 Views)

Get Startup Bonus Of $500 To Trade From Instaforex / News And Technical Analysis From Superforex / News From Instaforex (2) (3) (4)

(1) (2) (3) ... (10) (11) (12) (13) (14) (15) (16) ... (23) (Reply) (Go Down)

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 11:04am On May 03, 2018 |

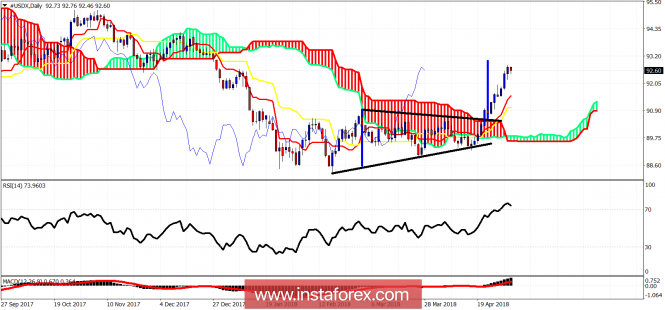

Technical analysis on USDX for May 3, 2018 The Dollar index continues to make higher highs and higher lows. Trend remains bullish as price remains inside the bullish channel. The warnings from the RSI bearish divergence are still there but now we have also another reason to exit longs. Price has reached very close to the triangle breakout target.  Black lines - triangle Blue lines - triangle breakout target The Dollar index is above the Ichimoku cloud. Price has reached the triangle breakout target very closely. The 61.8% Fibonacci retracement of the decline from 95.15 is also around this area so Dollar bulls should be very cautious at current levels. Trend remains bullish as long as price is above the Daily cloud at 90. A break below it opens the way for a push to new lows below 88. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 10:46am On May 04, 2018 |

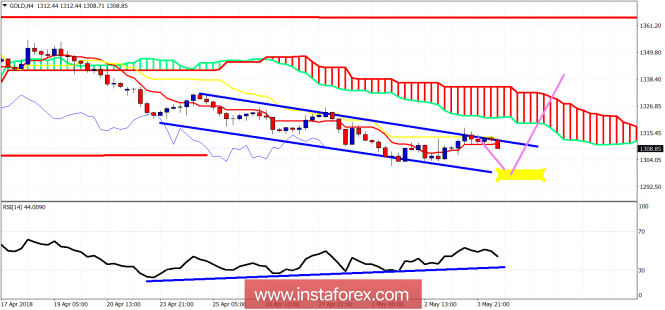

Technical analysis on Gold for May 4, 2018 Gold price remains inside the bearish channel. Price bounced yesterday but was unable to break out of the bearish channel. Price got rejected and is pulling back. I expect price to make new lows towards $1,300-$1,290 today and reverse to the upside.  Blue lines - bearish channel Blue upward sloping line - bullish divergence Yellow rectangle - target for reversal Gold price has short-term resistance at $1,319 and support at $1,295. The RSI continues to diverge and a new lower low might provide the final divergence signal. I'm medium-term bullish Gold looking for a new low with divergence in the RSI to be bought for a reversal at least towards $1,330. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. Read more: https://www.instaforex.com/forex_analysis/114968 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 10:21am On May 07, 2018 |

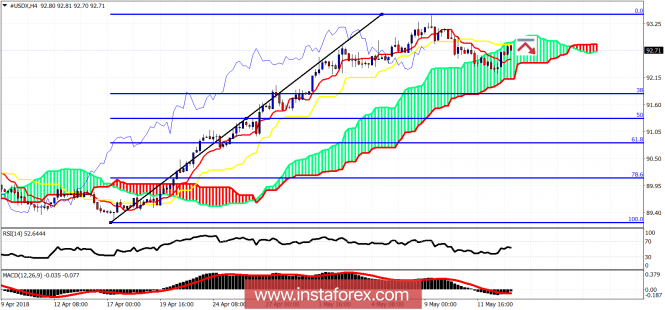

Technical analysis on USDX for May 7, 2018 The Dollar index has broken out of the bullish channel. Despite the new high on the Daily chart we observe a bearish divergence. Last week we noted the bearish divergence signs in the 4 hour chart. I continue to believe that the Dollar looks toppy around current levels and it is not worth chasing bullish positions but looking signs of weakness to sell.  Blue lines - bullish channel Downward sloping blue line - bearish divergence The Dollar index is expected to make a pull back towards 92 at least. Currently trading at 92.80 it has very important resistance here at 93. Very important short-term support is at 91. A break below it will increase the chances that a major top is in. I'm bearish the Dollar. *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:24am On May 09, 2018 |

CAD/CHF testing its resistance, remain bullish CADCHF is testing its resistance at 0.7745 (38.2% Fibonacci retracement, horizontal overlap resistance) where we expect the price to rise to its resistance at 0.78070 (horizontal swing high resistance) if broken. Stochastic (55, 5, 3) bounced from its support at 7.7% where a corresponding rise is expected. Buy above 0.7745. Set stop loss at 0.7714 and take profit at 0.7807.  *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. Read more: https://www.instaforex.com/forex_analysis/115322 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 10:33am On May 10, 2018 |

Global macro overview for 10/05/2018 The decision of the Bank of England will be published on Thursday, May 10 at 01:00 pm GMT. Market participants expect the interest rate to stay at 0.50%. Together with the decision, the Inflation Report will be published with economic forecasts. In the data from the last meeting, the biggest blow was a terrible GDP growth reading after the first quarter, which showed a minimal increase of 0.1% (the slowest since the fourth quarter of 2012). Difficult weather conditions in this period are indicated as the main culprit, although there are also no votes, can everything really be dumped for a prolonged winter? On the other hand, the labor market remains strong, wages accelerate and outpace inflation, and the unemployment rate has already fallen below the NAIRU equilibrium level. And if it was not for fear of Brexit, BoE would have started aggressively tightening politics for a long time. Hence, although in the description of the data already published, the BoE message should contain a dovish language with regard to growth and inflation, it is doubtful that the bank would opt for a clear revision of the outlook under the influence of one weaker series. A potential hawkish risk is to downplay readings from the first quarter as charged with one-off events. A new projection assuming a rebound in the second quarter will be an additional argument that the bank will look for an opportunity to raise earlier. The distribution of votes in the vote to keep the interest rate to stay at 7-2 with Saunders and McCafferty opposed, but the risk lies in the third vote for the increase from Vlieghe. In his last comment, Vlieghe pointed to the strength of the labor market and the need to remove the monetary stimulus earlier. The change in the distribution of votes to 6-3 confirms that the bank does not pay much attention to weaker data and remains at the "three hikes in three years" rate set in February. Expectations for a rate hike have moved away in time and the market is discounting the full hike only in November 2018. It is difficult to imagine that at the conference President Carney would even further weaken these expectations and, in the worst case scenario, he would repeat that the hike this year is "probable". Given the impetus that the market abandoned long positions in the pound in the second half of April, now the bar for hawkish surprises should be suspended quite low and it will be easier to start a fresh start in rebuilding GBP. Let's now take a look at the GBP/USD technical picture at the H4 time frame before the BoE interest rate decision is made. Two possible scenarios are available here and both of them depends on the nature of the BoE statement. In a case of a dovish statement from BoE, the market should remain in a horizontal consolidation zone between the levels of 1.3486 - 1.3608. On the other hand, any hawkish statements or comments from BoE will likely result in a breakout above the technical resistance at the level of 1.3608 and an impulsive and sudden move upward towards the levels of 1.3708 and even 1.3889.  Read more: https://www.instaforex.com/forex_analysis/115461 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 2:25pm On May 11, 2018 |

Fundamental Analysis of AUD/JPY for May 11, 2018 AUD/JPY has been quite impulsive with the bullish gains since it bounced off the support area of 80.50-81.80. There has been certain volatility in this pair as both currencies in this pair has been struggling for gains amid mixed economic reports. Today, Australia's Home Loans report was published with a greater deficit to -2.2% from the previous value of -0.2% which was expected to be at -1.9%. The worse economic report did not quite impact the gains of AUD against JPY while JPY has found support from economic reports today. On the JPY side, today M2 Money Stock report was published with an increase to 3.3% from the previous value of 3.1% which was expected to be at 3.2%. Despite the positive economic report, JPY failed to gain momentum over AUD gains which indicates a change in the current market sentiment on the pair. As for the current market scenario, AUD is expected to gain further against JPY in the coming days until Australia comes up with better economic reports before the AUD Employment Change and Unemployment Rate reports to be published in the coming days. Now let us look at the technical view. The price is following a bullish trajectory with the gains which has surpassed the dynamic level of 20 EMA with a daily close. As for the current volatility in the market, the price is expected to push higher against the dominant bearish trend of the market and proceed higher towards 84.50 resistance area in the coming days. As the price remains above 80.50 with a daily close, further bullish pressure is expected in this pair.  Read more: https://www.instaforex.com/forex_analysis/115601 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 2:04pm On May 14, 2018 |

EUR/CHF analysis for May 14, 2018  Recently, the EUR/CHF pair has been trading upwards. The price tested the level of 1.1971. Anyway, according to the 30M time – frame, I found a potential end of the upward corrective structure, which is a sign that buying looks very risky. I also found a hidden bearish divergence on the MACD oscillator in the background, which is another sign of weakness. My advice is to watch for potential selling opportunities if you see a valid breakout of upward trendline. The downward target is set at the price of 1.1870. Resistance levels: R1: 1.1957 R2: 1.1960 R3: 1.1976 Support levels: S1: 1.1948 S2: 1.1942 S3: 1.1939 Trading recommendations for today: watch for potential selling opportunities. Read more: https://www.instaforex.com/forex_analysis/115687 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:55am On May 15, 2018 |

Technical analysis on USDX for May 15, 2018 The Dollar index is bouncing after a couple days of a bearish reversal towards 92. I do not expect the index to make new highs. Resistance by the Ichimoku cloud is at 92.90 and I expect the price to get rejected there today and turn lower. Support is at 92.25-92.15.  My first target for this pullback is at 91.80 and next at 90.80 where the 61.8% Fibonacci retracement is found. Short-term support is at 92.50. Breaking below it will increase chances of moving to new weekly lows towards 91.80. If resistance at 92.90 is broken, we could see a test of the highs at 93.40. I'm bearish the Dollar. Read more: https://www.instaforex.com/forex_analysis/115813 *The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade. |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:44am On May 16, 2018 |

Elliott wave analysis of EUR/JPY for May 16, 2018  EUR/JPY - 4 Hourly EUR/JPY has resumed its downtrend towards the ideal target-area between 123.33 - 125.32. With wave iv in place at 131.27, the final decline in wave C of (E) is now developing. The next minor support is seen at 129.96 and a break below here should accelerate the decline in wave iii/ of v lower to 128.80 and likely even closer to 128.40 as the next downside targets. The former support at 130.73 has now transformed into resistance and is expected to cap the upside. R3: 131.13 R2: 130.98 R1: 130.73 Pivot: 130.54 S1: 130.28 S2: 129.96 S3: 129.64 Trading recommendation: We took profit at 130.70 and booked a nice little profit of 52 pips. We sold EUR again at 130.95 and has placed our stop at 131.20. Read more: https://www.instaforex.com/forex_analysis/115925 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 12:53pm On May 17, 2018 |

Elliott wave analysis of EUR/NZD for May 17, 2018  EUR/NZD - 4 Hourly We were looking for upside acceleration, but important resistance at 1.7310 once again proved to be strong to break and the bulls gave up the effort to conquest this resistance. Instead, the bears turned EUR/NZD 180 degrees around and managed to break below short-term important support at 1.7056 indicating that wave ii/ still is developing. This means more downside closer to the 169.19 - 169.55 area should be expected before wave ii/ finally completes and is ready to surrender itself to the next rally higher in wave iii/, towards 1.7474 and 1.7832 as the next upside targets. R3: 1.7158 R2: 1.7129 R1: 1.7097 Pivot: 1.7068 S1: 1.7044 S2: 1.6989 S3: 1.6955 Trading recommendation: Our stop at 1.7090 was hit for a profit of 126 pips. We will wait for a new EUR buying opportunity at 1.6965 or upon a break above resistance at 1.7188. Read more: https://www.instaforex.com/forex_analysis/116061 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 7:12am On May 18, 2018 |

Elliott wave analysis of EUR/JPY for May 18, 2018  As EUR/JPY unexpectedly took out minor resistance at 130.73, we were told, that the wave iv is still developing and the final decline in the wave v closer to the target-area between 123.33 and 125.32 is being delayed. Yesterday we said, that a break above minor resistance at 130.73 would call for a more complex correction in the wave iv and likely a rally to 131.68 and this still holds true, but we also need to be open to another complex corrective pattern, which is a triangle consolidation. If minor resistance near 131.15 is able to cap the upside for a break below 130.56, then this corrective pattern will be the preferred count for the wave iv and a dip closer to 130.05 will be expected in the wave c of the triangle. R3: 131.68 R2: 131.37 R1: 131.15 Pivot: 130.75 S1: 130.56 S2: 130.27 S3: 130.04 Trading recommendation: Our stop at 130.80 was hit for a small profit of 15 pips. We will be looking for another selling opportunity at 131.50. Read more: https://www.instaforex.com/forex_analysis/116195 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 2:16pm On May 21, 2018 |

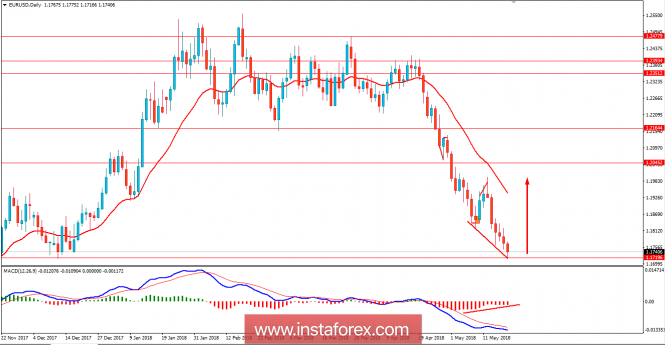

Fundamental Analysis of EUR/USD for May 21, 2018 EUR/USD has been quite impulsive and non-volatile with the bearish gains recently which lead the price to reside at the edge of the 1.1700-20 support area today. USD has been the dominant currency in the pair for a certain period of time where EUR was struggling with the weak economic reports in the process. Today, due to observance of Whit Monday, there is no impactful EUR economic report or event to be held, but this week, on Thursday, ECB Monetary Policy Meeting Accounts will be held which is expected to inject some volatility in the market in favor of EUR gains in the coming days. On the other hand, this week, Fed Chair Powell is going to speak about the upcoming interest rate and inflation rate decision which is expected to favor USD in the coming days. Since 2015, there has been 6 times rate hikes in the US where the trend is expected to continue throughout 2018 as well. Today, FOMC Member Bostic is going to speak about the interest rates and monetary policy which is expected to be quite neutral with the impact on USD gains in the coming days. As of the current scenario, ahead of the upcoming high impact economic report of EUR of this week, certain volatility is expected in the market, whereas EUR might gain against USD for a certain period before the price continues with its bearish trend in future. Now let us look at the technical view. The price is currently residing at the edge of the 1.1700-20 area from where it is expected to push higher towards the 1.1950-1.20 resistance area in the coming days. After such an impulsive bearish pressure, current bullish pressure is expected to be backed by the Bullish Continuous Divergence along the way. As the price remains above 1.1700 with a daily close, certain bullish intervention is expected in this pair.  Read more: https://www.instaforex.com/forex_analysis/116370 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 12:25pm On May 22, 2018 |

Analysis of Gold for May 22, 2018  Recently, Gold has been trading upwards. The price tested the level of $1,295.00. According to the H1 time – frame, I found a valid breakout of downward channel (ending diagonal), which is a sign that selling looks risky. I also found a hidden bullish divergence on the MACD oscillator, which is another sign of strength. My advice is to watch for a potential bullish flag and then watch for buying. The upward targets are set at the price of $1,299.10 and at the price of $1,306.00. Resistance levels: R1: $1,296.15 R2: $1,300.40 R3: $1,307.85 Support levels: S1: $1,284.45 S2: $1,277.00 S3: $1,272.00 Trading recommendations for today: watch for potential buying opportunities. Read more: https://www.instaforex.com/forex_analysis/116524 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 7:29am On May 23, 2018 |

Elliott wave analysis of EUR/NZD for May 23, 2018  EUR/NZD has followed the expected path almost to perfection. Red wave v spike a bit lower than expected as it bottomed at 1.6889 and not at our ideal target at 1.6922, but the rally that followed the spike to 1.6889 is very constructive and indicates much more upside should be expected from here. The next upside targets to look for is seen at 1.7168 and then important resistance near 1.7300 and break above the later, will release a lot of energy and call for a continuation higher to 1.7474 on the way higher to 1.8000 on the way towards at least 1.8437. Short-term support is see at 1.6999 and again at 1.6963. The later should be able to protect the downside. R3: 1.7125 R2: 1.7074 R1: 1.7045 Pivot: 1.7013 S1: 1.6999 S2: 1.6963 S3: 1.6889 Trading recommendation: We are long EUR from 1.6930 and we will place our stop at 1.6950. If you are not long already, then buy EUR near 1.7000 and use the same stop at 1.6950. Read more: https://www.instaforex.com/forex_analysis/116580 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 1:09pm On May 24, 2018 |

Global macro overview for 24/05/2018 Yesterday, FOMC Meeting Minutes confirmed the willingness of further gradual interest rate hikes by the Fed. The market is convinced that another 25 bp cost increase will take place in June. Thus, the process of monetary policy normalization would be continued. In the last statement, the Fed pointed to the symmetry of the inflation target. Yesterday's minutes revealed that the majority of FOMC members are ready to tolerate higher price dynamics for some time, which, given the slight wage pressure, may be an argument for three rather than four interest rate hikes this year. Attention was also paid to the need to change the language of the message and remove the phrase referring to the expansive attitude in monetary policy. Some Fed members believe that monitoring the shape of the yield curve of US bonds remains an important issue. The reverse yield curve can be an indicator that can signal the risk of occurrence. In conclusion, the Fed is about to hike the interest rates in June. The question remains whether the Fed will hike again in September and in December or just in December? Nevertheless, the US Dollar should continue its appreciation across the board. Let's now take a look at the US Dollar Index technical picture at the H4 time frame. The bulls have managed to make another local high at the level of 94.19 in overbought market conditions and despite the growing bearish divergence. The price is still trading inside of the channel and as long as the support zone between the levels of 93.21 - 93.11 is not cleary violated, the dominant bias is bullish.  Read more: https://www.instaforex.com/forex_analysis/116781 |

| Re: News And Technical Analysis From Instaforex by Bloomyloo: 7:14pm On May 24, 2018 |

Is there a problem with your Bitcoin deposit platform?. My account is yet to be funded after a deposit of 2000$. Its over 9hrs. Account number: 50200577 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 11:51am On May 25, 2018 |

Bloomyloo: Please kindly provide the transaction ID |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 11:56am On May 25, 2018 |

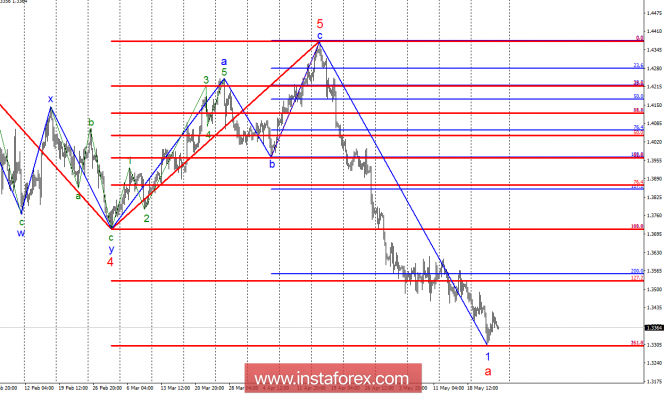

Wave analysis of GBP / USD for May 25. The 33rd figure can be a starting point for an upward trend segment  Analysis of wave counting: During the trading on May 24, the GBP / USD currency pair failed to update the minimum of May 23. Thus, the instrument continues to make attempts to form the first wave in the composition of the future wave 2, in the downtrend section of the trend. If this assumption is true, then the increase in quotations will continue to at least 35 and 36 figures. A break of the 1.3300 mark will lead to an even more complication of the internal wave structure of the proposed wave 1, a, and further lowering of quotations in the region of 31 figures. The objectives for the option with purchases: 1.3528 - 127.2% of the Fibonacci of the highest order 1.3555 - 200.0% of Fibonacci The objectives for the option with sales: 1.3300 - 161.8% of the Fibonacci of the highest order 1.3300 - 261.8% of Fibonacci 1.3045 - 200.0% of the Fibonacci of the highest order General conclusions and trading recommendations: The instrument continues to make an attempt in completing the construction of wave 1, a. Around 1.3300, I recommend fixing the profit, and new sales should be started if a successful breakthrough attempt of 33 figures is made. The targets for the complicated wave 1 are located near the calculated mark of 1.3045, which corresponds to 200.0% of Fibonacci, constructed from the size of the entire wave 5 of the rising trend section, which ended on April 17. I recommend buying the pair very carefully and with Stop Loss under the minimum of wave 1, a as well. Read more: https://www.instaforex.com/forex_analysis/206422 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 7:10am On May 28, 2018 |

Elliott wave analysis of EUR/JPY for May 28, 2018  With the direct decline to 127.11, we need to reconsider the potential downside for now. If the wave C/ had dropped to 127.06, the wave A/ and C/ would have been exactly equal in length. As EUR/JPY turned almost exactly from the equality target at 127.06, we will have to consider the wave Y and maybe even the wave (E) as complete. Therefore, we have changed our stand temporary and will be looking for a rally back up to 130.30 and maybe even closer to 131.05 before a possible new push lower in a triple zig-zag correction. A break above the minor resistance at 128.53 will confirm that a low is in place for a rally towards at least 130.30. R3: 129.93 R2: 129.31 R1: 128.87 Pivot: 128.35 S1: 127.94 S2: 127.68 S3: 127.11 Trading recommendation: We will buy EUR at 127.75 or upon a break above 128.35. We will place our stop at 127.05. Read more: https://www.instaforex.com/forex_analysis/116963 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 11:02am On May 30, 2018 |

GBP/JPY Approaching Support, Watch For A Bounce GBP/JPY is approaching our support at 143.08 (Horizontal overlap support, 78.6% Fibonacci retracement, 100% Fibonacci extension) where we expect price to bounce above this level to our resistance at 146.20 (horizontal pullback resistance, 100% Fibonacci extension, 50% Fibonacci retracement). Stochastic (55,5,3) is also seeing a bullish divergence and is approaching its support where a bounce off this level will see a corresponding rise in price. GBP/JPY is approaching support where we expect a bounce. Buy above 143.08. Stop loss 141.21. Take profit at 146.20.  |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:47am On May 31, 2018 |

Global macro overview for 31/05/2018 The ADP Non-Farm Employment Change data published yesterday had indicated, that in May in the private sector of the American economy, the number of jobs increased by 178,000. That's less than the consensus (190,000), but still a decent figure. At the same time, the previous reading has been revised downwards (from 204,000 to 163,000). A decent rate of creation of new jobs is not shocking anyone. It also seems that with such low unemployment (below 4%), the pace of employment growth must finally slow down. Therefore, the key carrier of information on the condition of the labor market, especially in the context of the Fed's policy outlook, is the growth of wages. This data, of course, we will get to know on Friday, but already the secret of the power of broader trends has been abolished by the Beige Book of the Fed containing a description of the economic situation in individual regions. The Beige Book prepared for the 12-13 June FOMC meeting, covering information through 21 May, indicated few material changes in the trajectory of economic growth in most districts. A large number of districts reported acceleration in manufacturing and industrial activity, but the outlook for employment and wage growth was largely unchanged with most districts reporting moderate increases in employment but only modest increases in wages. It looks like the global investors will have to wait for the Friday's Non-Farm Payrolls data to make themselves more familiar with the latest details in the US job market direction. Let's now take a look at the SP500 technical picture at the H4 time frame. The market remains locked in a horizontal zone between the levels of 267.96 - 274.15 in neutral market conditions. This consolidation might take some time as the broader technical pattern that is being formed at the larget time frames looks like a triangle. The key level to the upside is still the zone between the levels of 274.15 - 273.42. The key technical support is seen at the level of 259.36.  Read more: https://www.instaforex.com/forex_analysis/117387 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 12:03pm On Jun 01, 2018 |

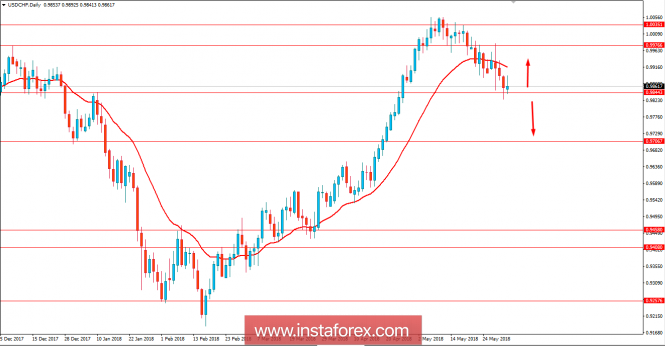

Fundamental Analysis of USD/CHF for June 1, 2018 USD/CHF has been quite impressive inside the the bearish bias recently after being rejected off the 1.0035 area with a daily close. Ahead of the upcoming high impact US economic reports to be published today, the market is currently quite indecisive and volatile at the edge of 0.9850 area. Today, US Average Hourly Earnings report is going to be published which is expected to increase to 0.2% from the previous value of 0.1%, Non-Farm Employment Change report is expected to increase to 189k from the previous figure of 164k and Unemployment Rate is expected to be unchanged at 3.9%. Though are a lot of speculations whether US economic reports wil be strong. If true, it may lead to further momentum in USD. On the other hand, today Switzerland Manufacturing PMI report was published with a slight decrease to 62.4 from the previous figure of 63.6 which is expected to make certain weakness effect on the CHF gains against USD in the coming days. As for the current scenario, high impact economic reports from the US today is expected to encourage USD gains further in the coming days. Though CHF has been gaining quite well against USD recently, upcoming positive economic reports may lead to continuation of the bullish trend in the pair in the future. Now let us look at the technical view. The price is currently residing at the edge of 0.9850 support area from where certain bullish pressure is expected in this pair. Ahead of the upcoming high impact USD economic reports today, the market is expected to be volatile but as the price remains above 0.9850 with a daily close, certain bullish pressure is expected in this pair. On the other hand, a break below 0.9850 with a daily close, will lead to further bearish pressure in the pair with target towards 0.97.  Read more: https://www.instaforex.com/forex_analysis/117532 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 9:40am On Jun 04, 2018 |

Elliott wave analysis of EUR/NZD for June 4, 2018  We are still looking for a clear break above minor resistance at 1.6764 to confirm that wave ii has bottomed and wave iii to above 1.7300 is ready to develop. As long as minor resistance at 1.6764 is able to cap the upside, a final dip to just below 1.6605 can not be excluded. However, the clear loss of downside momentum does argue, that a low already has been seen at 1.6605 or will be seen just below here for a new rally soon. R3: 1.6825 R2: 1.6764 R1: 1.6720 Pivot: 1.6675 S1: 1.6636 S2: 1.6605 S3: 1.6584 Trading recommendation: We will buy EUR at 1.6600 or upon a break above 1.6764. If our buy-order at 1.6600 is done, we will place our stop at 1.6510. Read more: https://www.instaforex.com/forex_analysis/117584 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 10:28am On Jun 05, 2018 |

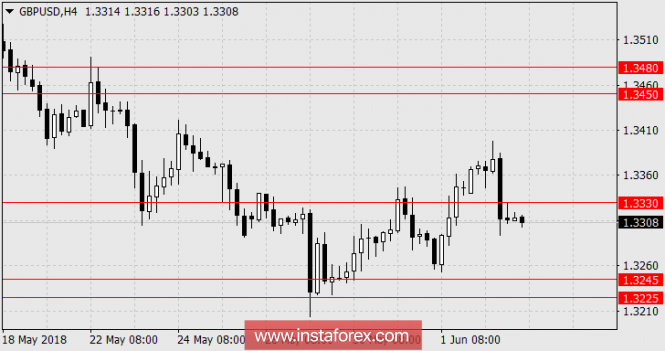

The British pound is not pleased GBP / USD In the first half of Monday, the British pound rose by 50 points due to business activity growth in the construction sector, as the May estimate did not changed since April (52.5) but did not fall to the projected 52.0. At the same time, Silvana Tenreyro, a member of the Bank of England's Monetary Policy Committee, announced several possible rate increases over the next three years. But, firstly, it only confirmed the already known line of the Central Bank and secondly, Tenreyro has always been distinguished by increased (and subsequently unjustified) optimism in this regard. As a result, the pound closed the day with a decrease to 35 points under the pressure of the dollar. Today, the UK business activity index for May is expected to rise to 52.9 from 52.8. The American ISM Non-Manufacturing PMI is expected with even greater growth from 56.8 to 57.9, balance in favor of the dollar. We are waiting for the British pound in the range of 1.3225 / 45.  Read more: https://www.instaforex.com/forex_analysis/206997 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:41am On Jun 06, 2018 |

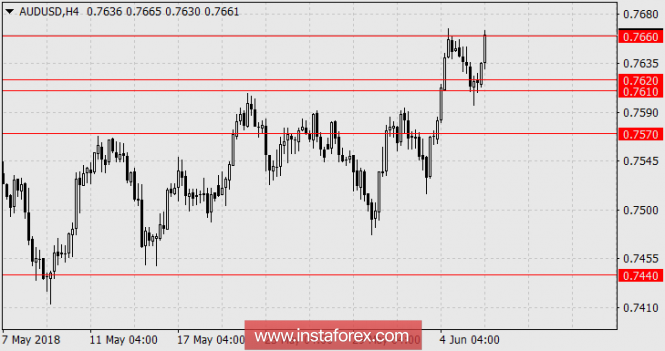

Good news is overdue AUD / USD Yesterday, the Australian dollar against the growth of European currencies fell by 30 points. The pessimism was influenced by the Reserve Bank of Australia's statement on the growth of political and economic risks, high lending to households, cooling mortgages, and undesirability of the high exchange rate of the national currency for the economy. But this morning, the excellent GDP data for the first quarter came out. The economic growth was 1.0% vs. the forecast of 0.8% and the annual growth estimate was 3.1% vs. the forecast of 2.8%. As part of the GDP, household consumption increased by 0.3% q/q. Capital expenditures increased by 0.5% in the quarter against -0.9% in the fourth quarter. But tomorrow, the trade balance for April will be published and projected to lower the balance from 1.52 billion dollars to 1.00 billion. On the same day, the US consumer lending data is expected to increase from 11.6 billion dollars to 13.9 billion. In a week, the Fed will take a decision on monetary policy with a high probability that the rate will be raised. Typically, pressures from the media and the preparation of markets begins one week before the FOMC meeting. We are waiting for the decline of the Australian currency to 0.7570.  Read more: https://www.instaforex.com/forex_analysis/207069 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:06am On Jun 07, 2018 |

Elliott wave analysis of EUR/NZD for June 7, 2018  EUR/NZD has rallied nicely from the 1.6598 low and is currently testing important resistance at 1.6764. We need a clear break above here, to confirm that wave ii did complete at 1.6598 and wave iii higher to above 1.7300 is developing. Short-term, we could see a set-back from important resistance at 1.6764 towards 1.6688 for a new challenge of resistance at 1.6764 and the next time we expect a clear break confirming wave iii/ higher towards 1.6937 starts to develop. At this point on a break below minor support at 1.6612 will question our bullish outlook. R3: 1.6874 R2: 1.6929 R1: 1.6786 Pivot: 1.6764 S1: 1.6720 S2: 1.6704 S3: 1.6688 Trading recommendation: We are long EUR from 1.6600 and will raise our stop from 1.6510 to 1.6610. If you are not long EUR yet, then buy near 1.6688 or upon a break above 1.6764. Read more: https://www.instaforex.com/forex_analysis/117947 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:24am On Jun 08, 2018 |

EUR/AUD reversed nicely off resistance, prepare for a drop EUR/AUD reversed off its resistance at 1.5515 (61.8% Fibonacci extension, 38.2% Fibonacci retracement, 38.2% Fibonacci retracement, horizontal overlap resistance) where we expect the price to drop to the support at 1.5289 (horizontal swing low support). We have to be cautious and watch for the intermediate support at 1.5385 (50% Fibonacci retracement, horizontal overlap support). Stochastic (55, 5, 3) has also reversed off its resistance at 95% where a corresponding drop is expected. Sell below 1.5515. Set stop loss at 1.5601 and take profit at 1.5289.  1 Like |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:28am On Jun 11, 2018 |

Technical analysis on Gold for June 11, 2018 Gold price has broken above the medium-term trend line resistance, back tested it but still remains inside the $1,307-$1,290 trading range. We continue to be bullish on Gold, expecting at least a bounce towards $1,320-30.  Yellow line - medium-term resistance Magenta lines - trading range Green line - target Gold price is trading above the yellow trend line resistance. Support is at $1,293 and next at $1,289. Resistance is at $1,303.25 and next at $1,307. For several days Gold has been moving sideways. My longer-term view remains bullish, but a break below $1,288 could see Gold price dip to $1,275 before turning higher. So traders should keep this scenario also in mind. Read more: https://www.instaforex.com/forex_analysis/118203 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 10:57am On Jun 12, 2018 |

Wave analysis of EUR/USD for June 12. The pair is expected to resume growth.  Analysis of wave counting: During trading on Monday, the EUR/USD fell 40 basis points from the highs of the day, and this development fits perfectly into the scenario of constructing the correctional wave 4, in the composition of the future wave 1, in 1, in 3. If this assumption is correct, then after the completion of the construction of the internal wave c, at 4, the rise in quotations within the framework of wave 5 with targets above the estimated mark of 1,1837, which corresponds to 200.0% of Fibonacci. After the completion of the construction of wave 5, a decrease in the region of 17 figures is expected in the framework of constructing the corrective wave 2, at 1, at 3. Targets for selling: 1.1700 - 1.1650 Targets for buying: 1.1958 - 161.8% by Fibonacci of the highest order 1.2070 - 127.2% by Fibonacci of the highest order General conclusions and trading recommendations: The EUR/USD currency pair is supposed to be within the framework of wave 4, at 1, at 1. Based on this, it is recommended to keep buying in order to build a wave of 5, at 1, at 1 with minimal targets near the mark of 1.1837. Successful attempt to break the mark of 1,1837 will lead to a further increase in quotations with a target of about 1.1958, which is equivalent to 161.8% of Fibonacci. During the construction of wave 5, at 1, at 1 it is recommended to reduce buying gradually, because after the completion of this wave, a decrease in the area of 17 figures is possible. Read more: https://www.instaforex.com/forex_analysis/207430 |

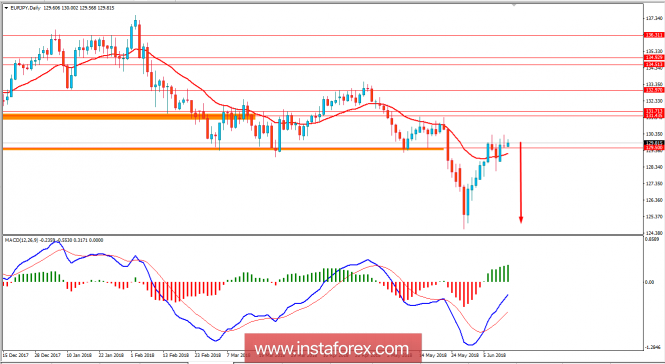

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 8:35am On Jun 13, 2018 |

Fundamental Analysis of EUR/JPY for June 13, 2018 EUR/JPY has been quite corrective and volatile above 129.50 area which indicates the bearish pressure persists in the current market situation. Though JPY has been quite weak with the recent fundamentals providing no hint for further gains, EUR is also struggling for gains as well. Recently, Japan's economic reports were published with mixed results, including BSI Manufacturing Index decreasing to -3.2 from the previous positive value of 2.9 which was expected to increase to 3.2 and PPI report was published with an increase to 2.7% which was expected to be unchanged at 2.1%. Moreover, Tertiary Industry Activity also showed a surge to 1.0% from the previous negative value of -0.3% which was expected to be at 0.6%. Ahead of the upcoming BOJ Policy Rate and Policy Statement this week, JPY is expected to gain certain momentum over EUR if Japan manages to provide upbeat economic reports consistently in the coming days. On the other hand, today the eurozone's Employment Change report is going to be published which is expected to be unchanged at 0.3% and Industrial Production report is expected to decrease to -0.6% from the previous value of 0.5%. Though forecasts are quite dovish at the moment for EUR, certain gains against EUR can be observed ahead of the ECB Press Conference to be held tomorrow. As for the current scenario, certain volatility and correction is likely to persist in the pair in the coming days which may lead to certain indecision and indefinite pressure in the pair. Though JPY is expected to have an upper hand, recent eurozone's economic reports signal a further struggle of the currency in the future. Now let us look at the technical view. The price is currently a bit bullish after the severe bullish rejection based daily candle closed yesterday above 129.50 area. Currently the price is to push lower towards 124.50 support area as it remains below 131.50 area. So, the bearish bias is expected to continue further in the coming days.  Read more: https://www.instaforex.com/forex_analysis/118413 |

| Re: News And Technical Analysis From Instaforex by Instaforexbuk(f): 11:02am On Jun 14, 2018 |

Global macro overview for 14/06/2018 Not that long ago global investors thought that the risks to the Euro before the meeting outweighed the negative side, because they assumed, that the currency could strengthen based on the expectations of the hawkish result of the meeting, while the tone of decisions and conferences may be less aggressive or result in "sale the facts" behaviour. Nevertheless, the next few days brought stabilization, if not even cooling the demand for EUR, which made investors' attitude return into balance. But the rebound of the EUR/USD after the yesterday's Fed's decision prompts to conclude, that the market is again setting up on a hawkish ECB message. There is a potential for a positive reaction to the decision of the ECB regardless of whether the traders will know the specific details of extending the QE, or the decision will be postponed until July and today we will have to rely on Draghi's suggestions. In the latter case, a lot will depend on how optimistic Draghi will be about the prospects of accelerating the recovery in the Eurozone and return of inflation to the target levels while reducing the importance of internal risks (like uncertainty in Italy, deterioration in economic data, etc.) and external (like US trade policy and tariffs tax ). However, if the ECB shows that it remains at a previously set exchange rate, it may offer investors confidence in building expectations of a progressive normalization of monetary policy, which will be an important pillar of the long-term EUR power. Let's now take a look at the EUR/USD technical picture at the H4 timeframe, before the ECB interest rate decision was made. The price has bounced higher after the Fed interest rate hike yesterday and now the market is approaching the swing high at the level of 1.1839. An interest rate hike by ECB or Draghi hawkish remarks will make EUR/USD to rally way higher than this level. In this case, the first target would be at the level of 1.1994 (practically round number 1.2000), but in that case, I think it might get extended even to the level of 1.2068 easily. If, however, the ECB will leave the rate unchanged or the Draghi remarks will not be as hawkish as expected, the EUR/USD will likely test the 38% Fibo at 1.1852 and stop there to consolidate the gains.  |

(1) (2) (3) ... (10) (11) (12) (13) (14) (15) (16) ... (23) (Reply)

Today's Naira Rate Against The Dollar, Pounds And Euro / Lady Embarrassed For Not Paying Bill At A Restaurant [video] / Money Mistakenly Transferred To Opay Account

(Go Up)

| Sections: politics (1) business autos (1) jobs (1) career education (1) romance computers phones travel sports fashion health religion celebs tv-movies music-radio literature webmasters programming techmarket Links: (1) (2) (3) (4) (5) (6) (7) (8) (9) (10) Nairaland - Copyright © 2005 - 2024 Oluwaseun Osewa. All rights reserved. See How To Advertise. 155 |